Solana’s SOL price hovers at $80.85 amid a slight 0.77% dip over the past 24 hours, yet its governance token ecosystem thrives, drawing spenders to rewards cards that blend everyday utility with DeFi control. In 2026, these cards transform routine transactions into stakes in protocols like Jito and Jupiter, where holders vote on validator picks or aggregator upgrades. Forget flat cashback; earn governance tokens crypto card Solana options now yield APY potential up to 6.77% via auto-staking, as seen in emerging products. This shift empowers users beyond passive holding, especially as Solana wallets like Phantom and Solflare integrate seamless spending.

Solana’s Governance Edge in Rewards Cards

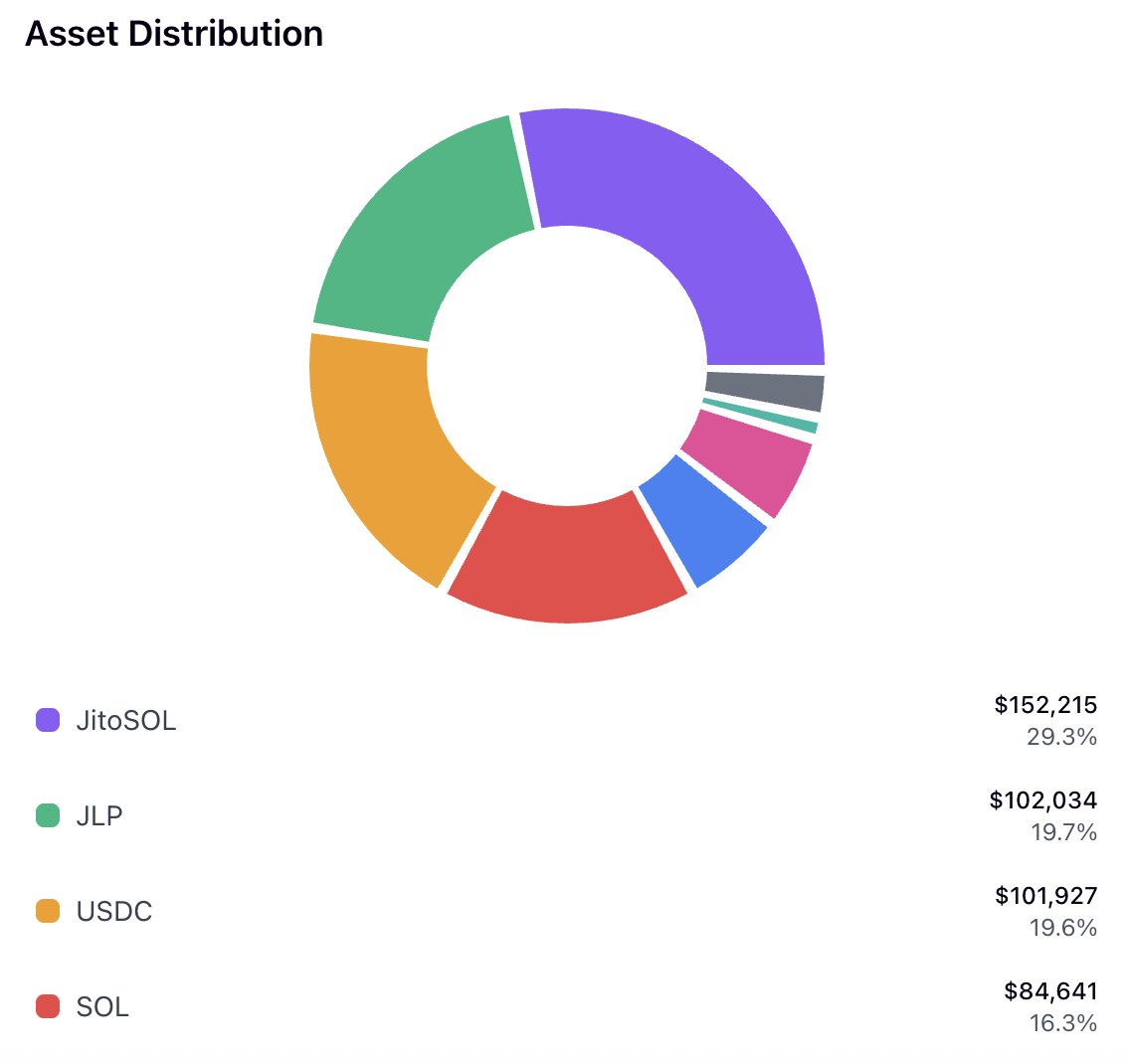

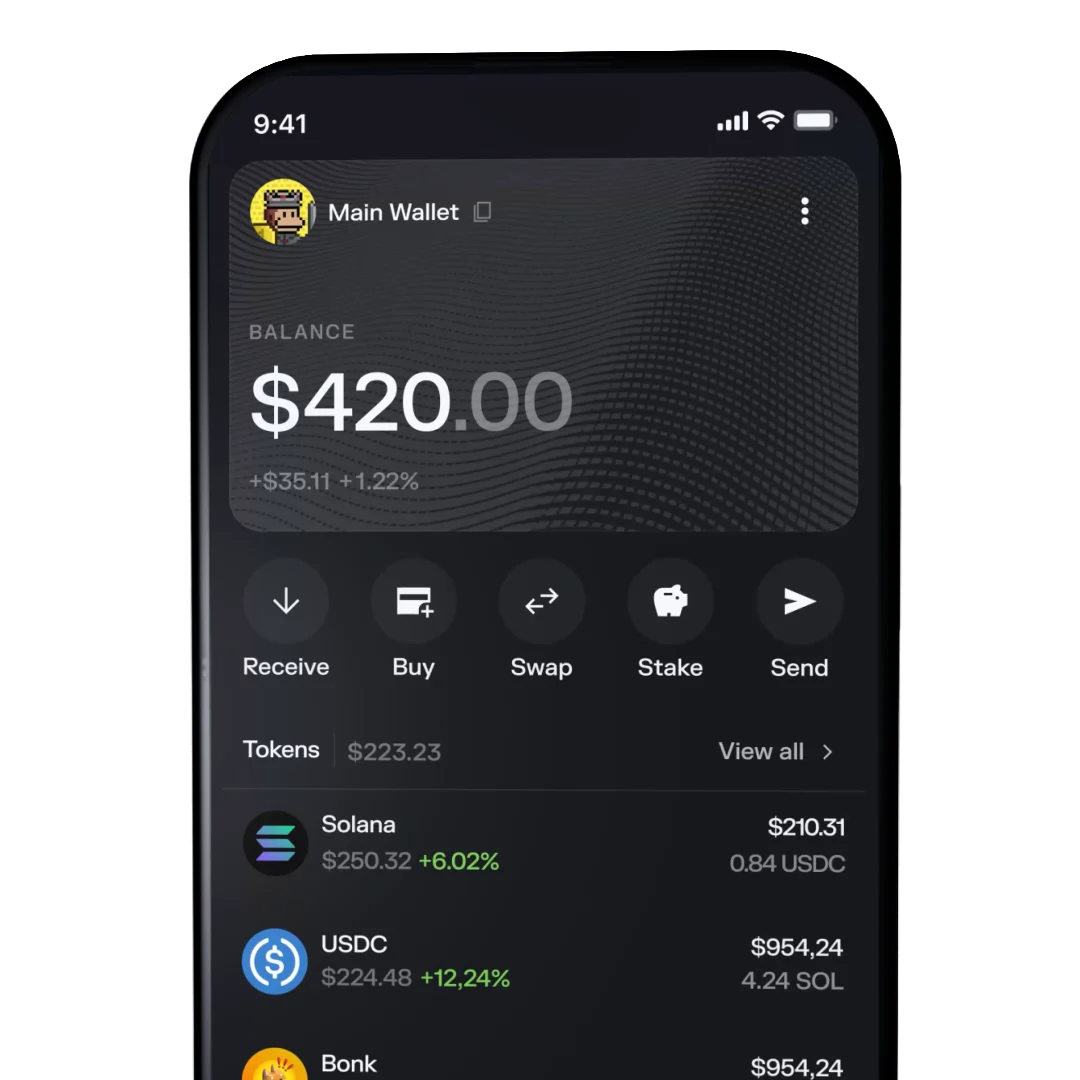

Governance tokens aren’t just speculative plays; they grant real influence. JTO, with its $187M market cap, lets holders shape Jito’s restaking mechanics and reward splits. Cards channeling these tokens via spending reward that participation directly. Top Solana governance token rewards cards prioritize self-custody and zero-fee USDC spends, sidestepping centralized pitfalls. Solflare Self-Custodial Debit Card leads here, pulling funds straight from your wallet for instant liquidity without KYC hurdles or exchange intermediaries. Its integration shines for Phantom users, offering up to 2% back in SOL-flavored governance perks.

Pragmatically, these cards rank by APY potential, wallet sync, and voting utility. Jito JTO Rewards Card follows closely, dishing 1.5-3% JTO cashback on debit spends, auto-compounding into staked positions for compounded yields. Jupiter JUP Cashback Visa edges ahead for aggregators fans, with 2.5% JUP rebates that fuel perpetual DEX votes. Drift DRIFT Governance Debit Card appeals to perps traders, yielding 4% DRIFT on volumes tied to protocol liquidity decisions.

Breaking Down the Top 5 by APY and Integration

Drilling into metrics, here’s the analytical cut: Solflare tops for pure self-custody, no FX fees, real-time balances, and 2-4% variable governance yields across JTO/JUP pools. Jito’s card amplifies with restaking boosts, hitting 5% effective APY when SOL dips like today’s $80.85 level signal buy-ins. Jupiter’s Visa variant integrates limit orders for spends, channeling 3% JUP to governance proposals that optimize swap routes.

Kamino KMNO Lending Rewards Card shifts to lending alpha, offering 2.8% KMNO on borrows funded by card swipes, with votes on leverage caps. Marginfi MRGN Savings Card counters with savings-focused 3.5% MRGN rebates, governance over risk parameters ideal for conservative stackers. These aren’t gimmicks; Phoenix V2 Trading Rewards Card layers in 4.2% PHOENIX tokens for orderbook participants, tying spends to CEX-grade liquidity votes on Solana.

Orca Whirlpool Cashback Card leverages concentrated liquidity for 3.2% ORCA back, empowering votes on pool incentives. Raydium RAY Farm Debit Card farms 2.9% RAY via AMM spends, governance dictating emission schedules. Sanctum LST Rewards Mastercard rounds with liquid staking mastery, 3.7% LST tokens for validator delegation power.

Jito (JTO) Price Prediction 2027-2032

Forecast based on crypto rewards cards adoption, Solana ecosystem growth, APY rewards, and governance utility amid 2026 market conditions (SOL at $80.85)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $0.40 | $1.50 | $3.00 | +76% |

| 2028 | $0.80 | $3.00 | $6.00 | +100% |

| 2029 | $1.50 | $5.50 | $12.00 | +83% |

| 2030 | $2.00 | $9.00 | $20.00 | +64% |

| 2031 | $3.00 | $14.00 | $30.00 | +56% |

| 2032 | $4.00 | $22.00 | $45.00 | +57% |

Price Prediction Summary

JTO price is projected to experience substantial growth from 2027-2032, with average prices rising from $1.50 to $22.00 (over 14x increase), fueled by integration into Solana-based crypto rewards cards, high APY staking rewards, and broader DeFi adoption. Minimums reflect bearish market cycles or regulatory hurdles, while maximums capture bullish adoption surges and Solana TVL expansion.

Key Factors Affecting Jito Price

- Rising adoption of Solana rewards cards (e.g., Solflare, Gemini) offering JTO governance token rewards and auto-staking APYs up to 6-7%

- Solana ecosystem expansion with increased TVL and validator rewards boosting JTO utility

- Market cycles: Recovery post-2026 consolidation, potential bull run in 2028-2029

- Regulatory developments favoring DeFi staking and crypto payments

- Technological upgrades in Jito liquid staking and MEV infrastructure

- Competition from JUP/DRIFT balanced by JTO’s leadership in Solana governance

- Macro factors: Broader crypto card market growth and self-custodial spending trends

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Market Momentum Fuels 2026 Adoption

With SOL at $80.85 and 24-hour range from $78.26 to $82.79, these cards capitalize on volatility. Gemini’s SOL card sets precedent with 4% staking yields, but Solana natives like Solflare outpace via DeFi depth. Reddit buzz and Binance spotlights confirm: self-custody rules, governance amplifies returns. Expect best crypto debit cards governance rewards 2026 to dominate as ETFs and wallets converge spending with protocol power.

Self-custodial designs minimize counterparty risk, a pragmatic choice when SOL volatility tests positions at $80.85. Sanctum’s Mastercard, for instance, excels in LST mechanics, letting users earn 3.7% while delegating votes on staking pools without bridging hassles. Raydium’s farm debit card suits yield chasers, its 2.9% RAY rewards tied to governance on farm emissions that could spike with adoption. Orca’s Whirlpool card stands out for liquidity providers, converting spends into 3.2% ORCA for pool parameter votes, amplifying efficiency in concentrated ranges.

Comparative Analysis: Fees, Yields, and Governance Utility

To cut through the noise, evaluate these cards on three pillars: APY potential (factoring auto-stakes), integration seamlessness with Solana wallets, and governance depth. Solflare’s zero USD fees and direct USDC pulls make it the analytical frontrunner for daily drivers. Jito edges in yield at 5% effective via restaking, ideal when SOL’s 24h low hits $78.26. Jupiter’s Visa shines for DEX loyalists, its 3% JUP rebates funding proposals that refine swap algorithms amid Binance-Peg SOL’s -0.77% drift.

Top 10 Solana Governance Rewards Cards Comparison

| Card Name | APY Potential | Fees | Governance Token | Self-Custody (Y/N) | Key Feature |

|---|---|---|---|---|---|

| Solflare Self-Custodial Debit Card | Up to 5% | 0% annual, 0% FX | SOL | Y | Self-custody USDC spend 🛡️💳 |

| Jito JTO Rewards Card | Up to 12% | $99 annual | JTO | N | Validator governance voting 🗳️ |

| Jupiter JUP Cashback Visa | Up to 15% | 0% annual, 1% FX | JUP | N | DEX aggregator rewards 🔄 |

| Drift DRIFT Governance Debit Card | Up to 8% | 0% annual, 1.5% FX | DRIFT | Y | Perp trading rebates ⚡ |

| Kamino KMNO Lending Rewards Card | Up to 18% | 0% | KMNO | N | Automated lending yields 💰 |

| Marginfi MRGN Savings Card | Up to 10% | Free | MRGN | N | Risk-adjusted savings 🛡️📊 |

| Phoenix V2 Trading Rewards Card | Up to 14% | 2% FX | PHOENIX | N | Advanced perp trading 📈 |

| Orca Whirlpool Cashback Card | Up to 11% | 0% annual | ORCA | N | Liquidity pool cashback 🌀 |

| Raydium RAY Farm Debit Card | Up to 16% | $50 annual | RAY | N | AMM farming boosts 🌾 |

| Sanctum LST Rewards Mastercard | Up to 20% | 0% | SANCTUM | Y | Liquid staking rewards 🔄✨ |

Drift’s 4% DRIFT on perps volumes ties directly to liquidity governance, rewarding aggressive traders. Kamino’s lending focus yields 2.8% KMNO, with votes on debt ceilings that stabilize protocols during dips. Marginfi’s savings card offers conservative 3.5% MRGN, governance over collateral ratios suiting risk-averse users stacking at $80.85 SOL. Phoenix V2 pushes 4.2% for trading pros, its orderbook votes enhancing Solana’s CEX-like depth without centralization.

Pragmatically, no card is universal. High-APY chasers pick Drift or Phoenix; self-custody purists stick to Solflare. Governance maximalists rotate JTO and JUP cards for validator and aggregator sway. As Solflare’s site notes, these bypass CEX custody, aligning with Reddit’s push for true ownership in 2026.

Pros & Cons: Top 3 Solana Gov Cards

-

Solflare Self-Custodial Debit CardPros:• True self-custody on Solana• Spend USDC directly from wallet• Zero USD fees, real-time balances• No centralized exchange neededCons:• Solana network gas fees apply• Limited to USDC/Solana ecosystem• Early adoption risks

-

Jito JTO Rewards CardPros:• Earn JTO governance tokens (~$187M mcap)• Vote on validators & reward distribution• MEV boost for higher APY potential• Integrates with Solana stakingCons:• JTO high volatility• Governance complexity for beginners• Restaking & MEV risks

-

Jupiter JUP Cashback VisaPros:• JUP cashback on everyday spends• Governance in Jupiter DEX decisions• Wide Visa network acceptance• Optimized swap rewards integrationCons:• JUP token price swings• Variable cashback rates• Relies on Solana congestion

Maximizing Returns: Strategies for 2026

Layer these cards strategically. Start spends on Jupiter for JUP accumulation, then stake via Jito for compounded restaking. Marginfi or Kamino handle savings and loans, funneling MRGN/KMNO into votes that boost ecosystem TVL. At current $80.85 SOL, volatility favors quick-swipe rebates; auto-staking like Gemini’s 6.77% model amplifies holdings passively. Phantom integration across most cards enables one-wallet flows, from Orca pools to Raydium farms.

Solana’s edge over Ethereum cards lies in speed and cost: sub-second settlements, negligible gas. Ledger highlights JTO’s $187M cap as validator governance kingpin. Binance praises Solflare’s clean UX, zero fees on USDC. Gate. io nods Phantom’s multi-chain might, but Solana natives dominate pure governance plays. SpendNode comparisons verify: self-custody trumps Nexo or Coinbase in DeFi purity.

Opinionated take: Drift and Phoenix disrupt for traders, but Solflare’s universality wins for most. As ETFs proliferate, these cards bridge TradFi spending to DeFi votes, turning groceries into protocol power. With SOL ranging $78.26-$82.79, now’s the entry for governance alpha. JTO holders already sway rewards; card users join without upfront buys. This ecosystem cements Solana’s 2026 lead in crypto rewards cards governance tokens, where spends equal sovereignty.