The landscape for crypto rewards cards is evolving rapidly, with the latest wave of launches focusing on governance token features that empower users to shape the protocols they support. As we approach 2025, a curated set of five upcoming crypto rewards cards stands out for their unique blend of spending utility and participatory governance. These new offerings are more than just tools for earning cashback in crypto; they are gateways to direct influence over some of DeFi’s most important protocols.

Why Governance Token Rewards Are the Next Frontier

Traditional crypto rewards cards have focused on providing users with Bitcoin, Ethereum, or stablecoins as cashback. While effective, these rewards rarely offer a say in how platforms operate or evolve. The new breed of upcoming crypto rewards cards changes this dynamic by distributing governance tokens, assets that grant holders voting rights and sometimes a share in protocol fees or revenues.

This shift comes at a time when DeFi protocols increasingly prioritize community-driven decision making. By integrating governance tokens into their reward structures, these cards not only encourage spending but also foster deeper user engagement and loyalty. Holders can now actively participate in critical decisions such as protocol upgrades, fee structures, and even treasury management.

The Five Most Anticipated Governance Rewards Cards

Let’s examine the five most anticipated future DeFi cards set to launch in late 2024 and early 2025. Each card is designed to deliver both robust financial incentives and meaningful on-chain participation opportunities:

Top 5 Upcoming Crypto Rewards Cards with Governance Tokens

-

EigenLayer Card (by Eigen Labs): This upcoming card integrates with the EigenLayer restaking protocol, enabling users to earn rewards in EIGEN governance tokens. Cardholders can influence protocol upgrades and fee structures through on-chain voting, while spending crypto at supported merchants.

-

dYdX Chain Card: Designed for the dYdX decentralized derivatives platform, this card rewards users with DYDX governance tokens. Holders gain a direct say in protocol parameters, trading incentives, and community grants, combining DeFi utility with real-world spending.

-

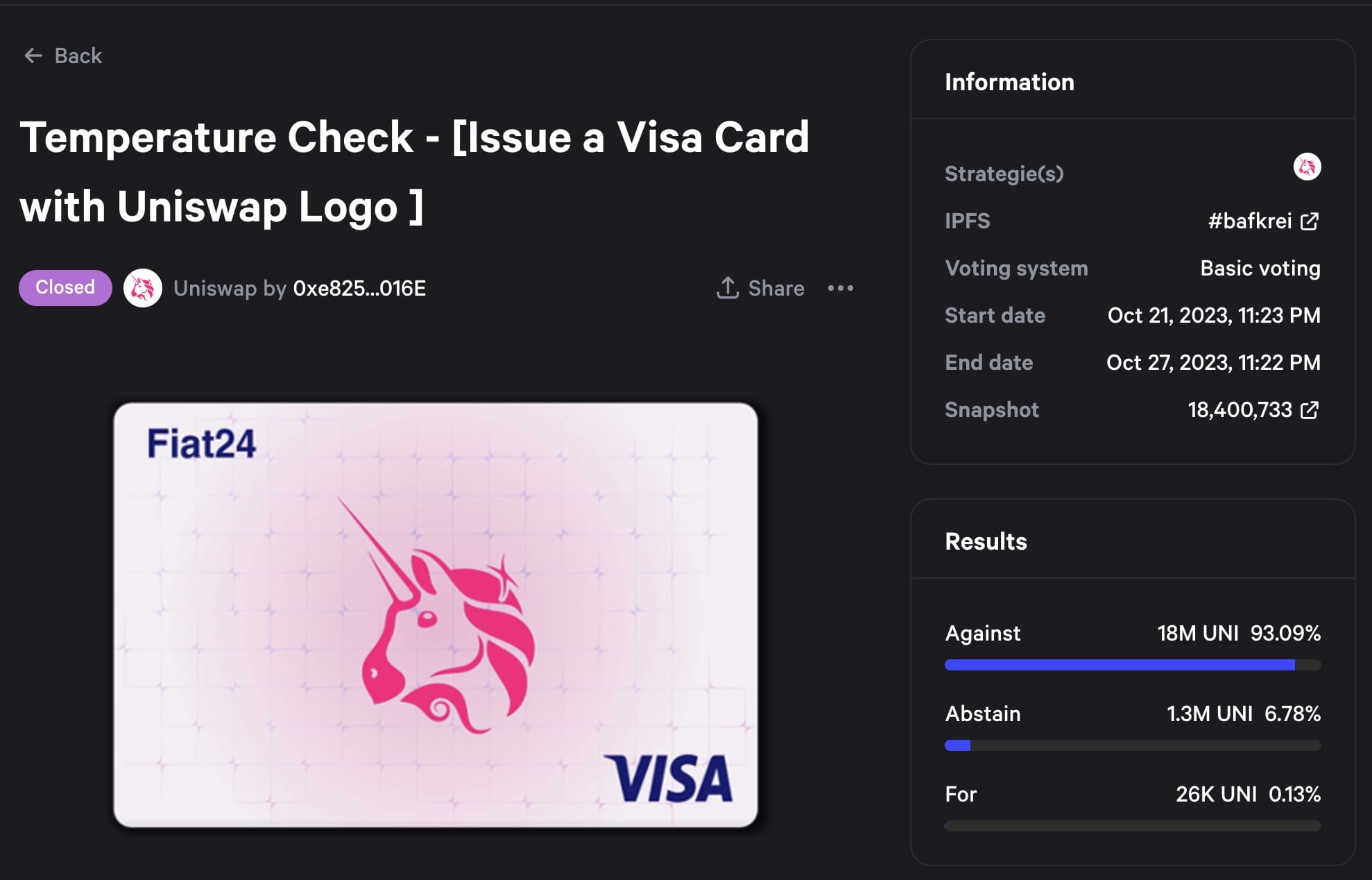

Uniswap x Visa Governance Card: This collaboration brings Uniswap’s governance to everyday spending. Users earn UNI tokens as rewards, which can be staked or used to vote on liquidity pool incentives, fee changes, and protocol governance proposals.

-

Aave Arc Rewards Debit Card: Targeted at institutional and compliant DeFi users, this card offers AAVE governance token rewards for spending and lending activities. Cardholders can participate in Aave Arc’s permissioned governance, shaping risk parameters and asset listings.

-

Curve DAO Community Card: Linked to the Curve Finance ecosystem, this card provides CRV governance token rewards. Users can lock CRV for boosted rewards and actively participate in DAO votes affecting pool weights, fee distribution, and protocol direction.

1. EigenLayer Card (by Eigen Labs)

EigenLayer Card is expected to be a game-changer for users who value both yield generation and governance participation. By offering its native EIGEN token as part of its rewards program, the card enables users not only to earn from their spending but also to vote on restaking parameters and protocol upgrades within EigenLayer’s ecosystem. Early previews suggest tiered reward rates based on staking activity, a model designed to align user incentives with long-term platform health.

2. dYdX Chain Card

The dYdX Chain Card brings decentralized derivatives trading closer to everyday spending by rewarding users with DYDX tokens earned through purchases. These tokens unlock voting rights on key proposals related to trading fees, liquidity incentives, and risk management policies on dYdX’s standalone chain. For traders who want their everyday transactions to translate into real influence over one of DeFi’s leading perpetuals exchanges, this card is poised to be highly attractive.

A New Era: Uniswap x Visa Governance Card and Beyond

Uniswap x Visa Governance Card, arguably the most high-profile collaboration in this space, merges Visa’s global acceptance network with Uniswap’s UNI token-based governance model. Cardholders will earn UNI tokens as they spend, which can be used for voting on liquidity pool parameters or even new feature rollouts within Uniswap v4 and beyond.

This trend isn’t isolated, protocols like Aave Arc and Curve DAO are following suit by launching their own branded debit cards that embed governance participation into every transaction.

Aave Arc Rewards Debit Card is tailored for institutional DeFi participants and compliance-focused users. By integrating AAVE token rewards, this card allows users to both earn and stake tokens, directly impacting Aave Arc’s risk frameworks and lending parameters. The card’s reward system is built to encourage not just spending, but also thoughtful participation in on-chain votes that steer the direction of one of DeFi’s most respected lending markets. For those seeking a hands-on role in protocol governance without sacrificing everyday usability, the Aave Arc card stands out.

4. Curve DAO Community Card

The Curve DAO Community Card distinguishes itself with its focus on stablecoin liquidity and community-driven incentives. Users receive CRV tokens as rewards, which can be locked for boosted voting power or additional staking yields within the Curve ecosystem. This structure is designed to align cardholder interests with the long-term growth of Curve’s liquidity pools, ensuring that active users have a voice in fee allocations, gauge weight votes, and new pool proposals.

Each of these upcoming crypto rewards cards leverages governance token features not just as a marketing differentiator but as a mechanism to deepen user commitment and drive sustainable protocol development. The convergence of daily payments with on-chain voting rights is transforming how DeFi communities grow and self-govern.

Comparing Key Features Across Governance Rewards Cards

Comparison of Upcoming Crypto Rewards Cards with Governance Token Features

| Card Name | Reward Rate | Supported Tokens | Governance Participation Options |

|---|---|---|---|

| EigenLayer Card | Up to 3% back in EIGEN | ETH, EIGEN, select LSTs | On-chain voting, staking for protocol upgrades |

| dYdX Chain Card | 2% back in DYDX | DYDX, USDC | Delegate votes, participate in governance proposals |

| Uniswap x Visa Governance Card | 1.5% back in UNI | UNI, ETH, USDC | Direct on-chain voting, proposal submission |

| Aave Arc Rewards Debit Card | Up to 2.5% back in AAVE | AAVE, stablecoins (USDC, DAI) | Staking for governance, vote on protocol parameters |

| Curve DAO Community Card | Up to 4% back in CRV | CRV, select stablecoins | On-chain voting, boost rewards via veCRV locking |

As shown above, each card offers distinct advantages, whether it’s EigenLayer’s restaking-centric model or Curve DAO’s enhanced stablecoin incentives. The shared thread is clear: these cards empower users with direct protocol influence while rewarding everyday financial activity.

What to Watch For: Risks and Opportunities

While governance token rewards unlock new dimensions of engagement, they also introduce considerations around volatility, tax treatment, and potential centralization if whales accumulate large voting shares via spending. Conservative investors should weigh these factors alongside traditional concerns like security practices and fee structures before choosing a card.

For those committed to shaping the future of decentralized finance, without sacrificing real-world utility, these upcoming launches represent an unprecedented opportunity. As protocols race to integrate more robust governance mechanisms into their consumer offerings, expect further innovation in reward structures and participatory design.

The next generation of crypto cards is set to redefine what it means to be both a spender and a stakeholder in DeFi. By aligning incentives between users and protocols through governance token features, these offerings are poised to drive greater autonomy, and responsibility, across the crypto ecosystem.