Imagine swiping your debit card for coffee or groceries and earning tokens that let you vote on multimillion-dollar DeFi decisions. In 2026, crypto rewards cards paying governance tokens like UNI and AAVE have evolved into powerful tools for everyday users to gain real influence in protocols. With Uniswap’s UNI trading at $4.84, up slightly today, these cards turn spending into strategic DeFi participation. We’re breaking down the top contenders offering rewards in tokens such as CRO, NEXO, BNB, WXT, and STRK, focusing on rates, fees, and governance utility to help you pick the best for 2026.

Why Governance Token Rewards Beat Traditional Cashback

Traditional cashback feels good until inflation eats it away, but governance tokens like those from Crypto. com Card (CRO) or Nexo Card (NEXO) offer upside potential and voting power. Picture this: earn STRK from Ready Metal Card, then stake it to shape Starknet’s future upgrades. These aren’t just rewards; they’re entry tickets to decentralized decision-making. In a market where UNI hovers at $4.84, holding governance tokens positions you for appreciation while influencing protocols that power billions in TVL. Cards like Wirex with WXT rewards let you exchange for broader DeFi exposure, amplifying your voice across ecosystems.

Pro tip: Always stake your rewards promptly. Locked CRO from Crypto. com boosts yields and voting weight, turning passive spending into active governance.

Top 5 Crypto Rewards Cards for Governance Tokens in 2026

After sifting through 2026’s launches and updates, these five stand out for blending high cashback with meaningful governance perks. Each supports seamless spending via Visa or Mastercard networks, self-custody options where possible, and tokens akin to UNI or AAVE in utility. Let’s spotlight them:

Top 5 Governance Rewards Cards

-

Crypto.com Visa Card: Tiered 1.5-8% CRO cashback. Stake CRO to vote on Cronos proposals and ecosystem upgrades. Motivating perks like Spotify rebates await!Ideal for everyday DeFi spending.

-

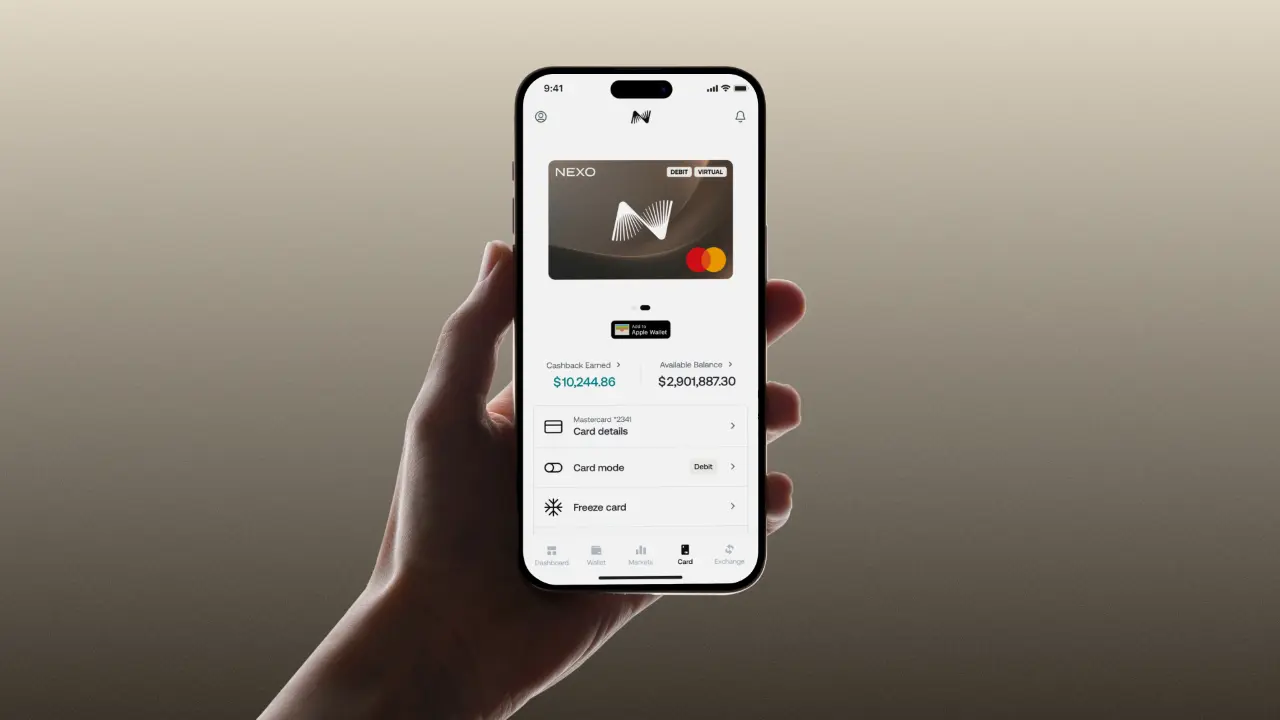

Nexo Card: Up to 2% NEXO rewards. Hold/stake NEXO for voting on asset listings and rates. Empower your financial decisions in Nexo’s ecosystem!

-

Binance Card: Earn BNB cashback (up to 8%). Use BNB for governance in Binance Smart Chain proposals. Seamless global spending with DeFi power.

-

Wirex Card: Up to 8% WXT back, exchangeable for DeFi tokens. Flexible crypto spending with governance token utility in Wirex app.

-

Ready Metal Card: 3% STRK cashback on self-custody debit spends. Exclusive perks; use code THEBLOCK for 15% off. Shape DeFi with your rewards!

- Crypto. com Card: Tiered up to 8% CRO back, vote on Cronos proposals. Spotify rebates sweeten the deal.

- Nexo Card: 2% NEXO rewards, influence platform rates and listings via staking.

- Binance Card: BNB cashback with Binance Smart Chain governance access, ideal for high-volume traders.

- Wirex Card: Up to 8% WXT, swappable for other governance tokens, US investor favorite per CoinLedger.

- Ready Metal Card: 3% STRK self-custody rewards, exclusive perks with code THEBLOCK for 15% off (The Block rec).

These cards shine in 2026’s competitive landscape, outpacing generics like Coinbase by tying rewards to DeFi control. For instance, Binance Card’s BNB lets you propose chain improvements, mirroring AAVE’s risk parameter votes.

Comparing Rewards Rates, Fees, and DeFi Utility

Rewards rates are table stakes, but governance depth sets winners apart. Crypto. com leads for high tiers (5-8% CRO with staking), but Nexo edges on low fees and instant 2% NEXO back, perfect for conservative spenders eyeing platform votes. Wirex’s 8% WXT ceiling tempts aggressive users, exchangeable for UNI-like exposure, though monthly fees apply above base tiers.

| Card | Rewards Rate | Governance Token | Key Fees | DeFi Utility |

|---|---|---|---|---|

| Crypto. com | 1.5-8% CRO | CRO | No FX, tier locks | Cronos voting, staking boosts |

| Nexo | Up to 2% NEXO | NEXO | Zero spending fees | Asset listings, rate votes |

| Binance | Up to 8% BNB | BNB | 0.9% FX | BSC proposals |

| Wirex | Up to 8% WXT | WXT | $1.50/month premium | Token swaps for governance |

| Ready Metal | 3% STRK | STRK | No annual | Starknet upgrades, self-custody |

Fees matter: Ready Metal’s self-custody avoids custodial risks, paying steady 3% STRK without lockups. Binance suits globetrotters despite FX hits, with BNB fueling high-stakes votes. My pick for balanced utility? Wirex, blending top rates with flexibility. Check upcoming launches for evolutions.

Uniswap (UNI) Price Prediction 2027-2032

Forecast based on governance token rewards in crypto cards, DeFi adoption, and market cycles (Current 2026 price: $4.84)

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $4.00 | $8.00 | $15.00 | +65% |

| 2028 | $5.50 | $12.00 | $22.00 | +50% |

| 2029 | $7.00 | $18.00 | $32.00 | +50% |

| 2030 | $9.00 | $25.00 | $45.00 | +39% |

| 2031 | $12.00 | $35.00 | $65.00 | +40% |

| 2032 | $15.00 | $50.00 | $90.00 | +43% |

Price Prediction Summary

UNI is forecasted to see strong growth from $8 average in 2027 to $50 by 2032, fueled by governance rewards cards like Uniswap x Visa, DeFi TVL expansion, and Ethereum scaling. Min prices reflect bearish corrections; max capture bull runs tied to adoption and cycles.

Key Factors Affecting Uniswap Price

- Integration into rewards cards (e.g., Uniswap x Visa Governance Card) boosting UNI demand and governance participation

- DeFi sector growth and rising DEX volumes on Uniswap

- Ethereum L2 improvements reducing fees and increasing throughput

- Regulatory clarity enabling mainstream DeFi adoption

- Crypto market cycles influenced by BTC halvings

- Competition from AAVE, Curve, and emerging DEXs

- Uniswap protocol upgrades (v4+) enhancing liquidity and yields

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

With UNI at $4.84, governance tokens from these cards position you to capture similar growth while wielding real protocol influence. Ready Metal’s STRK rewards stand out for Starknet enthusiasts, letting you vote on layer-2 scaling without intermediaries. Binance Card users tap BNB for BSC governance, proposing fee reductions that could boost yields ecosystem-wide.

2026 Comparison: Top Crypto Rewards Cards Offering Governance Tokens Like UNI & AAVE

| Card | Rewards Rate | Governance Token | Annual Fees | Monthly Spending Limit | DeFi Utility |

|---|---|---|---|---|---|

| Crypto.com Card | 1.5% – 8% (tiered) | CRO | $0 (staking req.) | Up to $25,000 | Vote on Cronos ecosystem upgrades & proposals |

| Nexo Card | Up to 2% | NEXO | $0 | Unlimited* | Voting on platform decisions, asset listings & rates |

| Binance Card | Up to 8% | BNB | $0 | $10,000+ (region-dependent) | BNB Chain governance & community proposals |

| Wirex Card | Up to 8% | WXT | $0 | Up to $30,000 | Exchange for DeFi tokens like UNI/AAVE; app governance |

| Ready Metal Card | 3% | STRK | $0 (15% discount w/code THEBLOCK) | Up to $50,000 | Self-custody perks; STRK governance voting |

Unlocking DeFi Utility: Beyond Cashback

These cards transform routine spending into governance firepower. Take Crypto. com Card: lock CRO rewards to amplify your vote on Cronos chain upgrades, much like UNI holders tweak Uniswap fees. I’ve seen users double their influence by stacking tiers, earning 5-8% back while shaping multimillion-dollar decisions. Nexo Card’s 2% NEXO feels modest, yet staking unlocks votes on interest rates, directly impacting your lending returns. It’s a stealth powerhouse for steady earners.

Wirex shines for versatility; swap WXT for UNI or AAVE equivalents inside the app, then delegate votes across protocols. Per CoinLedger’s 2026 rankings, it’s the cashback king for US folks, blending high rates with low barriers. Binance Card demands higher volumes for peak 8% BNB, but the governance payoff justifies it, especially if you’re bullish on BSC’s DeFi hubs. Ready Metal disrupts with true self-custody, no KYC headaches, and 3% STRK that funds Starknet proposals. Use code THEBLOCK for that 15% discount and jumpstart your stack.

2026 Governance Utility Comparison: Top Crypto Rewards Cards

| Card | Governance Token | Voting Utility | Voting Power Multiplier | Cashback Rewards | Key Perks |

|---|---|---|---|---|---|

| Crypto.com Card | CRO | Cronos proposals & network upgrades | Up to 5x with higher staking tiers | 1.5% – 8% CRO | Spotify/Netflix rebates, lounge access |

| Nexo Card | NEXO | Rate votes & platform decisions (e.g., asset listings) | 2x+ via NEXO staking/holding | Up to 2% NEXO | Interest rate influence |

| Binance Card | BNB | BSC improvements & chain proposals | 3x via veBNB locking | Varies by VIP level | Global spending, low fees |

| Wirex Card | WXT | Token swaps & DeFi governance exchanges | Flexible multipliers via WXT swaps | Up to 8% WXT | Multi-crypto support |

| Ready Metal Card | STRK | Starknet upgrades | 2x with self-custody staking | 3% STRK | 15% discount w/ code THEBLOCK, partner perks |

Strategies to Maximize Rewards and Votes

Pair high-spend categories like groceries with top-tier cards. For Crypto. com, hit Ruby Steel level via $400 CRO stake for 3% base, scaling to 8%. Immediately stake rewards; it compounds voting weight, echoing AAVE’s safety module. Nexo skips tiers altogether, crediting 2% NEXO daily with zero FX fees, ideal for borderless spenders.

Opinion: Skip Binance if FX fees sting, unless BNB’s governance aligns with your portfolio. Wirex’s premium tier at $1.50/month unlocks 8% WXT, worth it for swappers eyeing UNI at $4.84. Ready Metal wins for purists, self-custody STRK letting you run nodes or delegate freely. Track via apps, set auto-stake, and join DAOs. Dive deeper with our strategies for DeFi enthusiasts.

Risks exist: token volatility mirrors UNI’s swings, and not all votes pass. Custodial cards like Crypto. com demand trust, unlike Ready Metal’s keys-in-hand model. Fees erode small spends, so calculate net yield first. Yet, with DeFi TVL soaring, these cards democratize power previously reserved for whales.

Picture voting yes on a Starknet upgrade funded by your coffee cashback. Or pushing Nexo listings that juice your portfolio. In 2026, these five cards lead because they blend usability with agency. Wirex for flexibility, Crypto. com for perks, Nexo for simplicity, Binance for scale, Ready Metal for sovereignty. Pick one, spend smart, govern boldly. Your DeFi voice awaits, UNI at $4.84 signaling more upside ahead. Ready to level up?