Governance tokens are the backbone of decentralized finance, conferring voting power and a direct stake in protocol evolution. As crypto rewards cards increasingly offer governance tokens like AAVE, COMP, and DOT as incentives, the responsibility for safeguarding these assets grows. Unlike typical loyalty points, governance tokens grant users real influence over DeFi protocols – and that makes them prime targets for theft and fraud. If you’re earning governance tokens via rewards cards, implementing best-in-class security practices is non-negotiable.

Why Governance Token Security Demands Discipline

Unlike speculative tokens, governance assets represent both financial value and on-chain authority. A compromised token doesn’t just mean lost funds – it can disrupt protocol votes or even tip the scales in contentious decisions. That’s why protecting your crypto rewards isn’t just about personal gain; it’s about preserving the very integrity of DeFi platforms you support.

Below are the top 5 best practices for securely managing and protecting governance tokens earned through crypto rewards cards. Each recommendation is tailored to address today’s most pressing DeFi security threats.

Top 5 Best Practices for Securing Governance Tokens

-

Use Hardware Wallets for Long-Term Storage of Governance TokensStore your governance tokens in reputable hardware wallets like Ledger or Trezor. These devices keep your private keys offline, protecting your assets from online threats and unauthorized access.

-

Enable Multi-Factor Authentication (MFA) on All Crypto Card and Exchange AccountsActivate MFA on platforms such as Coinbase, Binance, and your rewards card apps. This adds a critical layer of protection beyond passwords, reducing the risk of unauthorized account access.

-

Regularly Transfer Rewards from Custodial Platforms to Personal WalletsMove governance tokens earned through rewards cards from custodial services to your own non-custodial wallets. This minimizes exposure to third-party risks and gives you full control over your assets.

-

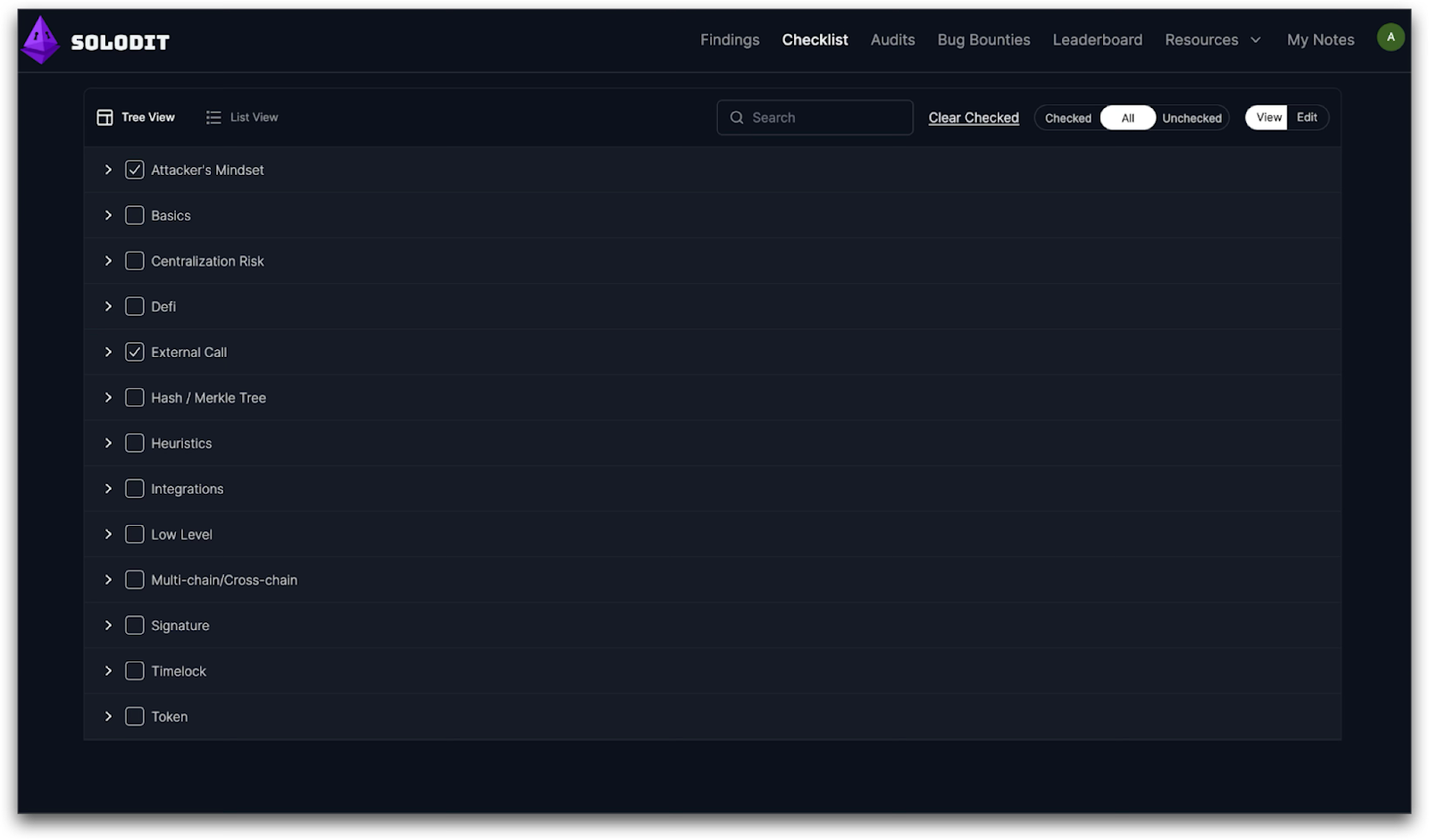

Stay Updated on Smart Contract Audits and Platform Security AnnouncementsMonitor audit reports and official security updates from DeFi platforms like Compound, Aave, and Uniswap. Understanding the latest vulnerabilities and fixes helps you avoid compromised protocols.

-

Beware of Phishing Scams and Only Interact with Verified DeFi ProtocolsAlways verify URLs and use official links to access DeFi services. Be cautious of unsolicited messages and double-check protocol authenticity before connecting your wallet or approving transactions.

1. Use Hardware Wallets for Long-Term Storage of Governance Tokens

Storing your governance token rewards in a reputable hardware wallet (such as Ledger or Trezor) is the gold standard for long-term protection. Hardware wallets keep your private keys offline, dramatically reducing exposure to malware, phishing, or browser-based attacks that plague software wallets and custodial platforms. For anyone holding more than trivial amounts of governance tokens or planning to participate actively in protocol votes, this step is essential.

2. Enable Multi-Factor Authentication (MFA) on All Crypto Card and Exchange Accounts

Multi-factor authentication (MFA) is no longer optional in today’s threat landscape. Enable MFA on every account associated with your crypto card and any exchange where you might redeem or transfer your token rewards. This extra layer requires attackers to compromise not only your password but also a secondary device or authentication method – significantly raising the bar for unauthorized access.

3. Regularly Transfer Rewards from Custodial Platforms to Personal Wallets

If your crypto card provider issues rewards directly into an exchange wallet or other custodial environment, make it routine to transfer those assets out as soon as possible. Custodial platforms remain attractive targets for hackers; by moving tokens into wallets under your sole control (preferably hardware wallets), you minimize counterparty risk and reduce exposure windows.

4. Stay Updated on Smart Contract Audits and Platform Security Announcements

The security profile of DeFi protocols evolves rapidly – new vulnerabilities are discovered often, and platforms regularly push updates or patches based on smart contract audits. Subscribe to official communication channels for both your reward-issuing platform and any protocols whose governance tokens you hold. Staying informed lets you react swiftly to emerging threats or migrate funds ahead of potential exploits.