If you’re earning governance tokens through crypto rewards cards, it’s time to pay close attention to your tax obligations. While the thrill of stacking tokens and flexing your voting power in DeFi is real, the IRS wants its share of your digital spoils. Let’s break down what you need to know about tax on governance tokens, how crypto rewards card tax rules work, and why keeping records is your new best friend.

![]()

How the IRS Views Crypto Rewards Cards and Governance Tokens

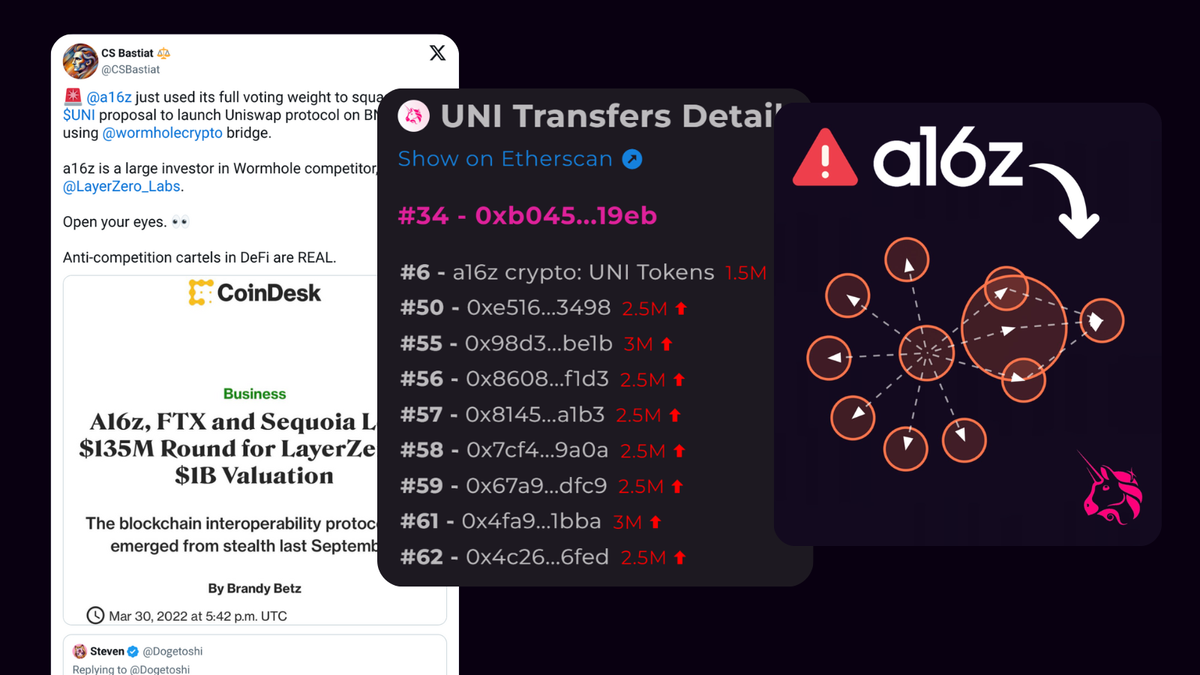

First things first: not all crypto card rewards are taxed equally. Traditional cashback from credit cards is usually considered a rebate, reducing the cost of your purchase rather than counting as income. But when you earn governance tokens as a reward, especially if they’re delivered without an associated purchase (like a sign-up bonus): the IRS takes notice.

According to recent guidance, if you receive governance tokens as a reward for spending with your crypto card, these are generally non-taxable rebates. However, if you get those tokens through other means (such as referral or sign-up bonuses), their fair market value at receipt is treated as taxable income. This aligns with how staking rewards are taxed: you owe income tax based on the value of the token the moment it lands in your wallet (cryptotaxcpa. com). Miss this step, and you could be in for an unpleasant surprise come tax season.

The Two-Part Tax Hit: Income Tax and Capital Gains

Here’s where it gets spicy. The tax implications of earning governance tokens don’t stop at receipt:

- Income Tax: When you receive governance tokens (whether through spending or bonuses), their fair market value at that moment is considered ordinary income. You’ll need to report this on Form 1040 when filing your taxes (gtlaw. com).

- Capital Gains Tax: If you later sell, swap, or spend those governance tokens, any change in value from when you received them counts as a capital gain or loss. This means more tracking, and potentially more taxes (tokentax. co).

This two-step process makes governance token tax implications more complex than typical cashback rewards, and much more important for DeFi enthusiasts who want to stay compliant.

The Importance of Accurate Crypto Tax Reporting

The IRS isn’t shy about enforcing compliance on digital assets. Whether it’s staking rewards or DeFi yield farming, they expect accurate reporting down to the cent. That means every time you receive governance tokens via a reward program, you should note their fair market value at receipt, think date/time and USD value.

Key Steps to Report DeFi Rewards & Governance Token Income

-

Determine if your rewards are taxable income. Crypto rewards from purchases on most major cards (like Crypto.com Visa) are usually non-taxable rebates, but sign-up bonuses or rewards not tied to purchases are generally taxable. Check IRS guidance and your card’s terms.

-

Record the fair market value at the time you receive tokens. When you earn governance tokens (e.g., Uniswap (UNI), Aave (AAVE)) from DeFi platforms or rewards cards, note their USD value the moment you gain control. This is your taxable income amount.

-

Report income on your IRS Form 1040. Enter the fair market value of your governance tokens as ordinary income in the year received. Use reputable tax software like CoinTracker or Koinly for accuracy.

-

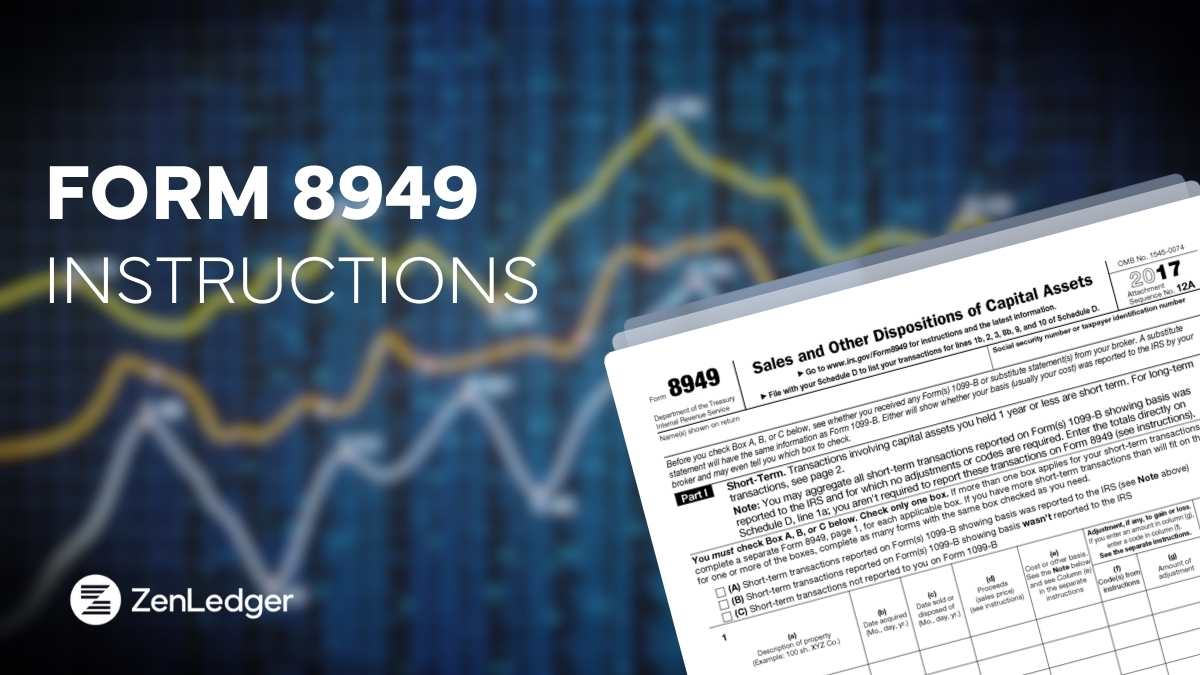

Track all disposals for capital gains or losses. If you later sell, swap, or spend your governance tokens, calculate the difference between their value when received and when disposed. Report this on IRS Form 8949 and Schedule D.

-

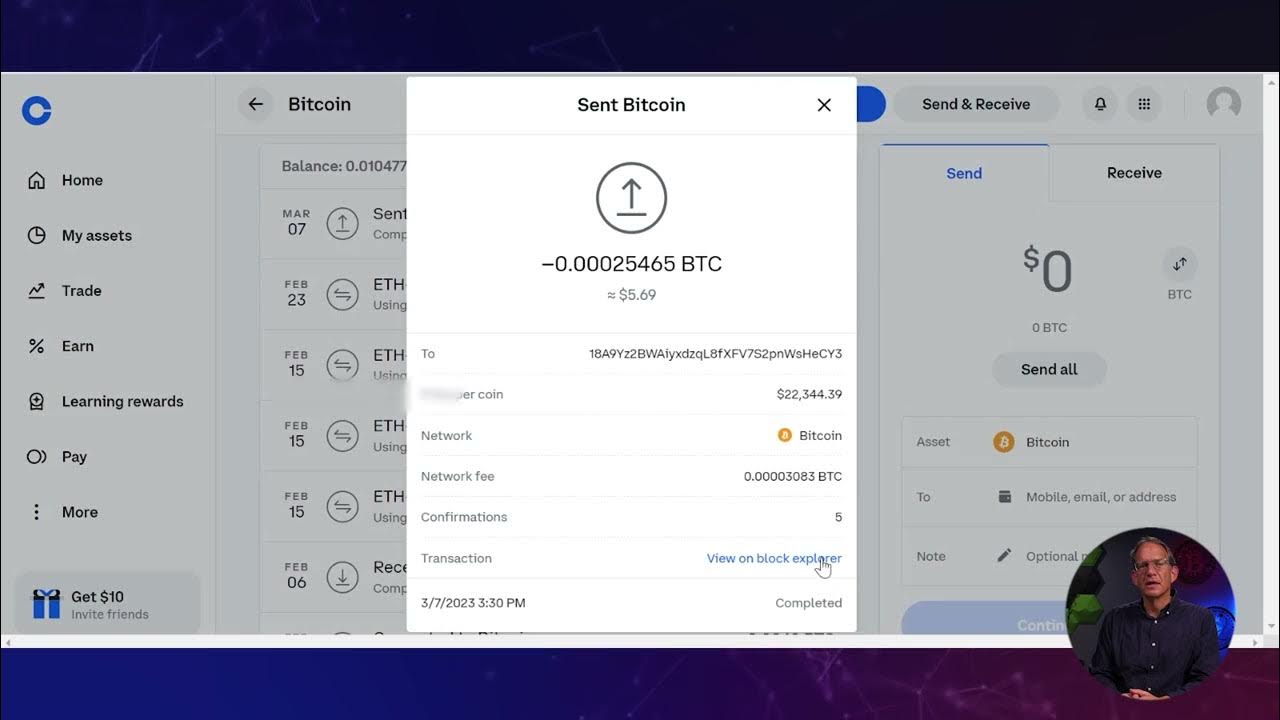

Maintain detailed records for each transaction. Keep documentation of transaction dates, token amounts, and fair market values. Major platforms like Coinbase and Kraken offer downloadable transaction histories to help you stay organized.

-

Consult a crypto tax professional for complex situations. Tax rules can change, and DeFi rewards reporting is evolving. Reach out to specialists like Gordon Law Group or Crypto Tax Girl for personalized advice.

If you dispose of those tokens later (by selling or swapping), record both the original value and the price at disposal so you can calculate capital gains or losses precisely. Good recordkeeping isn’t just smart, it’s essential for avoiding mistakes that could trigger audits or penalties.

One of the trickiest parts of reporting DeFi rewards tax is that crypto prices can swing wildly within hours. The IRS expects you to use the fair market value at the exact moment you gain control of the tokens. This means you can’t just average out prices or estimate later, specificity matters. Many DeFi users rely on portfolio trackers or even spreadsheets to log each transaction, but dedicated crypto tax software can make this process much less painful.

Common Pitfalls and How to Avoid Them

Even seasoned crypto enthusiasts can get tripped up by the nuances of crypto rewards card tax. Here are some classic mistakes people make, and how you can sidestep them:

Common Mistakes in Reporting Governance Token Rewards

-

Ignoring the Fair Market Value at Receipt: Many people forget to report the fair market value of governance tokens as income when they receive them, as required by the IRS. Always record the token’s value on the day it hits your wallet.

-

Confusing Card Rewards with Rebates: While most crypto card rewards are considered non-taxable rebates, sign-up bonuses or rewards not tied to purchases are usually taxable. Double-check your rewards source to determine if you need to report them as income.

-

Missing Capital Gains on Token Disposal: After reporting income at receipt, you must also track and report capital gains or losses when you sell or swap governance tokens. This is based on the difference between the value at receipt and at disposal.

-

Not Consulting a Tax Professional: Crypto tax rules can be complex and change frequently. Skipping advice from a qualified tax professional can result in costly mistakes or audits. A pro can help you stay compliant with the latest IRS guidance.

If your rewards are a mix of non-taxable rebates (from purchases) and taxable bonuses (from referrals or sign-ups), don’t lump them together. Document each type separately with dates, amounts, and their respective USD values. If you ever get audited, this level of detail will be your best defense.

Staying Ahead: Best Practices for DeFi Tax Compliance

The crypto space is notorious for its rapid evolution, and tax rules are no exception. While today’s guidance is clear that most purchase-based card rewards are non-taxable, regulators could tighten definitions as DeFi adoption grows. It pays to:

- Stay updated: Bookmark IRS digital asset resources and major crypto tax guides.

- Consult a pro: When in doubt, work with a tax professional who understands both DeFi and U. S. regulations.

- Avoid shortcuts: Don’t ignore small transactions, every governance token counts toward your total income and potential capital gains.

- Plan ahead: If you’re stacking significant amounts of governance tokens, consider how future price swings could impact your capital gains liability down the line.

If you’re serious about maximizing your earnings while staying compliant, it’s worth reviewing your records quarterly instead of scrambling at year-end. This proactive approach not only helps with taxes but also gives you a clearer picture of your true returns from governance token rewards.

Final Thoughts: Empower Your Crypto Journey, Legally

Earning governance tokens through crypto rewards cards is an exciting way to participate in decentralized ecosystems while building financial autonomy. But as these assets become more mainstream, expect continued scrutiny from regulators, and potentially more nuanced guidance around what counts as taxable income versus rebates.

The bottom line? Treat every transaction as if it could be reviewed by the IRS. Keep meticulous records, understand when income and capital gains taxes apply, and don’t hesitate to seek professional help if things get complicated. Mastering these habits ensures that your journey toward DeFi empowerment doesn’t stumble over avoidable tax headaches.