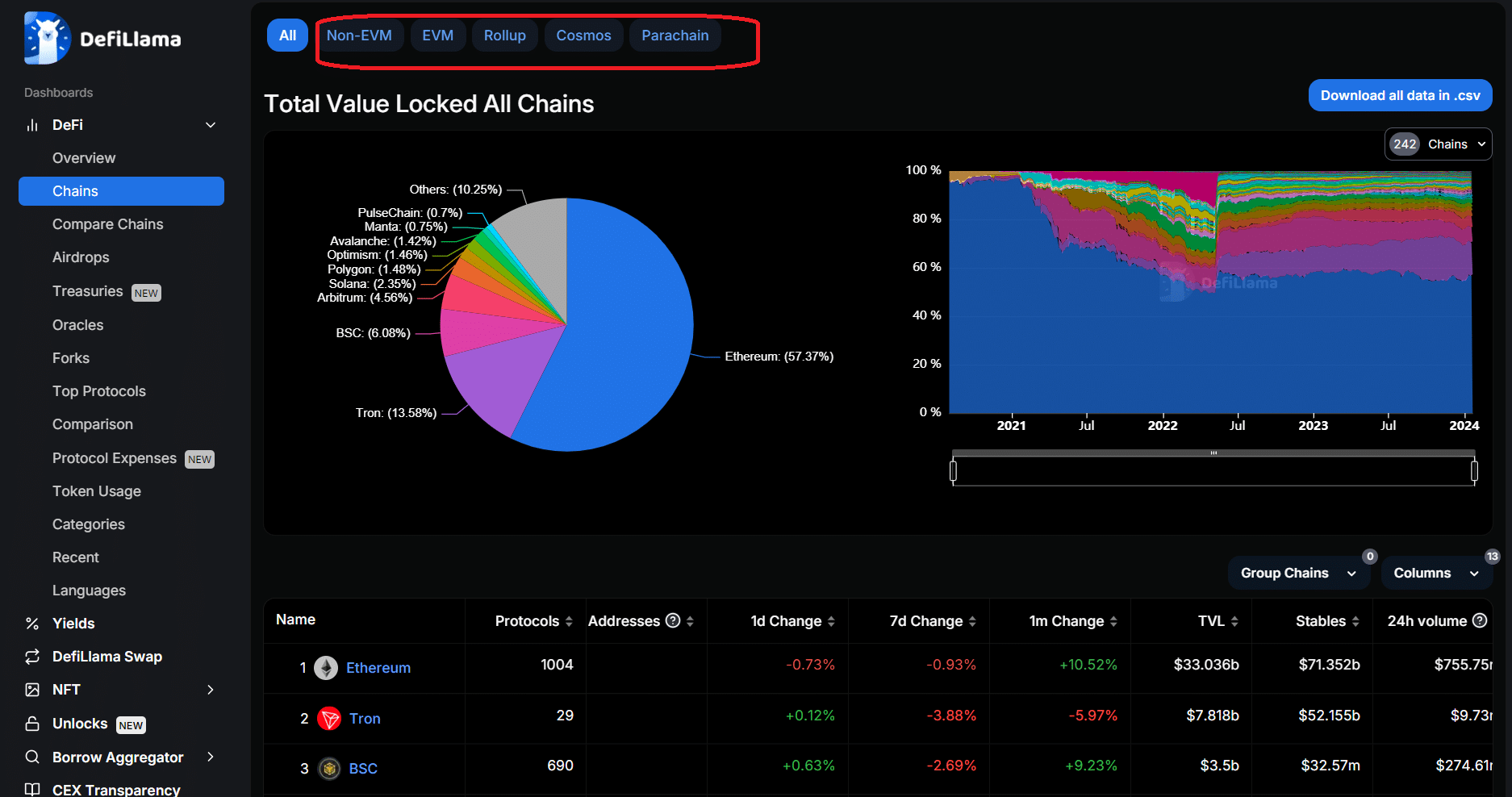

On-chain governance token rewards represent one of the most compelling intersections of decentralized finance, user incentives, and community-driven protocol evolution. As protocols mature, the structure and utility of governance tokens have evolved, moving well beyond simple voting rights to encompass a robust suite of financial and participatory benefits. For investors and crypto rewards card users alike, understanding how to maximize these rewards through strategic claiming, staking, and active community engagement is essential for both capital efficiency and meaningful protocol influence.

Claiming Governance Rewards: Timing and Strategy Matter

Many protocols now distribute on-chain governance token rewards based on user participation, staking activity, or even retroactive engagement. Missing a claim window can mean forfeiting valuable rewards or compounding opportunities. For instance, platforms like ZenChain require users to claim their rewards within specific timeframes to avoid missing out entirely. This trend is mirrored in recent initiatives such as the Gigaclaim 0 retroactive rewards by Space and Time, where eligible users must utilize the official eligibility checker and claims interface starting May 8 to secure their share.

- Set reminders for claim windows to avoid missing out on time-sensitive distributions.

- Track your eligibility using official dashboards or claim interfaces, never rely on third-party tools for critical actions.

- Calculate potential compounding effects if rewards can be restaked immediately after claiming.

Proactive claiming is not just about collecting tokens. It’s about maintaining your position in the protocol’s reward cycle and ensuring you’re always eligible for the next round of incentives. For a detailed breakdown of cross-liquidity staking mechanisms, see ZenChain’s documentation.

Staking Governance Tokens: Unlocking Yield and Influence

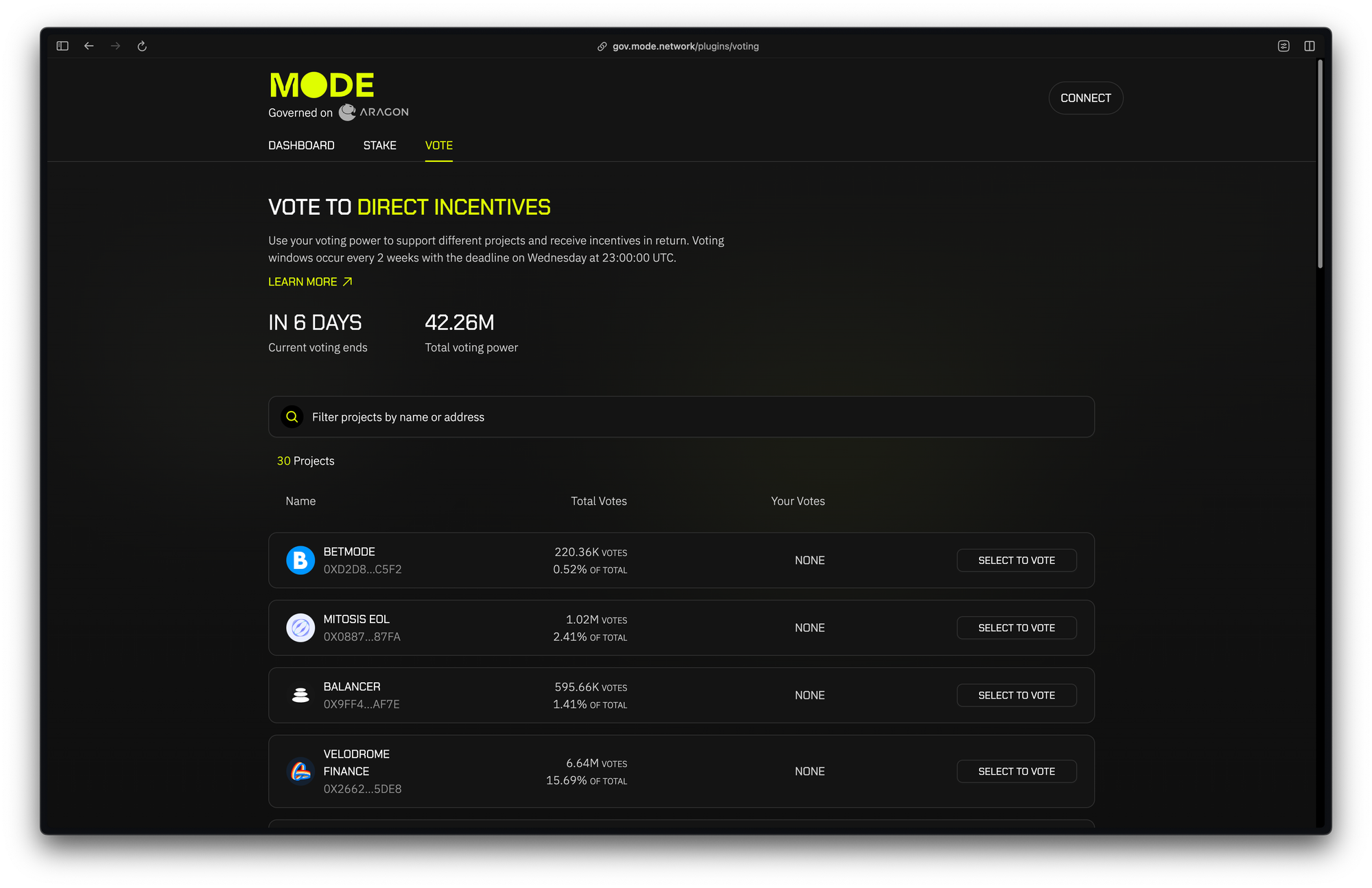

Staking has become foundational to DeFi governance strategies. By locking up your governance tokens, you not only earn additional yield but may also unlock enhanced voting rights or exclusive operational privileges. For example, PropChain incentivizes long-term stakers with increased governance power and access to unique community programs. This dual incentive structure aligns economic interests with protocol health, making staking an essential tactic for any serious participant.

Top Platforms Offering Staking-Based Governance Rewards

-

Algorand Governance: Participate in Algorand’s on-chain governance by staking ALGO tokens. Earn quarterly rewards by voting on proposals and maintaining your committed stake throughout each governance period. Algorand recently shifted from traditional governance to a staking-based rewards model, making participation accessible and rewarding for all ALGO holders.

-

Obol Collective (stOBOL): Stake OBOL tokens via the Obol Governance Portal to receive stOBOL, which grants both staking rewards and governance rights. This seamless process allows users to earn yield while actively participating in protocol decisions.

-

PropChain: Stake PROP tokens on PropChain to unlock enhanced governance rights, exclusive operational privileges, and a share of operational revenues. Long-term stakers benefit from increased influence in protocol decisions and access to community-driven ecosystem initiatives.

-

Wormhole (W Token): Stake W tokens through the Wormhole Dashboard to earn staking rewards and participate in governance. Staying staked not only yields rewards but also ensures eligibility for future community programs and special incentives.

-

DaoMine: DaoMine integrates staking rewards directly with governance participation. By staking tokens and engaging in governance activities, users align economic incentives with network health and earn additional rewards for their active role in the ecosystem.

The mechanics of staking vary by protocol, some require simple wallet connections, while others may involve more complex delegation or smart contract interactions. Regardless of the process, the underlying principle remains: staking strengthens your influence over protocol decisions while generating yield that can be compounded through regular restaking cycles. For more specifics on how staking intersects with governance rights and ecosystem participation, review PropChain’s official guide.

Community Participation: Beyond Passive Holding

The most successful protocols reward not just capital commitment but also active community involvement. Voting on proposals, contributing feedback, or even participating in data provision can unlock additional incentives. Projects like DaoMine have pioneered systems where staking rewards are directly linked to governance participation, aligning network health with user engagement. The goal is to foster robust ecosystems where token holders are incentivized to shape the platform’s future rather than passively accumulate tokens.

In addition to direct financial rewards, active participants often gain early access to new features, exclusive events, or even premium platform capabilities. This creates a positive feedback loop where informed and engaged users drive both the utility and value of their holdings. To explore innovative mechanisms that tie staking directly to governance outcomes, refer to DaoMine’s latest update.

Staking and community participation are not mutually exclusive; in fact, the most effective DeFi governance token strategies combine both to maximize on-chain governance token rewards. By maintaining an active presence in protocol discussions and governance forums, you ensure that your influence grows alongside your financial rewards. Remember, many protocols now allocate a portion of operational revenues or future airdrops to users who have demonstrated both capital commitment and active governance engagement. This dual approach is especially relevant for crypto rewards card governance users seeking to leverage their everyday spending into tangible protocol influence and additional yield.

Staying Informed: The Key to Sustained Rewards

In the rapidly evolving DeFi landscape, information asymmetry is a persistent risk. Governance proposals, claim windows, and staking program updates can change quickly, often with little warning. To stay ahead, make it a habit to monitor official protocol channels, subscribe to governance proposal notifications, and participate in community calls or AMAs. Early awareness of upcoming changes allows you to reposition your tokens or adjust your strategy for optimal benefit. Platforms like Wormhole and Obol Collective have demonstrated the importance of keeping staked tokens engaged to access future governance programs and community rewards.

Top Tips to Stay Updated on Governance Token Rewards

-

Subscribe to Official Platform Announcements: Follow the official communication channels (such as Algorand Foundation Blog or Wormhole Blog) to receive timely updates on reward cycles, claim windows, and staking opportunities.

-

Set Calendar Reminders for Claim Cycles: Mark key dates for reward claims and staking periods—platforms like Space and Time and Wormhole provide specific claim windows (e.g., Gigaclaim 0 eligibility starting May 8). Missing these can mean forfeiting rewards.

-

Join Active Community Channels: Participate in official Discord servers, Telegram groups, and forums of major governance platforms (such as Obol Collective or PropChain) to stay informed about governance proposals, reward updates, and community events.

-

Enable Notifications on Governance Dashboards: Use platform dashboards (like the Wormhole Dashboard or PropChain Governance Portal) and enable notifications for new proposals, reward distributions, and staking opportunities.

For those using crypto rewards cards that offer governance token incentives, this diligence is doubly important. These products often tie cardholder activity to periodic governance token distributions, which may require manual claiming or additional staking steps. Missing a notification or failing to act within the required window can mean missing out on both financial and participatory benefits.

Leveraging Governance Tokens for Utility and Autonomy

Beyond voting and staking, governance tokens are increasingly being integrated into broader protocol ecosystems. Some platforms allow their use for transaction fee discounts, access to premium features, or participation in exclusive events. These additional utilities further enhance the value proposition for holders who are willing to engage beyond passive accumulation. For example, the integration of staking with operational privileges on platforms like PropChain and DaoMine demonstrates how governance token utility can drive both financial autonomy and deeper protocol alignment.

Pro tip: Always review the latest protocol documentation before committing tokens to staking or governance activities. Terms, lockup periods, and reward structures can and do change, impacting both your yield and your rights as a participant.

Ultimately, maximizing on-chain governance token rewards is about more than just chasing yield. It’s about understanding the evolving landscape of DeFi governance, actively participating in protocol development, and leveraging every available tool to enhance both your financial outcomes and your influence within the community. By combining timely claiming, strategic staking, and consistent community engagement, you position yourself to capture the full spectrum of benefits that modern governance tokens have to offer.