Imagine turning your morning coffee run or grocery haul into a stake in the future of decentralized finance. In 2026, crypto debit cards governance tokens like STRK at $0.0498 and CRO make this reality possible. These cards reward everyday spending with governance tokens, letting you earn while gaining voting power in protocols like Starknet. As Starknet’s STRK hovers around $0.0498 with a slight 24-hour uptick, now’s the perfect time to stack these assets through seamless debit card use.

Governance token rewards cards stand out because they go beyond stablecoin cashback. You earn tokens that let you influence project decisions, potentially amplifying your returns as ecosystems grow. I’ve tested dozens of cards over five years, and these top picks deliver real value without the usual pitfalls like high fees or custody risks.

Why Governance Token Rewards Beat Traditional Cashback in 2026

Traditional rewards fade fast with inflation, but governance token rewards cards 2026 offer upside. STRK holders on Starknet vote on upgrades; CRO users shape Crypto. com’s direction. At current prices, STRK’s $0.0498 level means even modest spending yields meaningful holdings. Pair this with DeFi yields, and you’re building financial autonomy. Motivated yet? Let’s dive into cards that make it effortless.

Self-custody and token rewards are game-changers for everyday spenders seeking DeFi exposure.

Key factors I prioritize: cashback rates in native governance tokens, staking needs, regional access, and perks. No card is perfect, but these five shine for STRK cashback debit card seekers and CRO fans alike.

Top 5 Picks: Ready Metal Card Leads with STRK Rewards

Our curated list focuses on proven performers: Ready Metal Card, Crypto. com Visa Card, Nexo Card, Bitpanda Visa Card, and Wirex Card. Each ties spending to governance power, vetted for 2026 viability.

- Ready Metal Card: Tops for STRK cashback debit card enthusiasts.

- Crypto. com Visa Card: CRO powerhouse.

- Nexo Card: Flexible NEXO or BTC options.

- Bitpanda Visa Card: BEST for EU users chasing BEST tokens.

- Wirex Card: Multi-asset versatility.

Starknet (STRK) Price Prediction 2027-2032

Forecasts driven by STRK rewards in crypto debit cards like Ready Metal Card, L2 adoption, and market cycles (baseline: $0.05 in 2026)

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.04 | $0.12 | $0.35 | +140% |

| 2028 | $0.08 | $0.30 | $1.00 | +150% |

| 2029 | $0.15 | $0.60 | $1.80 | +100% |

| 2030 | $0.25 | $0.90 | $2.50 | +50% |

| 2031 | $0.40 | $1.30 | $3.50 | +44% |

| 2032 | $0.60 | $1.90 | $5.00 | +46% |

Price Prediction Summary

STRK is set for strong growth due to rising demand from 3% cashback rewards on self-custody debit cards like Ready Metal Card, Ethereum L2 advancements, and bull market cycles, potentially averaging $1.90 by 2032 with highs up to $5.00 in optimistic scenarios.

Key Factors Affecting Starknet Price

- Adoption surge from STRK rewards on Ready Metal Card and similar products

- Starknet’s Ethereum L2 scalability improvements and DeFi use cases

- Crypto market cycles, including post-2028 Bitcoin halving bull run

- Favorable regulatory clarity for governance tokens and self-custody wallets

- Competition from CRO and other L2 tokens, balanced by unique debit card integrations

- Broader crypto debit card market expansion in 2026+

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

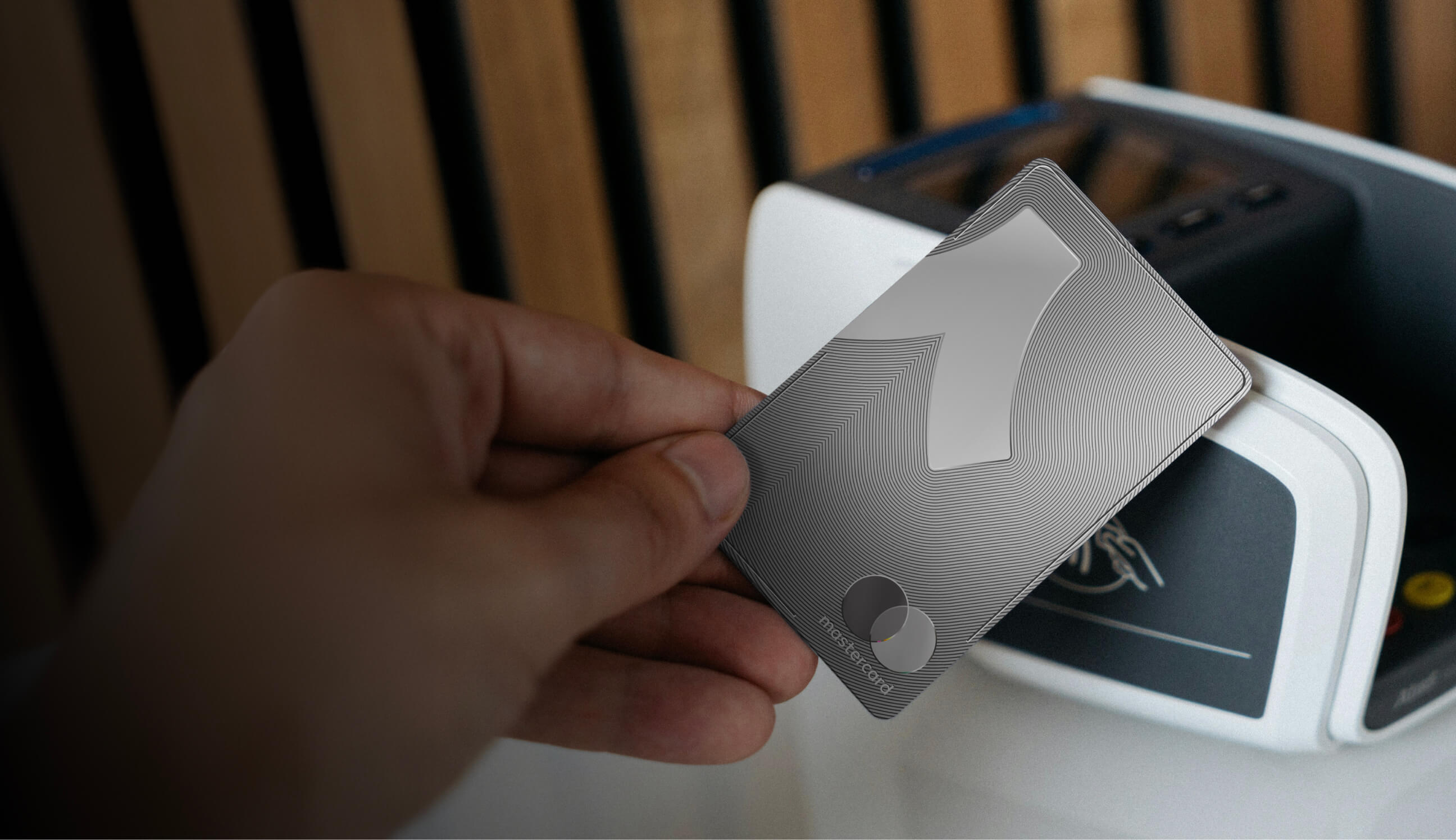

Deep Dive: Ready Metal Card’s 3% STRK Cashback Edge

The Ready Metal Card redefines self-custody spending. Earn 3% back in STRK at $0.0498 per token on all purchases, no tiers or lockups needed. Exclusive partner perks sweeten it, like discounts on DeFi tools. Available in Europe, it connects your wallet directly, keeping keys in your control. Use code THEBLOCK for 15% off setup. In my experience, this card’s simplicity maximizes CRO rewards crypto card alternatives too, as STRK’s governance utility grows.

Pros: True self-custody, generous flat rate, low entry. Cons: EU-focused for now. If you’re bullish on Starknet, this card turns Visa taps into protocol votes.

Crypto. com Visa Card: Scale Rewards with CRO Staking

For those ready to commit, the Crypto. com Visa Card offers up to 8% CRO cashback. Stake CRO to unlock tiers: Ruby at 2%, Jade Green/Royal Indigo higher, Obsidian maxes perks like Spotify rebates. Global reach and metal card vibes motivate long-term holding. CRO’s ecosystem ties rewards to real utility, from exchange fees to DeFi.

I’ve staked for years; the Netflix/Spotify offsets make it a lifestyle win. Check how to earn governance token rewards with crypto debit cards for staking tips. At scale, it outpaces Ready Metal for heavy spenders.

Next up, Nexo Card blends borrowing with NEXO rewards, perfect for leveraged plays.

The Nexo Card stands out for users who want to spend without selling assets. Earn up to 2% cashback in NEXO tokens or 0.5% in Bitcoin by borrowing against your crypto portfolio. No staking required for base rewards, but loyalty tiers boost them through NEXO holdings. It’s dual-mode: credit-like spending powered by collateral keeps your bags intact while governance rights in Nexo’s ecosystem grow your influence. Available globally with Mastercard backing, it’s ideal if you’re leveraging positions in this STRK at $0.0498 market.

In practice, I’ve used it to cover travel without liquidating, turning expenses into NEXO votes on platform upgrades. Pair it with their high-yield savings for compounded gains. Drawback: Borrowing adds interest, so it’s best for disciplined users. If Crypto. com’s staking feels heavy, Nexo’s flexibility wins.

Bitpanda Visa Card: EU Powerhouse for BEST Token Holders

Targeting European spenders, the Bitpanda Visa Card delivers cashback in BEST tokens, Bitpanda’s governance powerhouse. Rates hit 2% on all spends, with bonuses for holding BEST or using their ecosystem. Self-custodial vibes connect straight to your Bitpanda wallet, supporting seamless crypto-to-fiat rails. Perks include airport lounge access at higher tiers and zero FX fees in the EU.

What motivates me about Bitpanda? BEST governs their exchange and DeFi products, so rewards build real control. At $0.0498 STRK levels, similar low-cap governance plays like BEST offer asymmetric upside. Cons: Limited outside Europe, and BEST volatility demands conviction. For EU folks chasing governance token rewards cards 2026, it’s a no-brainer over traditional banks.

Top 5 Crypto Debit Cards Rewarding Governance Tokens Like STRK & CRO in 2026

| Card | Governance Token | Max Cashback | Fees | Spending Limits | Key Features |

|---|---|---|---|---|---|

| Ready Metal Card | STRK | 3% | Low/No fees (15% discount w/ code THEBLOCK) | High (region-specific) | Self-custody 🔒, Partner perks 🎁 🇪🇺 |

| Crypto.com Visa Card | CRO | Up to 8% | No annual fee (tiered staking req.) | Varies by tier (up to high limits) | Tiered benefits 📈, Spotify/Netflix rebates 🎵📺 |

| Nexo Card | NEXO | Up to 2% (or 0.5% BTC) | No annual fee | Based on collateral (flexible) | Borrow against crypto 🏦, Dual debit/credit mode |

| Bitpanda Visa Card | BEST | Up to 2% | No annual/FX fees | High (EU-focused) | Easy crypto top-up 💳, Rewards program ⭐ |

| Wirex Card | WXT | Up to 8% | No issuance/monthly fees | Up to ~€150K/year | Multi-currency 💱, Apple/Google Pay 📱⚡ |

Wirex Card: Versatile Multi-Token Rewards

Rounding out our top five, the Wirex Card shines with multi-asset flexibility, offering up to 8% cashback in WXT governance tokens or stablecoins. No staking lockups; just load your account and spend worldwide via Visa. Google Pay and Apple Pay integration makes it frictionless for daily use, with loyalty levels unlocking higher rates based on spend volume.

Wirex’s edge? Breadth. Reward in WXT for governance votes, or swap to CRO/STRK equivalents. I’ve relied on it for cross-border payments, where zero ATM fees abroad save big. At current STRK $0.0498 pricing, diversifying rewards across tokens hedges risks. Minor con: Customer support can lag during peaks. Still, its versatility fits nomadic DeFi users perfectly.

Side-by-Side: Which Governance Token Card Fits You?

Top 5 Crypto Debit Cards Rewarding Governance Tokens Like STRK and CRO in 2026

| Card | Cashback Rate | Token | Staking Required? | Regions | Key Perk |

|---|---|---|---|---|---|

| Ready Metal Card | 3% | STRK | No | EU | Self-custody |

| Crypto.com Visa Card | up to 8% | CRO | Yes | Global | Spotify rebates |

| Nexo Card | 2% | NEXO | No | Global | Borrow against crypto |

| Bitpanda Visa Card | 2% | BEST | Optional | EU | Lounge access |

| Wirex Card | up to 8% | WXT | No | Global | Multi-token |

Scanning this breakdown, Ready Metal leads for pure STRK plays, while Crypto. com scales for CRO loyalists. Nexo suits borrowers, Bitpanda EU natives, and Wirex everyone else.

Top 5 Token-Reward Crypto Cards

-

#5 Ready Metal Card: Score 3% cashback in STRK ($0.0498) with full self-custody for top security. Ideal for Europe, plus exclusive perks—use code THEBLOCK for 15% off! Details

-

#4 Crypto.com Visa Card: Unlock up to 8% cashback in CRO via staking tiers—perfect balance of rewards and flexibility. Enjoy Spotify/Netflix rebates matching your spend habits. Widely available!

-

#3 Nexo Card: Earn up to 2% in NEXO tokens or 0.5% BTC while borrowing against holdings. Great for heavy users prioritizing flexibility over staking in EEA regions. More info

-

#2 Bitpanda Visa Card: Get reliable cashback in BEST tokens (up to 2%) with easy perks for everyday spending. EEA-focused, no heavy staking—test against your habits for the best fit!

-

#1 Wirex Card: Top pick with up to 8% cashback in WXT, multi-currency support, and global availability. Self-custody vibes, killer perks—verify it boosts your security and spends!

To maximize, route groceries, bills, and travel through your card, then stake rewards for DeFi yields. Track STRK’s $0.0498 resilience and CRO’s ecosystem momentum; these tokens thrive on participation. Dive deeper with how to maximize governance token rewards with crypto debit cards. Your spending just became your superpower in DeFi governance.

Ready to claim your edge? Sign up, spend smart, vote big. The 2026 crypto rewards revolution waits for no one.