As AAVE trades at $103.24, down 14.37% in the last 24 hours from a high of $122.21, disciplined investors see a prime entry for accumulation. Crypto rewards cards offering direct AAVE governance token rewards turn everyday spending into a DeFi powerhouse, blending cashback, staking yields, and voting power. In 2026, these crypto rewards cards AAVE focused tools let you stake, spend, and maximize returns without touching your principal stack.

These cards bridge fiat spending with Aave’s lending protocol, where your purchases yield AAVE tokens eligible for staking and governance. At current prices, a 2% cashback on $5,000 monthly spend nets about 0.97 AAVE, worth $100, plus staking APYs pushing compounded gains. Forget low-yield bank cards; these AAVE governance token debit cards demand active participation for outsized results.

Why Prioritize AAVE Rewards Cards Over Stablecoin Cashback

Governance token cashback cards like the best AAVE rewards crypto card 2026 contenders outpace USDC or USDT rebates by tying rewards to Aave’s growth. AAVE holders vote on risk parameters, fee structures, and upgrades, amplifying token value beyond raw yield. Recent protocol expansions, including cross-chain lending, reward stakers with safety modules and incentives. Cards in our lineup convert spending velocity into voting weight, a flywheel absent in generic crypto cards.

Staking AAVE isn’t passive; it’s your lever for protocol direction, turning consumer habits into ecosystem control.

Consider market context: Kraken’s 0.1% APR pales against card-boosted staking at 4-8% APY, per Coinspeaker benchmarks. With AAVE at $103.24, volatility favors buyers who spend strategically on groceries, fuel, and subscriptions.

Breaking Down the Top 8 AAVE Governance Rewards Cards

Our curated list spotlights cards delivering direct AAVE rewards, low fees, and staking integration. Each supports AAVE staking rewards spending cards mechanics for 2026 maximization.

- Bleap AAVE Rewards Mastercard: Leads with 2.5% AAVE cashback, no FX fees, instant staking boosts. Ideal for high-volume spenders chasing governance power.

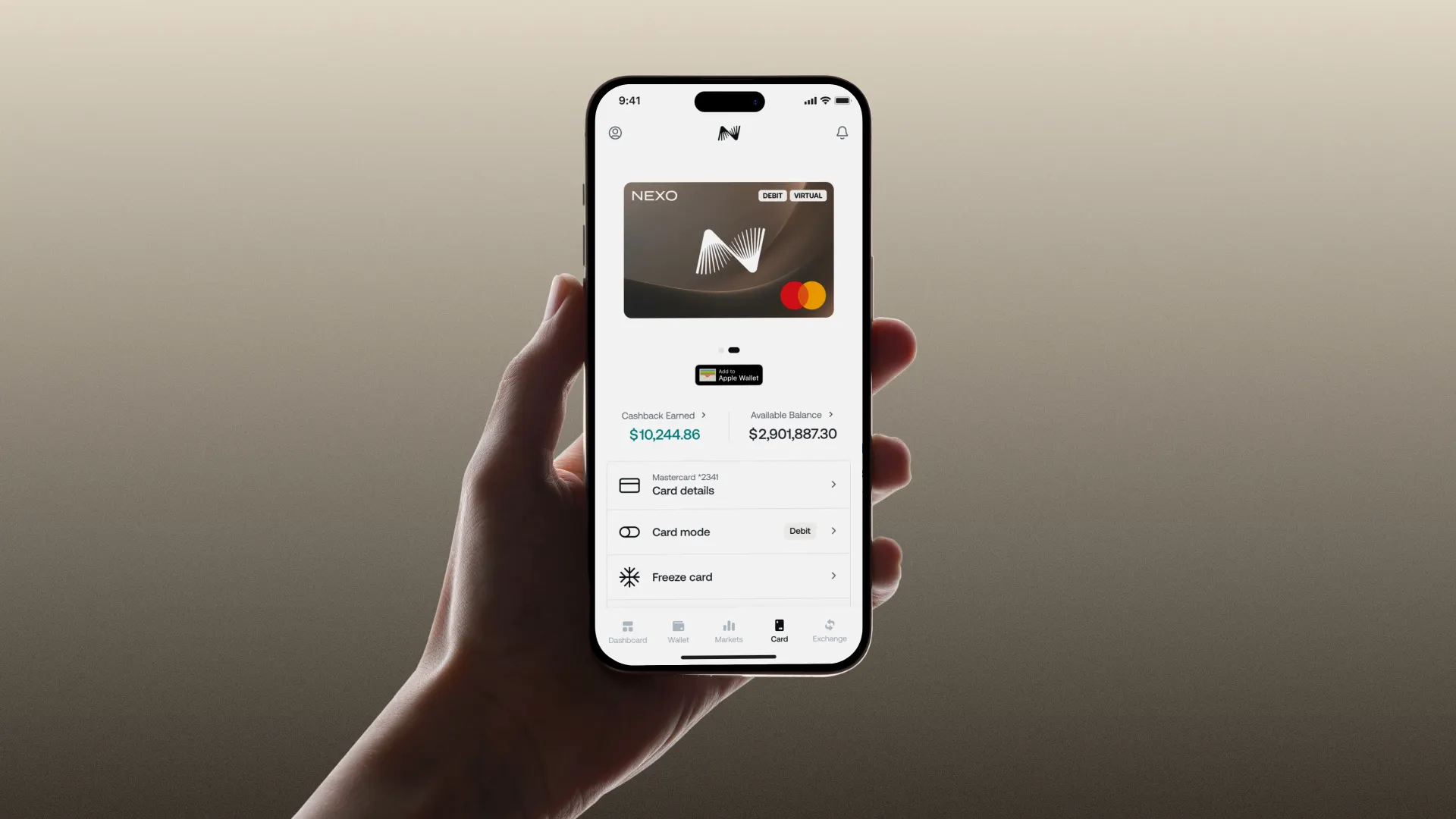

- Nexo AAVE Governance Debit Card: 2% back in AAVE, seamless staking at 5% APY, compliance-focused for institutions.

- Coinbase AAVE Cashback Card: User-friendly 1.8% AAVE rebates, one-tap staking, integrates Coinbase Wallet for voting.

- Gemini AAVE Credit Card: Premium 2.2% AAVE on all spends, regulated security, staking yields up to 6%.

- Crypto. com AAVE Staking Rewards Card: Tiered staking unlocks 3% AAVE cashback, CRO synergies for extra governance leverage.

- Binance AAVE Visa Card: Global reach, 2% AAVE rewards, direct staking to BNB Chain pools.

- Wirex AAVE Yield Card: Multi-currency, 1.5-2.5% AAVE yields, crypto-fiat hybrid for daily use.

- Bybit AAVE Rewards Debit Card: Trader-centric, 2.3% AAVE on derivatives-linked spends, high APY staking.

Bleak’s edge? Zero monthly fees pair with AAVE at $103.24 for cost-free accumulation. Nexo’s institutional tilt suits whales; Coinbase wins retail simplicity. See upcoming launches for evolutions.

Aave (AAVE) Price Prediction 2027-2032

Projections based on staking growth, DeFi adoption, crypto rewards cards offering AAVE governance token rewards, and market cycles

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from 2026 $200) |

|---|---|---|---|---|

| 2027 | $220 | $300 | $380 | +50% |

| 2028 | $350 | $480 | $650 | +60% |

| 2029 | $500 | $720 | $950 | +50% |

| 2030 | $650 | $1,000 | $1,350 | +39% |

| 2031 | $850 | $1,300 | $1,700 | +30% |

| 2032 | $1,100 | $1,600 | $2,100 | +23% |

Price Prediction Summary

AAVE is forecasted to experience robust growth from 2027 to 2032, driven by the integration of AAVE rewards in popular crypto cards like Aave Arc and Curve x Aave, boosting demand through staking, spending, and governance participation. Average prices could rise from $300 in 2027 to $1,600 by 2032, with min/max reflecting bearish corrections and bullish surges amid DeFi expansion.

Key Factors Affecting Aave Price

- Rising adoption of crypto rewards cards offering up to 5% AAVE cashback, increasing token demand

- Staking programs and governance voting enhancing holder engagement and protocol utility

- DeFi sector growth and Aave protocol upgrades improving lending efficiency

- Crypto market cycles, with potential bull runs post-2026 consolidation

- Regulatory clarity favoring compliant DeFi products like Aave Arc

- Competition from other DeFi protocols and general market volatility influencing min/max ranges

- Technological advancements in stablecoin rewards and cross-chain integrations

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Staking Mechanics to Supercharge Card Rewards

Activate staking post-earn: Deposit AAVE cashback into card-linked pools for compounded APYs. Bleap users stake via app, earning 5-7% while retaining spend limits. Governance follows: Delegate or direct vote on AIP proposals, influencing borrow rates that buoy token price.

Optimize by timing dips, like today’s $103.24 low; spend aggressively on non-essentials, stake immediately. Pair with Aave Arc for institutional-grade pools, boosting safety. This triad – spend, stake, govern – positions you ahead of 2026 bull cycles. Dive deeper via maximization strategies.

Risk management anchors this approach: Allocate 20-30% of spend to high-reward categories like travel or dining, where cards like Gemini AAVE Credit Card shine with boosted 2.2% rebates. Monitor AAVE’s $103.24 price via integrated wallets; sell highs only to rebuy dips, preserving governance stack.

Fees, Limits, and Real-World Yields: Side-by-Side Comparison

Raw cashback means little without fee erosion. Bleap AAVE Rewards Mastercard dominates zero-fee purity, while Crypto. com AAVE Staking Rewards Card tiers demand CRO locks for peak 3%. Binance AAVE Visa Card suits global nomads with FX immunity, but Wirex AAVE Yield Card edges multi-asset flexibility.

Top 8 AAVE Rewards Cards Comparison

| Card Name | Cashback % | Staking APY | Annual Fee | FX Fee | Network |

|---|---|---|---|---|---|

| Bleap AAVE Rewards Mastercard | 2.5% | 5-7% | $0 | $0% | MC |

| Nexo AAVE Governance Debit Card | 2% | 5% | $0 | $0.5 | Visa |

| Coinbase AAVE Cashback Card | 1.8% | 4-6% | $4.95 | 1% | Visa |

| Gemini AAVE Credit Card | 2.2% | 6% | $0 | $0% | MC |

| Crypto.com AAVE Staking Rewards Card | 3% | 5-8% tiered | $0-400 | $0% | Visa |

| Binance AAVE Visa Card | 2% | 4-7% | $0 | $0% | Visa |

| Wirex AAVE Yield Card | 1.5-2.5% | 5% | $0 | 0.5% | MC |

| Bybit AAVE Rewards Debit Card | 2.3% | 6-8% | $0 | $0% | Visa |

At $103.24, Bybit’s trader tilt yields 2.3% on leveraged plays, netting $115 AAVE yearly on $5k spend, staked at 7% for $8 extra. Coinbase’s simplicity trumps for newbies; Nexo’s compliance appeals to pros wary of volatility spikes.

Governance Power Plays: Beyond Cashback

Governance token cashback cards elevate spending to protocol influence. Earned AAVE from Coinbase AAVE Cashback Card votes on Aave Improvement Proposals (AIPs), like recent borrow caps that stabilized LTVs. Stake via Gemini for 6% APY, delegate to whales, or solo vote – your spend volume dictates sway. Wirex users hybrid fiat ramps for seamless liquidity, funding larger stakes.

Opinion: Skip Crypto. com if CRO volatility irks; its synergies falter without dual staking. Prioritize Bleap for pure AAVE flywheel – 2.5% compounds faster at current lows. Binance AAVE Visa Card’s BNB pools add cross-chain alpha, but Bybit tempts derivatives degens.

Track AIPs weekly; proposals on safety modules directly hike token demand. This isn’t yield farming – it’s boardroom access via grocery runs.

Top 8 AAVE Rewards Cards 2026

-

Bleap AAVE Rewards Mastercard: 2% AAVE cashback, zero FX/monthly fees for high-volume spenders. Stake AAVE for boosted yields.

-

Nexo AAVE Governance Debit Card: Institutional-grade staking with AAVE rewards. Earn up to 2% back plus governance voting power.

-

Coinbase AAVE Cashback Card: Seamless wallet integration for AAVE cashback and on-chain voting. Earn rewards on daily spends.

-

Gemini AAVE Credit Card: Regulated security with AAVE rewards. Stake to participate in governance while earning 1-2% back.

-

Crypto.com AAVE Staking Rewards Card: Unlock tiers by staking AAVE for 3% boost. Maximize rewards on everyday purchases.

-

Binance AAVE Visa Card: Global spending FX-free with AAVE rewards. Stake for higher yields and governance influence.

-

Wirex AAVE Yield Card: Multi-currency support with AAVE yields. Earn cashback across 50+ fiat/crypto pairs.

-

Bybit AAVE Rewards Debit Card: Trader rebates in AAVE plus staking boosts. Optimize for high-frequency trading spends.

Actionable Roadmap to 2026 Maximization

Layer cards strategically: Primary Bleap for essentials, Gemini for premiums, Bybit for trades. At $103.24, $10k annual spend across duo yields 4.7 AAVE ($485), staked at 6% adds $29. Govern aggressively – vote conservatively on risks to preserve upside. See governance maximization for advanced delegates.

Disciplined execution turns crypto rewards cards AAVE into DeFi engines. With Aave’s lending dominance and cards like these, 2026 holders who spend smart govern smarter, compounding wealth through protocol skin-in-the-game.