Crypto rewards cards have rapidly evolved in 2024, offering more than just speculative gains. For savvy users, the real value lies in earning governance token rewards that unlock voting rights and influence within top DeFi ecosystems. With platforms like Crypto. com, Binance, Nexo, and Coinbase refining their card programs, maximizing your crypto card rewards is now about strategic participation as much as passive accumulation.

Choose Cards Offering Direct Governance Token Rewards

The first step to maximizing your returns is to select cards that pay out directly in governance tokens. The Crypto. com Visa Card, especially at the Obsidian or Frosted Rose Gold tiers, is a standout here. Users earn CRO tokens with every purchase – not only does this provide exposure to a major DeFi asset, but it also enables participation in protocol votes and platform upgrades. Similarly, the Nexo Card offers up to 2% cashback in NEXO tokens, which double as both reward and governance assets.

This direct approach means every transaction doesn’t just grow your portfolio – it strengthens your voice within these evolving platforms. For users who want a hands-on role in shaping DeFi products, prioritizing these cards is essential.

Optimize Spending Categories for Maximum Governance Token Yield

It’s not enough to simply earn governance tokens; optimizing where and how you spend can make a significant difference. The Binance Card, for example, offers BNB rewards on eligible purchases. Since BNB is central to Binance’s ecosystem governance and staking programs, targeting high-reward categories (like travel or dining) can accelerate your earning rate.

Many users overlook the impact of spending patterns on yield. By aligning everyday expenses with categories that offer higher rates of governance token cashback – and by monitoring seasonal promotions from card issuers – you can significantly boost both your holdings and your influence.

Leverage Staking Programs to Boost Governance Token Earnings

If you’re aiming for top-tier yields in 2024, staking is non-negotiable. Cards like Crypto. com require users to stake CRO for premium tiers; likewise, Swipe (now integrated with Binance) lets you stake SXP to unlock better rates. These programs don’t just increase your baseline rewards – they often add bonus multipliers or exclusive access to new governance proposals.

The key is understanding lock-up periods and balancing liquidity needs with potential upside from higher reward rates. For power users willing to commit assets for longer durations, these staking-linked bonuses can be a game-changer for both passive income and active participation.

Participate in Card-Linked Governance Proposals

Earning tokens is only half the equation – using them matters just as much. Platforms like Nexo have pioneered card-linked governance by allowing NEXO holders (including those earning via card rewards) to vote on platform upgrades or dividend distributions directly from their dashboard. This integration bridges everyday spending with real-time impact on product direction.

If you’re looking for actionable ways to turn everyday purchases into tangible influence over DeFi protocols, prioritize cards where earned tokens grant immediate voting rights or proposal access.

For many, this is the most compelling aspect of governance token rewards: your daily spending doesn’t just pad your portfolio, it actively shapes the protocols you rely on. With the Nexo Card, for instance, every NEXO token earned is a ticket to participate in platform decisions and revenue-sharing events. As more platforms roll out card-linked voting and governance dashboards, expect this trend to accelerate across the crypto rewards ecosystem.

Diversify Across Multiple Cards for Broader Governance Exposure

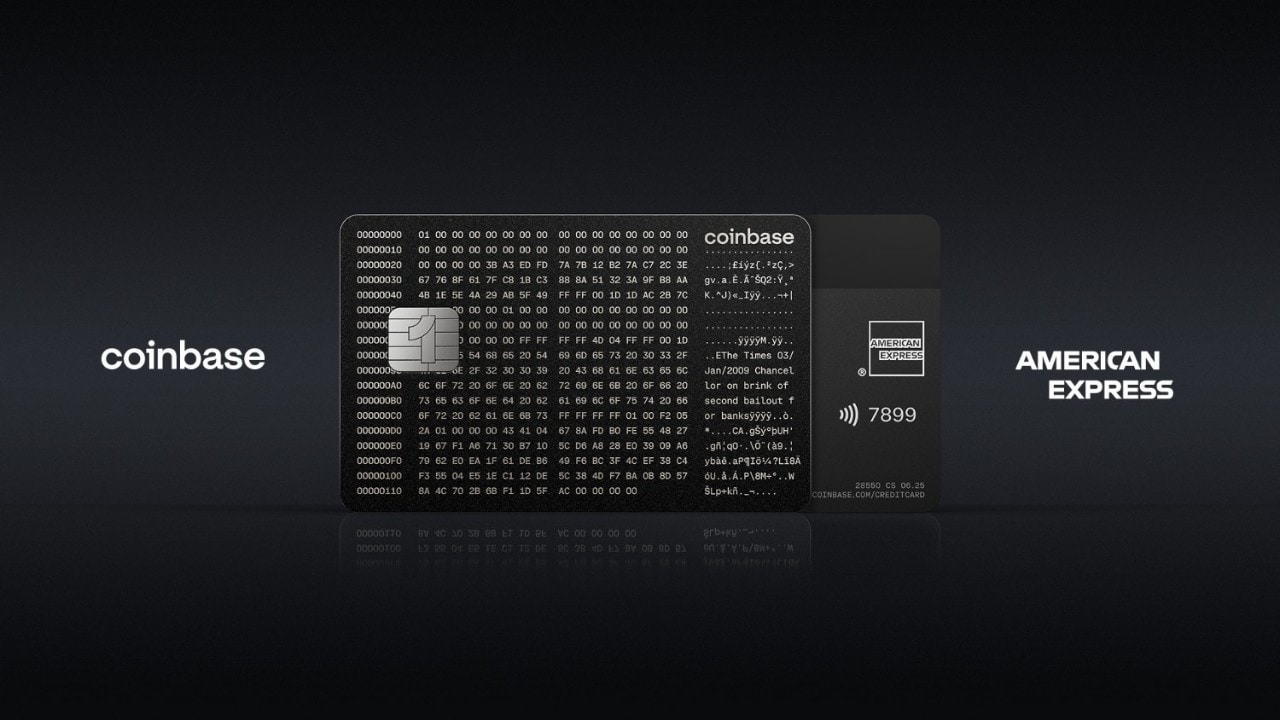

No single DeFi protocol dominates the landscape. That’s why seasoned users diversify their card usage to accumulate governance tokens from several ecosystems. Combining a Coinbase Card (which lets you earn ETH or DAI) with a Crypto. com Visa or Binance Card allows you to build influence across multiple protocols, each with its own set of proposals, staking opportunities, and community incentives.

This approach reduces risk and expands your toolkit for both passive income and active participation. For example, while CRO or BNB may offer high-yield staking and voting rights on their respective platforms, holding ETH or DAI opens the door to governance within protocols like MakerDAO or Ethereum Layer 2s. The key is to regularly reassess which cards align best with your evolving DeFi interests and which tokens are gaining traction in on-chain governance.

Top 5 Strategies & Cards for Governance Token Rewards

-

Choose Cards Offering Direct Governance Token Rewards: Select crypto cards like the Crypto.com Visa Card (Obsidian or Frosted Rose Gold tiers) that reward users with CRO, a governance token enabling participation in platform decisions. Higher tiers offer increased CRO cashback, but require substantial staking.

-

Optimize Spending Categories for Maximum Governance Token Yield: Use cards such as the Binance Card, which offers BNB rewards on eligible purchases. BNB holders can participate in Binance ecosystem governance and staking, maximizing both spending rewards and DeFi influence.

-

Leverage Staking Programs to Boost Governance Token Earnings: Stake tokens (e.g., CRO on Crypto.com or SXP on Swipe) to unlock higher reward rates and additional governance token bonuses tied to your card usage. Staking increases both your rewards and your voting power within the ecosystem.

-

Participate in Card-Linked Governance Proposals: Engage with platforms like Nexo Card, where holding and earning NEXO tokens through card rewards enables voting on platform upgrades and dividend distributions. This direct link between card use and governance participation enhances your role in the platform’s future.

-

Diversify Across Multiple Cards for Broader Governance Exposure: Combine usage of cards like Coinbase Card (offering ETH or DAI rewards) and Crypto.com Visa to accumulate various governance tokens. This strategy increases your influence across multiple DeFi protocols and spreads risk across different ecosystems.

Practical Tips for Maximizing Your Governance Token Rewards

- Monitor Staking Requirements: Premium rewards often require significant token lockups, track minimums for cards like Crypto. com Visa (CRO) or Binance Card (BNB).

- Stay Informed on Platform Proposals: Use earned tokens to vote early, many platforms reward active participation.

- Rotate Spending: Take advantage of seasonal promotions or boosted categories across multiple cards to maximize yield.

- Track Reward Rates: Rates can change frequently; keep up-to-date using trusted resources like our latest comparison guide.

- Avoid Overconcentration: Don’t lock all assets into one ecosystem; diversification helps manage risk as DeFi evolves.

The intersection of crypto rewards cards and governance token participation is where utility meets strategy in 2024. By choosing cards that pay out directly in governance tokens, optimizing your spending categories, leveraging staking programs, participating in protocol proposals, and diversifying across multiple ecosystems, you can convert everyday transactions into both financial upside and real influence over the future of DeFi.

If you’re ready to take your strategy further or want a deeper dive into advanced techniques for power users, check out our dedicated resource: How to Maximize Crypto Card Rewards with Governance Tokens: Strategies for Power Users.