In the evolving landscape of crypto rewards cards, the Ether. fi Visa Card stands out by blending everyday spending with DeFi governance participation. As of January 26,2026, ETHFI trades at $0.5945, down 0.8250% over the past 24 hours, yet its utility in this card’s ecosystem offers tangible value beyond spot price fluctuations. Cardholders earn 3% cashback on all purchases while positioning for ETHFI airdrops through targeted promotions, making it a pragmatic choice for users seeking ether. fi visa card rewards and ETHFI governance token airdrops.

This DeFi-native Visa card, accepted worldwide and integrated with Apple Pay and Google Pay, lets users spend from non-custodial crypto balances or fiat inflows. Repay flexibly with no monthly minimums, and instantly pocket cashback. What elevates it above standard crypto debit cards? The direct tie-in to ETHFI governance token airdrops, where spending and referrals unlock token rewards from substantial pools.

Core Cashback Structure and Instant Rewards

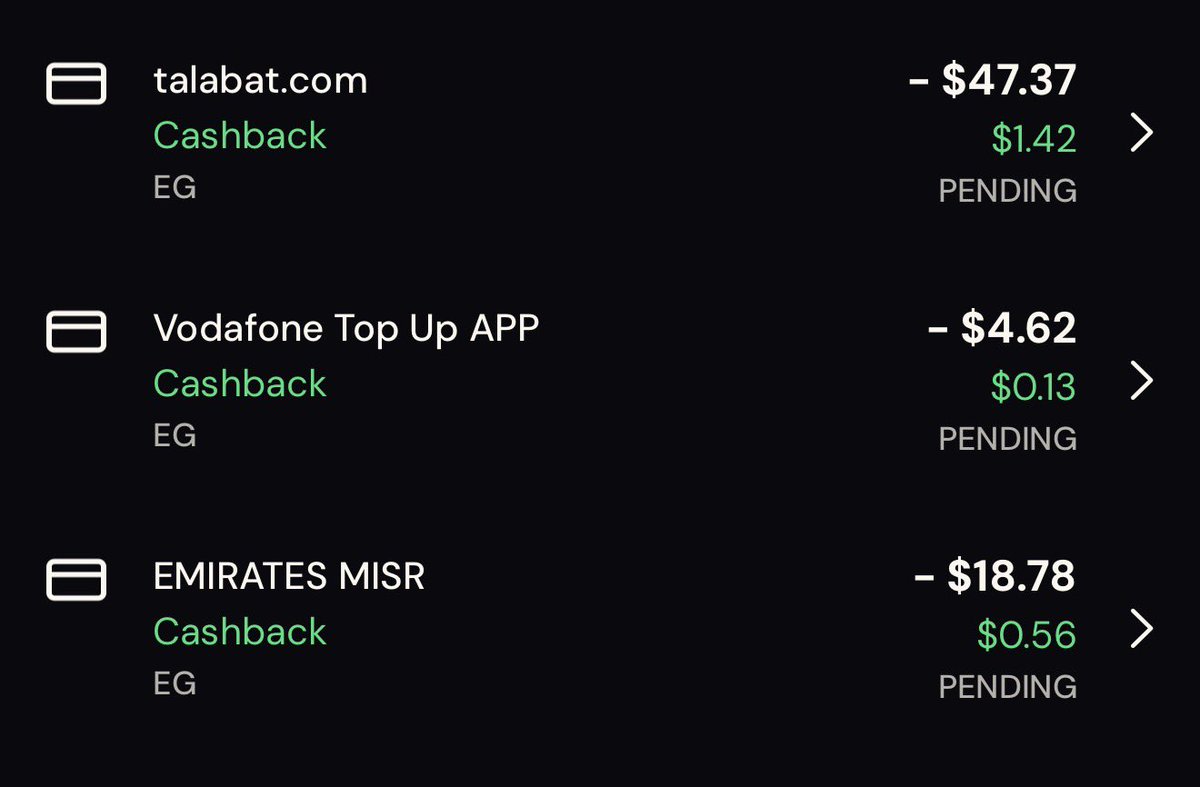

The 3% cashback applies universally across purchase tiers, a consistent draw in 2026’s competitive field. Users load via ether. fi crypto balances or fiat, spending seamlessly while earning rewards in real-time. Recent campaigns amplify this: the Triple Rewards initiative distributes 400,000 ETHFI tokens across on-chain deposits, off-chain spending, and fiat inflows. Meanwhile, Spend, Eat, Earn boosts referrals and food purchases up to 10% cashback, layering incentives without caps.

Analytically, this structure minimizes opportunity cost. At ETHFI’s current $0.5945 price, a $1,000 monthly spend yields $30 cashback, potentially convertible to ETHFI at market rate. Historical distributions, like $5M in membership rewards plus 20% extra cashback, underscore Ether. fi’s commitment to uncapped user upside.

ETHFI Governance Tokens: Beyond Cashback to Ownership

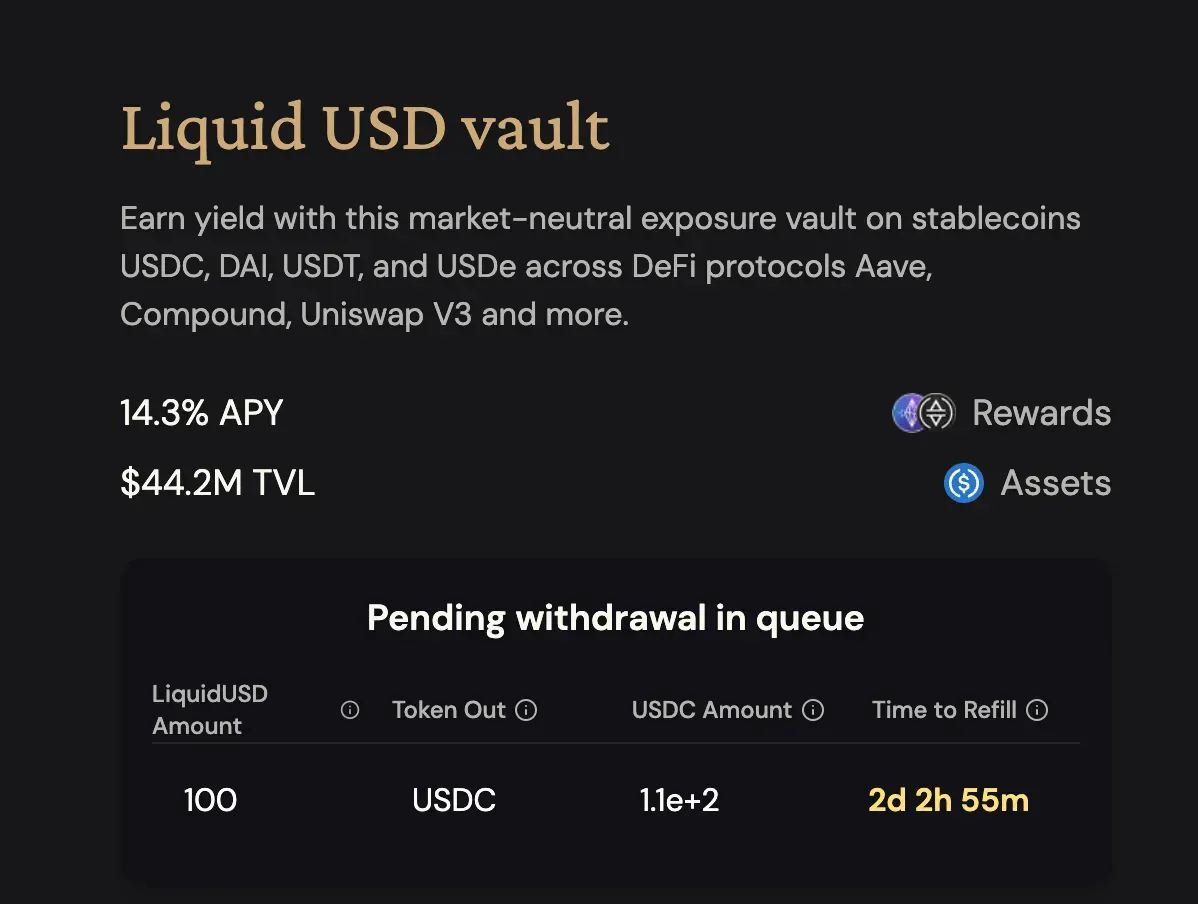

Ether. fi visa card rewards extend into governance via ETHFI, the protocol’s native token. Cashback often pays in ETHFI or partners like $SCR from Scroll integration, fostering long-term holding. Airdrops target active spenders: deposit crypto collateral to borrow against it, spend via the card, and qualify for token drops. This creates a flywheel, where daily transactions compound into voting power in Ether. fi’s DAO.

Pragmatically, governance participation matters. ETHFI holders influence protocol upgrades, fee structures, and reward allocations, turning passive spenders into stakeholders. With the card on Scroll Network, Layer 2 efficiency reduces gas costs, enhancing net yields. For 2026, this positions crypto debit card governance rewards as a differentiator against centralized alternatives lacking true decentralization.

Ether.fi (ETHFI) Price Prediction 2027-2032

Bullish projections based on Visa Card rewards, 3% cashback, ETHFI airdrops, and DeFi adoption from current price of $0.5945

| Year | Minimum Price | Average Price | Maximum Price | Avg Growth from Current (%) |

|---|---|---|---|---|

| 2027 | $1.00 | $2.00 | $4.00 | +236% |

| 2028 | $1.50 | $3.50 | $7.50 | +489% |

| 2029 | $2.20 | $5.50 | $12.00 | +825% |

| 2030 | $3.20 | $8.00 | $17.00 | +1,246% |

| 2031 | $4.50 | $11.00 | $23.00 | +1,750% |

| 2032 | $6.00 | $15.00 | $32.00 | +2,423% |

Price Prediction Summary

ETHFI is forecasted to surge significantly due to Ether.fi’s Visa Card innovations, including 3% cashback, governance token rewards, and promotions like Triple Rewards. Average prices are expected to climb progressively from $2.00 in 2027 to $15.00 in 2032, offering up to 2,423% growth from $0.5945. Min prices account for bearish market corrections and competition, while max prices reflect peak adoption and bull cycles.

Key Factors Affecting Ether.fi Price

- Global adoption of non-custodial Visa Card with Apple/Google Pay and up to 4% cashback in ETHFI/partner tokens

- Promotions driving engagement: 400k ETHFI Triple Rewards pool, 10% Spend-Eat-Earn cashback

- Strategic partnerships with Visa, Scroll L2, MEXC boosting usability and liquidity

- Ethereum DeFi ecosystem growth and ETHFI governance/staking utility

- Anticipated crypto market bull cycles post-2026 recovery

- Regulatory progress favoring crypto payments and credit products

- First-mover advantage in DeFi-native cashback cards amid rising competition

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Strategic Advantages in 2026 Market Dynamics

At $0.5945, ETHFI’s 24-hour range of $0.5556 to $0.6069 reflects mild consolidation amid broader DeFi traction. Ether. fi’s Visa Cash Card leverages this by enabling crypto-backed borrowing, sidestepping liquidation risks through flexible repayments. Referral perks add 1% extra cashback on invitee spends, plus travel and DeFi bonuses, scaling rewards exponentially for networks.

Compared to peers, Ether. fi’s non-custodial model avoids counterparty risk, a critical edge post-2025 exploits. Users rave about real-world integration: daily essentials to conference passes, all accruing ETHFI upside. This convergence of spend, earn, and govern redefines financial autonomy in volatile markets.

Real-world traction backs this edge. Partnerships like Scroll deliver $SCR alongside ETHFI, diversifying rewards without diluting core ether. fi cashback ETHFI yields. At today’s $0.5945 price, even modest spending snowballs into meaningful governance stakes, especially with no monthly caps on extras like the 20% boosts seen recently.

Maximizing ETHFI Airdrops Through Targeted Spending

Active users extract outsized value by aligning spends with campaigns. The Triple Rewards pool of 400,000 ETHFI tokens rewards on-chain activity, card swipes, and fiat loads equally, creating multiple entry points. Spend, Eat, Earn sweetens referrals with up to 10% cashback on dining, while invitees trigger 1% lifetime trailing cashback on their purchases. Strategically, front-load groceries or travel during peaks; a $500 food spend could net $50 back, convertible to ETHFI at $0.5945 for about 84 tokens, plus airdrop eligibility.

This isn’t scattershot; it’s calculated. Track 24-hour volatility from $0.5556 lows to $0.6069 highs, timing conversions when ETHFI dips for better accumulation. Governance savvy amplifies it: vote on proposals to tilt future rewards toward high-volume card users, embedding your spending habits into protocol economics.

Maximize Ether.fi Rewards

-

Align spending with campaigns like Triple Rewards (400K ETHFI pool via deposits, spending, fiat inflows) or Spend, Eat, Earn (up to 10% cashback on food/invites). Source

-

Leverage referrals for 1% extra cashback on every referral purchase, plus travel/DeFi perks.

-

Use crypto collateral to borrow for spending: non-custodial, no liquidation risk, repay anytime without minimums.

-

Convert cashback to ETHFI during dips below $0.5945 (current price) for optimal accumulation.

-

Participate in DAO votes with ETHFI for governance influence and long-term token upside.

Risks and Pragmatic Mitigations

No rewards card is risk-free, particularly with ETHFI at $0.5945 amid a -0.8250% daily dip. Volatility bites: a 10% drop erodes cashback value if unhedged. Borrowing against collateral invites smart contract scrutiny, though Ether. fi’s audited non-custodial setup fares better than custodial rivals post-2025 hacks. Gas fees on Scroll stay low, but Layer 2 bridges carry minor custody illusions during transfers.

Mitigate analytically. Diversify cashback into stables for spend stability, holding ETHFI portions for governance only. Set alerts at support levels like today’s $0.5556 low; avoid over-leverage beyond 50% loan-to-value. Referral networks buffer solo volatility, as group spends unlock conference perks and DeFi boosts. Opinion: for disciplined users, these risks pale against the crypto debit card governance rewards scarcity elsewhere.

Positioning for 2026 Visa Signature Crypto Card Dominance

Ether. fi’s trajectory points to category leadership. Bullish forecasts eyed $1.43 averages in 2025; extending from $0.5945, sustained DeFi inflows could double that by year-end if adoption mirrors user testimonials. MEXC collaborations tout up to 4% blended rates, but Ether. fi’s pure 3% plus airdrops edges it for governance hunters. Worldwide Visa acceptance, plus Apple/Google Pay, obliterates regional debit limitations.

Stakeholders gain most: convert cashback to ETHFI, stake for yields, govern for influence. This flywheel thrives in consolidation phases, turning visa signature crypto card 2026 hype into executable alpha. Daily drivers report seamless fiat/crypto bridges, with repayments timed to paycheck cycles. In a market favoring utility over speculation, Ether. fi Visa Card holders don’t just spend; they shape DeFi’s spend-to-earn paradigm.

Daily integration proves its mettle, from coffee runs accruing tokens to bulk groceries padding airdrop tiers. With Scroll’s efficiency and uncapped scaling, it’s built for compound growth at $0.5945 and beyond, handing users the reins in crypto’s reward renaissance.