Crypto rewards cards have rapidly evolved in 2025, moving beyond simple cashback to offering governance token rewards that empower users to shape the future of DeFi protocols. For the strategic DeFi enthusiast, this shift represents a rare opportunity: not only can you earn passive income through everyday spending, but you also gain a direct voice in the platforms you support. Let’s explore how to maximize these unique rewards and become an active participant in decentralized governance.

Why Governance Token Rewards Matter for DeFi Users

Unlike traditional crypto card rewards, governance tokens provide more than just monetary value. Holding tokens like GNO, CRO, CRV, or NEXO grants you voting rights within major DeFi ecosystems. This means you help decide on protocol upgrades, fee structures, and community initiatives. By earning these tokens through your daily spending, you’re not just stacking assets, you’re accumulating influence.

For example, the Gnosis Pay Card links directly to a Safe wallet and offers up to 4% back in GNO, making it a top pick for those who want both high-yield rewards and a stake in protocol governance. Similarly, the Crypto. com Visa Card, Curve Card, and Nexo Card each grant their own governance tokens as rewards, allowing you to participate in the ongoing evolution of their respective platforms.

The Top Crypto Rewards Cards Offering Governance Tokens in 2025

Top 4 Crypto Cards With Governance Token Rewards (2025)

-

Gnosis Pay Card: Directly links to your Safe wallet and offers up to 4% rewards in GNO governance tokens. Ideal for DeFi users who want to maximize rewards while gaining voting rights in the Gnosis ecosystem.

-

Crypto.com Visa Card: Earn up to 5% cashback in CRO tokens on every purchase. CRO holders can participate in protocol governance, and higher staking unlocks premium card tiers with extra perks.

-

Curve Card: Receive CRV governance token cashback on eligible spending. CRV rewards empower users to vote on Curve protocol upgrades and earn additional DeFi yields.

-

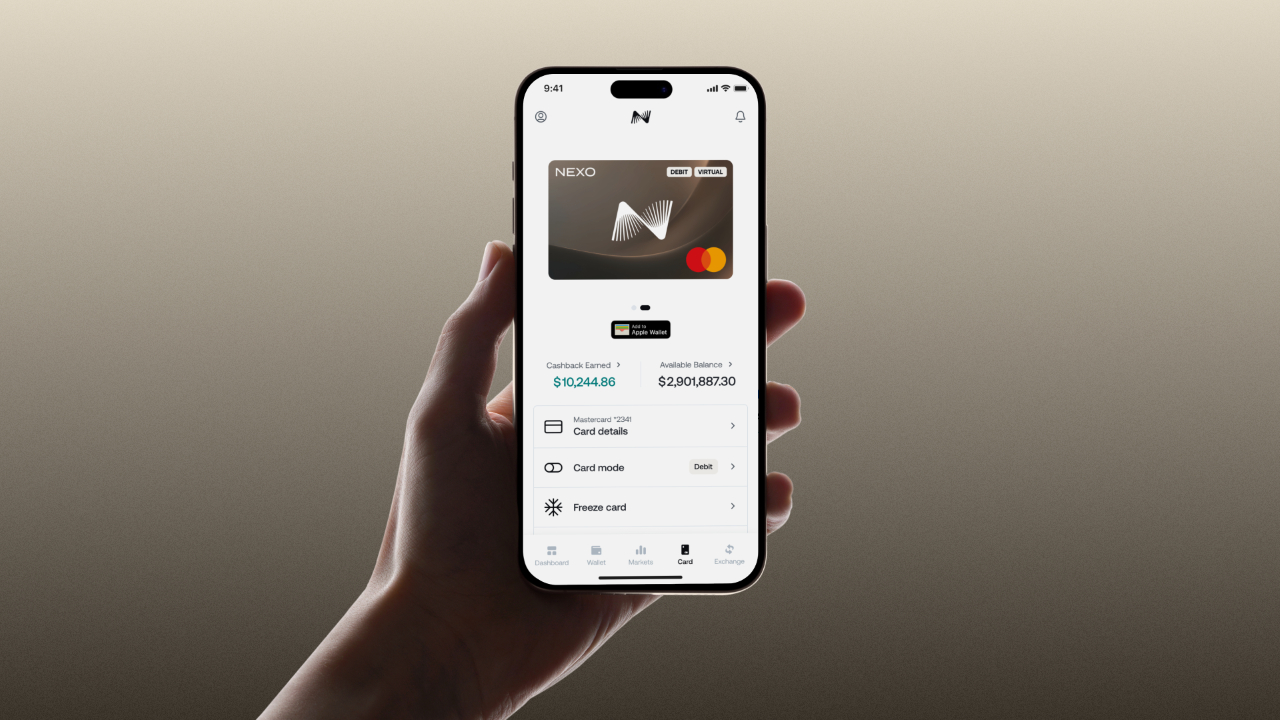

Nexo Card: Get up to 2% back in NEXO tokens on all transactions. NEXO token holders unlock governance participation and enhanced loyalty rewards within the Nexo platform.

Let’s break down the four leading options for maximizing crypto card rewards with governance token payouts:

- Gnosis Pay Card (GNO Rewards): Up to 4% back in GNO tokens. Seamless integration with Safe wallets. Ideal for users committed to the Gnosis ecosystem and direct protocol participation.

- Crypto. com Visa Card (CRO Token Rewards): Flexible tiers with up to 5% back in CRO. Staking CRO unlocks higher rewards and exclusive perks. CRO holders can vote on Crypto. com protocol proposals.

- Curve Card (CRV Governance Token Cashback): Earn CRV tokens on every purchase. CRV holders shape Curve’s fee structure and new pool listings. Perfect for yield farmers and liquidity providers.

- Nexo Card (NEXO Token Rewards): Up to 2% back in NEXO tokens. Rewards can be staked for compounding yields. NEXO holders vote on platform upgrades and dividend distributions.

Building a DeFi Strategy Around Governance Token Rewards

To truly maximize your crypto rewards cards with governance tokens, it’s crucial to match your spending habits to the right card and ecosystem. Start by assessing which protocols align with your values and financial goals. Are you passionate about decentralized exchanges, lending markets, or cross-chain infrastructure? Each card’s governance token grants influence over a different slice of the DeFi landscape.

Once you’ve chosen your primary card, consider the following strategies:

- Stake your earned tokens to unlock additional yield or voting multipliers.

- Participate in on-chain votes to help steer protocol direction, your voice is amplified when you accumulate more tokens.

- Diversify by using multiple cards, if possible, to gain exposure and influence across several leading DeFi projects.

Active participation isn’t just about voting, it’s about staying engaged with proposals, community discussions, and upcoming upgrades. By leveraging your daily spending through these cards, you’re building both your personal wealth and your stake in the decentralized future.

Evaluating Card Features: Beyond the Headline Rewards Rate

While rewards percentages are important, seasoned DeFi users know that true value lies in the utility of the governance token itself. For instance, GNO’s robust voting system on Gnosis DAO may appeal to those who want hands-on protocol influence, while CRO’s integration with Crypto. com’s expanding suite of services offers both flexibility and reach. Don’t overlook staking requirements, withdrawal fees, or token lockup periods, all of which can impact your net yield and participation power.

If you’re ready to take a deeper dive into advanced strategies for maximizing DeFi governance participation with rewards cards, check out our detailed guide at this link.

Another critical factor is the liquidity and market reputation of each governance token. For example, CRV and CRO are widely traded and supported on major exchanges, making it easier to convert rewards or stake them for additional yield. GNO, while more niche, offers deep integration with the Gnosis ecosystem, appealing to power users who value direct DAO engagement. NEXO’s token utility extends beyond governance, staked NEXO can yield daily interest payments, compounding your card rewards over time.

To optimize your approach, monitor protocol updates and reward structure changes. Crypto card issuers often adjust reward rates or introduce new governance features in response to market trends or community feedback. Staying informed ensures you don’t miss out on limited-time boosts or new staking opportunities that can significantly enhance your returns.

Practical Steps for Claiming and Using Governance Token Rewards

Claiming your rewards is only the first step. Here’s how to turn those tokens into real influence and yield:

- Track your governance token balances regularly. Use dashboards or wallet apps that support GNO, CRO, CRV, and NEXO for seamless management.

- Review upcoming governance proposals on each protocol’s forum or voting platform. Even a small number of tokens can sway decisions in less-contested votes.

- Stake or lend your tokens where possible. Platforms like Curve and Nexo offer additional rewards or interest for staked governance tokens.

- Consider long-term holding if you believe in the protocol’s future. Some cards offer bonus multipliers for users who lock up tokens for extended periods.

Adopting a disciplined approach to claiming and deploying your rewards will compound both your financial returns and your influence within DeFi communities. For a comprehensive breakdown of strategies tailored to power users, see our resource on maximizing crypto card rewards with governance tokens.

The Future of DeFi Card Rewards: Influence and Autonomy

As crypto rewards cards continue to evolve, governance token payouts are becoming a central pillar of DeFi participation. The four cards highlighted, Gnosis Pay Card, Crypto. com Visa Card, Curve Card, and Nexo Card, each offer a unique balance of yield, protocol influence, and ecosystem benefits. By aligning your spending with your governance ambitions, you can turn every transaction into a step toward greater financial autonomy and community-driven innovation.

Ultimately, the best crypto rewards cards for governance tokens are those that fit your personal strategy, whether that’s maximizing yield, shaping protocol policy, or diversifying your DeFi exposure. Stay agile, stay informed, and let your spending fuel both your portfolio growth and your voice in the decentralized future.