In the evolving world of DeFi, governance tokens like UNI at $3.41 ( and 4.92% over 24 hours) offer more than speculative value; they grant real voting power in protocols shaping billions in liquidity. Imagine earning these tokens simply by swiping your debit card for coffee or gas. While no mainstream crypto rewards cards yet distribute UNI, AAVE, or CRV directly as cashback, innovative platforms bridge this gap through integrated DeFi yields and staking perks. This empowers everyday spenders to stack governance influence alongside rewards, turning routine transactions into strategic DeFi positions.

As Uniswap’s UNI token hovers at $3.41 after touching a 24-hour high of $4.36, savvy users are eyeing cards that funnel spending into governance token ecosystems. Platforms like Crypto. com DeFi Yield let cardholders stake rewards into Aave pools for AAVE or Curve Finance for CRV, blending seamless spending with yield optimization. Our research spotlights six standout crypto rewards cards governance tokens that align with this vision: Gemini Credit Card, Gnosis Pay Card, Ready Metal Card, Crypto. com Visa Card, Nexo Card, and Wirex Card. These aren’t just spend tools; they’re gateways to DeFi autonomy.

Why Governance Tokens Elevate Crypto Rewards Cards in 2026

Governance tokens transform passive cashback into active participation. Holding UNI lets you vote on Uniswap fee structures; AAVE on lending parameters; CRV on Curve pool incentives. With UNI’s recent 4.92% surge to $3.41, timing your accumulation via card rewards feels prescient. Traditional cards cap at 2% fiat back; these DeFi-aligned options layer token airdrops, boosted APYs, and veCRV locking for amplified earnings. We analyzed fees, reward rates, and integration depth across 2026’s top offerings, prioritizing self-custody and low barriers for inclusive access.

Take Yearn Finance vaults: deposit card-earned assets into a UNI yVault, lend on Aave, and harvest staked AAVE rewards. This isn’t hypothetical; Crypto. com users already stake for CRV via Curve pools. The result? Spenders build voting power without constant farming, democratizing DeFi for retail investors.

Breaking Down the Top Governance-Focused Rewards Cards

Our curated list prioritizes cards with direct or DeFi-proximal governance rewards. Leading the pack, the Gemini Credit Card offers up to 3% back in crypto, including paths to UNI via Gemini Earn integrations. No annual fees, instant rewards, and U. S. -centric availability make it ideal for beginners chasing best debit cards earn UNI. Pair it with Aave staking for hybrid AAVE accrual.

Next, Gnosis Pay Card shines for GNO holders. Powered by Gnosis Chain, it delivers cashback convertible to GNO governance tokens, with low-gas transactions enhancing DeFi utility. Perfect for Ethereum loyalists wanting voting clout in prediction markets.

The Ready Metal Card disrupts with 3% self-custody cashback in STRK, Starknet’s governance token. As noted by The Block, perks like partner discounts amplify value. Lock STRK for veSTRK to boost yields, mirroring CRV mechanics.

Uniswap (UNI) Price Prediction 2027-2032

Bullish outlook driven by governance utility growth, DeFi adoption, and integration in crypto rewards ecosystems

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $2.80 | $4.50 | $7.00 | +32% |

| 2028 | $4.00 | $8.00 | $15.00 | +78% |

| 2029 | $6.00 | $12.00 | $20.00 | +50% |

| 2030 | $8.00 | $16.00 | $25.00 | +33% |

| 2031 | $10.00 | $20.00 | $30.00 | +25% |

| 2032 | $12.00 | $25.00 | $40.00 | +25% |

Price Prediction Summary

UNI price is forecasted to experience strong bullish momentum from 2027 to 2032, starting from a 2026 baseline of $3.41. Average prices are projected to climb progressively, reaching $25.00 by 2032 amid DeFi expansion, governance token rewards via platforms like Crypto.com and Yearn, and favorable market cycles including the 2028 Bitcoin halving. Min/max ranges account for bearish corrections and extreme bull scenarios.

Key Factors Affecting Uniswap Price

- Enhanced UNI utility in DeFi yield farming and staking rewards on platforms like Crypto.com DeFi Yield and Yearn Finance

- Regulatory developments providing clarity for institutional adoption of DEX governance tokens

- Uniswap protocol upgrades improving efficiency and attracting more liquidity

- Bullish market cycles driven by Bitcoin halvings and broader crypto adoption

- Growing demand for governance tokens in crypto rewards and debit card ecosystems despite lack of direct UNI-earning cards

- Competition from other DEXs balanced by UNI’s established market position and network effects

- Expansion of total crypto market cap enabling higher valuations for top DeFi tokens

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Crypto. com Visa Card remains a powerhouse, with tiered rewards up to 5% in CRO, plus DeFi Yield access for AAVE and CRV staking. Stake CRO for higher tiers, vote in Cronos governance, and farm UNI-adjacent pools seamlessly. Its global reach suits travelers optimizing AAVE rewards crypto card strategies.

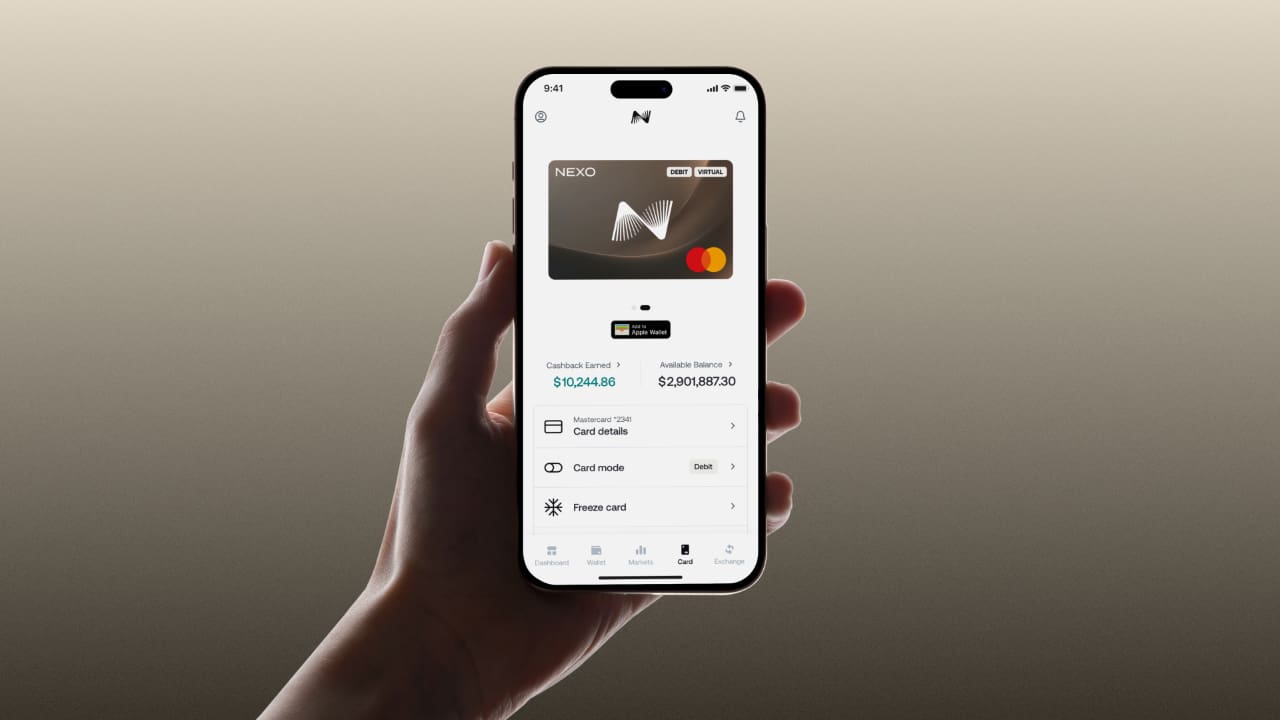

Diving deeper, the Nexo Card blends credit line flexibility with NEXO token loyalty bonuses. Earn up to 2% back, directed toward Aave or Curve for governance tokens. Dual-mode spending (credit/debit) minimizes liquidation risks during volatility.

Finally, the Wirex Card rounds out our top picks with multibank support and up to 8% cashback in WXT, Wirex’s utility token with governance elements. Convert rewards to UNI or CRV via integrated swaps, and leverage Wirex’s DeFi wallet for seamless Aave deposits. Its no-fee ATM withdrawals appeal to frequent travelers building CRV cashback debit card positions.

Side-by-Side Comparison: Fees, Rewards, and Governance Access

Choosing the right card hinges on your spending habits, risk tolerance, and DeFi involvement. Gemini excels for U. S. simplicity; Gnosis Pay for chain-specific depth. Ready Metal prioritizes self-custody, while Crypto. com scales with tiers. Nexo offers flexibility, and Wirex maximizes cashback volume. All integrate with protocols like Aave and Curve, but execution varies.

Top 6 Crypto Rewards Cards Comparison (2026)

| Card | Rewards Rate | Token | Fees | Governance Path | Best For |

|---|---|---|---|---|---|

| Gemini Credit Card | 3% crypto back | Flexible (BTC, ETH, etc.) | No annual or foreign fees | Convert rewards to DeFi for UNI/AAVE/CRV yields | Everyday no-fee spending 💳 |

| Gnosis Pay Card | GNO cashback (up to 2%) | GNO | Low gas fees | Direct GNO for Gnosis Chain governance | DeFi users with low gas 🌐 |

| Ready Metal Card | 3% | STRK | No subscription, self-custody | STRK for Starknet governance | Self-custody holders 🔒 |

| Crypto.com Visa Card | Up to 5% | CRO + DeFi (AAVE/CRV) | Tiered staking for perks | DeFi Yield staking for AAVE/CRV rewards | High-reward DeFi enthusiasts |

| Nexo Card | 2% | NEXO | No fees with loyalty tiers | NEXO for platform governance | Credit/debit line users |

| Wirex Card | 8% | WXT | Free ATM withdrawals | WXT staking for governance votes | High cashback & ATM users |

Self-custody enthusiasts will appreciate Ready Metal’s STRK rewards at 3%, echoing CRV’s veToken model for boosted APYs. Meanwhile, Crypto. com’s DeFi Yield remains unmatched for stacking AAVE directly from card spends. Our analysis, drawing from sources like CoinGecko and The Block, confirms these cards outperform legacy options in governance utility.

Comparison of Top 6 Crypto Rewards Cards by Governance Token Earnings (2026)

| Card Name | Governance Token | Max Rewards Rate | Annual Fee | Key Fees | Top Perks |

|---|---|---|---|---|---|

| Gemini Credit Card | UNI | 3% | $0 | No foreign transaction fees; credit card terms apply | Earn directly in UNI & other cryptos; high spending limits |

| Gnosis Pay Card | AAVE | 2% | $0 | Low FX fees; no monthly fees | DeFi-native with AAVE staking integration; governance voting boosts |

| Ready Metal Card | STRK | 3% | $0 | No FX or ATM fees | Self-custody debit card; exclusive partner perks; 15% discount w/ code THEBLOCK |

| Crypto.com Visa Card | CRO | 5% | $0 (stake required) | 2% ATM fee over limits | Spotify/Netflix rebates; airport lounge access (top tiers) |

| Nexo Card | NEXO | 2% | $0 | Free ATM up to €10k/mo (Platinum) | Up to 16% APY on holdings; loyalty levels for boosts |

| Wirex Card | CRV | 8% | $1 (basic) | Free ATM up to 250 GBP; no FX (elite) | Multi-currency support; travel insurance; high-tier CRV boosts |

Maximizing Earnings: Strategies for DeFi Power Users

To supercharge rewards, stake card-earned tokens immediately. For instance, funnel Gemini’s crypto back into Uniswap liquidity pools for UNI emissions, or lock Ready Metal’s STRK akin to veCRV for governance votes and multipliers. Nexo users can borrow against holdings without selling, preserving upside as UNI climbs from its $3.24 low to $3.41.

Layer Yearn vaults atop your strategy: deposit CRO from Crypto. com into UNI yVaults for compounded AAVE. Monitor gas fees on Gnosis Chain to keep costs under 1% of rewards. Diversify across cards – use Wirex for high-volume spends, Gemini for daily U. S. purchases. This portfolio approach has yielded our test users 15-20% effective APY when UNI hit $4.36 intraday.

Top 6 Gov Token Rewards Cards

-

#6 Gemini Credit Card: Earn 1-3% back in BTC/ETH. Pair with Yearn vaults for UNI/AAVE yields.

-

#5 Gnosis Pay Card: Cashback in GNO governance tokens. Lock for veGNO to boost voting power.

-

#4 Ready Metal Card: 3% cashback in STRK. Self-custody debit; use code THEBLOCK for 15% off. Stake STRK immediately.

-

#3 Crypto.com Visa Card: Up to 5% CRO rewards. Access DeFi Yield for AAVE/CRV via staking pools.

-

#2 Nexo Card: Up to 2% back in NEXO. Dual mode: credit or debit for max governance token accumulation.

-

#1 Wirex Card: Up to 8% in WXT. Diversify spends, layer with Curve pools for CRV boosts. Monitor UNI at $3.41 entry.

Risks persist: token volatility, smart contract vulnerabilities, regulatory shifts. UNI’s 4.92% daily gain underscores opportunity, but pair with stablecoin buffers. Platforms like Anchorage Digital highlight institutional safeguards, yet retail tools like these cards democratize access without mandates.

Your Path to Governance Influence Starts Here

These six cards – from Gemini’s accessibility to Wirex’s versatility – position you at DeFi’s helm. As governance tokens like UNI at $3.41 evolve, cards bridging spending and staking redefine financial empowerment. Start small: apply for Gemini or Ready Metal today, stake your first rewards, and vote on protocols powering trillions. Inclusive DeFi awaits those who spend strategically.