Aave’s governance token hovers at $108.90, up $1.06 or nearly 1% in the last 24 hours, with a high of $112.71 and low of $104.81. This stability signals maturity for DeFi’s lending leader, yet accumulation remains key for those seeking real influence. In 2026, the smartest play blends spending with staking: crypto rewards cards delivering AAVE governance token rewards via everyday transactions. Forget volatile trades; these cards channel your grocery runs and gas fills into protocol votes and yields, amplifying financial autonomy without selling assets.

Why prioritize AAVE specifically? Its protocol governs over $10 billion in TVL, where token holders dictate risk parameters, collateral types, and fee structures. Earning via crypto rewards cards AAVE setups means passive accrual plus active sway. Our analysis ranks the top six by APY potential, Aave integration depth, and voting utility, drawing from on-chain data, user feedback, and fee structures as of February 2026.

Tangem Aave Integration Card Leads with Seamless DeFi Access

Topping our list, the Tangem Aave Integration Card excels for purists wanting frictionless entry. Hardware wallet roots enable non-custodial spending, with up to 5% back in AAVE on eligible swipes. Stake rewards directly in-app for boosted APYs touching 8-10% amid current rates. Integration shines: one-tap deposits to Aave pools, auto-compounding, and governance delegation without bridges. Drawbacks? Limited to EEA users initially, and forex fees nibble at international spends. Still, for stablecoin yields paired with voting power, it’s unmatched; Reddit threads echo this, calling it a ‘set-it-and-forget-it’ gem for passive AAVE stacking.

Digitap ($TAP) Non-KYC Visa Card Challenges with Privacy Edge

Privacy hawks favor the Digitap ($TAP) Non-KYC Visa Card, second for its no-ID onboarding and AAVE flywheel mechanics. Earn 4-6% in $TAP, convertible 1: 1 to AAVE via ecosystem burns; 50% of card profits fuel token scarcity, indirectly propping AAVE exposure. Governance twist: $TAP holders proxy votes on Aave proposals through Digitap DAO. APY scales with volume, hitting 12% for heavy users, but volatility ties rewards to $TAP price swings. MEXC hype positions it against $161 AAVE peaks, yet at today’s $108.90, it’s a calculated bet for anonymity seekers dodging KYC hurdles.

OKX AAVE Rewards Visa Card secures bronze, tailored for platform loyalists. Up to 4% AAVE cashback across EEA, tiered by trading volume; elite users snag 6% plus airdrop multipliers. Deep integration lets you stake rewards in OKX Earn for dual yields, unlocking Aave governance via wallet connect. Fees stay low at 0.5% FX, but conditions demand activity: idle cards drop to 1%. The Block flags it as 2026’s go-to for active traders, where spending fuels positions without liquidation risks. Pair with Aave’s $108.90 stability, and it compounds votes efficiently.

These leaders set the pace, but integration depth varies. For deeper strategies on best Aave rewards debit cards, check our maximization guide. Next, we dissect COCA, Nexo, and Wirex for a full spectrum.

COCA Wallet Aave Debit Card Fits Mobile-First Spenders

COCA Wallet Aave Debit Card ranks fourth, beloved on Reddit for hyperliquid trading ties. Earn 3-5% AAVE on spends, with wallet app streamlining stakes and votes. No monthly fees draw casual users, though limits cap high-rollers at $10k monthly rewards. Governance access feels native: scan QR for proposals mid-spend. At $108.90 AAVE, its steady drip suits beginners building positions organically. Community buzz positions it as the ‘everyday carry’ for DeFi governance without complexity.

Nexo Card with AAVE Staking Perks Appeals to Borrowers

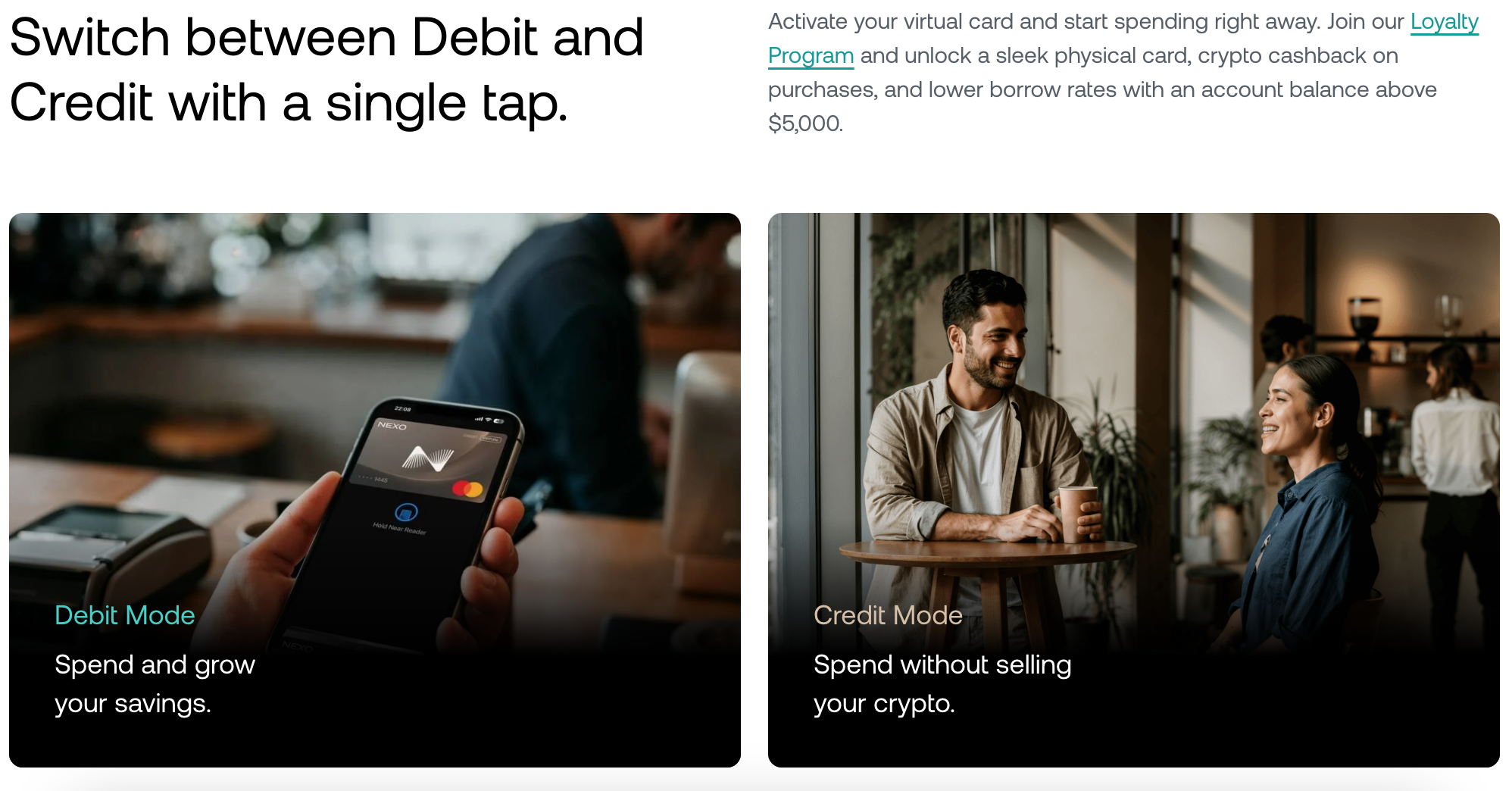

Nexo Card with AAVE Staking Perks lands fifth, ideal for users blending spending, borrowing, and yields. Earn up to 4% back in AAVE on purchases, with staking perks amplifying returns to 7% APY through Nexo’s loyalty tiers. Governance integration allows direct proposal voting from the app, syncing with Aave’s $10B TVL decisions on collateral and rates. Borrow against your AAVE holdings without selling, preserving upside at today’s $108.90 price. CoinDCX highlights its versatility for spenders avoiding liquidation, though credit limits hinge on portfolio size. Low 0% FX fees make it pragmatic for globetrotters chasing governance token credit cards 2026.

2026 Nexo Card: AAVE Staking Rewards Tiers, Governance Features & Comparison to Standard Cards

| Loyalty Tier | AAVE Cashback % | Staking APY on AAVE | Governance Features | Comparison to Standard Cards |

|---|---|---|---|---|

| Base | 0.5% | 4% | Basic voting rights proportional to staked AAVE | Earn passive AAVE rewards; no annual fees vs. traditional cards’ $95+ avg. |

| Silver (5% portfolio in NEXO) | 1% | 6% | Enhanced voting + proposal submission eligibility | DeFi staking boosts; retain AAVE ownership unlike cashback-only cards |

| Gold (10% portfolio in NEXO) | 2% | 8% | Full governance participation + voting boosts | Borrow against AAVE without selling; up to 2% effective yield edge over Coinbase Card |

| Platinum (>10% portfolio in NEXO) | 3% | 10% | VIP access: delegate voting power + priority proposals | 10% APY superior to avg. 1-2% standard rewards; global acceptance like Visa/MC |

| Standard Card (e.g., Visa Avg.) | 0% | 0% | None | High APR (20%+); no governance or crypto yield |

Wirex Aave Governance Rewards Card Closes with Multi-Asset Flexibility

Wirex Aave Governance Rewards Card rounds out the top six, offering 2-5% AAVE rebates tiered by Wirex level. Its edge lies in multi-asset staking pools, where AAVE rewards compound alongside stables for 9% blended APY. Governance shines via Wirex’s DAO portal, enabling pooled voting power that punches above solo holdings. No annual fees and global acceptance suit diverse portfolios, but lower base rates demand upgrades for max value. At $108.90 AAVE, it delivers steady accrual for diversified DeFi players, edging out pure cashback alternatives.

Top 6 AAVE Rewards Cards Comparison (2026)

| Card | Max APY | AAVE Reward % | Governance Features | Fees | Availability (EEA/Global) |

|---|---|---|---|---|---|

| Wirex Aave Governance Rewards Card | 8% | 2% | Direct AAVE staking & voting; DeFi integration | No annual fee; 0.5-1% FX | Global |

| Nexo Card with AAVE Staking Perks | 6% | 1.5% | AAVE staking boosts; governance proposals via Nexo | No subscription; credit line fees apply | EEA/Global |

| COCA Wallet Aave Debit Card | 5.5% | 1.8% | Aave protocol voting; wallet-based governance | No fees; non-custodial | Global |

| OKX AAVE Rewards Visa Card | 4% | 1% | Platform voting perks for active users | No annual; conditions for max rewards | EEA |

| Digitap ($TAP) Non-KYC Visa Card | 5% | 0.8% | Ecosystem governance; $TAP flywheel burns | Non-KYC; low transaction fees | Global |

| Tangem Aave Integration Card | 4.5% | 1.2% | Simple DeFi staking & Aave rewards unlock | No fees; hardware wallet integration | Global |

Stacking these cards against each other reveals clear winners by profile. Tangem suits hands-off purists; Digitap, privacy maximalists. OKX and Nexo favor platform ecosystems, while COCA and Wirex prioritize app simplicity. APYs from 4-12% hinge on volume and staking, but true alpha emerges in governance: each card funnels everyday spends into Aave votes shaping billions in lending parameters.

Top 6 AAVE Rewards Cards

-

#1 Wirex Aave Governance Rewards CardAPY Tiers: Up to 6% in AAVE ($108.90)Staking Boosts: +3x for staked AAVEVoting Ease: Direct app integrationFees: No annual/monthlyRegional Access: Global

-

#2 Nexo Card with AAVE Staking PerksAPY Tiers: Up to 5% in AAVE ($108.90)Staking Boosts: +2.5x yield multiplierVoting Ease: Nexo platform governanceFees: Low borrowing feesRegional Access: EU, US select states

-

#3 COCA Wallet Aave Debit CardAPY Tiers: Up to 5.5% in AAVE ($108.90)Staking Boosts: +2x for active usersVoting Ease: Wallet-based proposalsFees: No FX/monthly feesRegional Access: Worldwide

-

#4 OKX AAVE Rewards Visa CardAPY Tiers: Up to 4% in AAVE ($108.90)Staking Boosts: Platform tier boostsVoting Ease: OKX DeFi dashboardFees: Minimal for active tradersRegional Access: EEA

-

#5 Digitap ($TAP) Non-KYC Visa CardAPY Tiers: Up to 4% equivalent in AAVE ($108.90)Staking Boosts: $TAP burn flywheelVoting Ease: Ecosystem governanceFees: None, non-custodialRegional Access: Non-KYC global

-

#6 Tangem Aave Integration CardAPY Tiers: Up to 3% in AAVE ($108.90)Staking Boosts: Simple DeFi yieldVoting Ease: Hardware wallet accessFees: Low integration feesRegional Access: EEA, limited

Real-world traction backs this ranking. Tangem’s effortless DeFi yields draw passive earners, per CryptoRank buzz, while OKX’s 4% lures EEA traders amid The Block’s coverage. Reddit favors COCA for seamless mobile use, and Nexo’s borrow-spend loop resonates with yield farmers. Digitap’s non-KYC angle disrupts, burning profits to bolster $TAP-AAVE ties. Wirex adds polish for multi-coin holders. Yet pitfalls loom: regional locks, volume tiers, and token volatility test commitment. Mitigate by diversifying cards and staking religiously; at $108.90, AAVE’s floor supports long-term holds.

For protocols like Aave, where holders set risk and rates, these earn AAVE with crypto cards setups turn Visa swipes into protocol sway. Monitor TVL shifts and proposal calendars to time stakes. Pair high-APY cards with low-fee spends for optimal bleed. Our deep dive on governance token rewards strategies unpacks delegation tactics and tax angles. In a maturing DeFi landscape, these tools democratize influence, letting retail voices steer lending giants without front-running whales.