Picture this: your morning coffee run or grocery haul not only covers your essentials but also stacks governance tokens in a leading DeFi protocol. The Ether. fi Visa Card makes that reality possible, blending seamless spending at over 150 million merchants worldwide with direct rewards in ETHFI governance tokens. Right now, on January 30,2026, ETHFI sits at $0.5424, down slightly by -0.0617% in the last 24 hours, yet poised for growth in this evolving crypto rewards landscape.

Ether. fi, the powerhouse liquid staking protocol boasting over $5 billion in TVL, has redefined how we interact with Ethereum staking through its eETH rewards and now extends that innovation to everyday finance. This isn’t just another crypto debit card governance tokens play; it’s a strategic bridge to decentralized decision-making. By linking your spending to their Membership Points System, you climb tiers that unlock escalating ETHFI cashback, turning passive consumers into active governance participants.

Decoding the Membership Points System Behind ETHFI Rewards

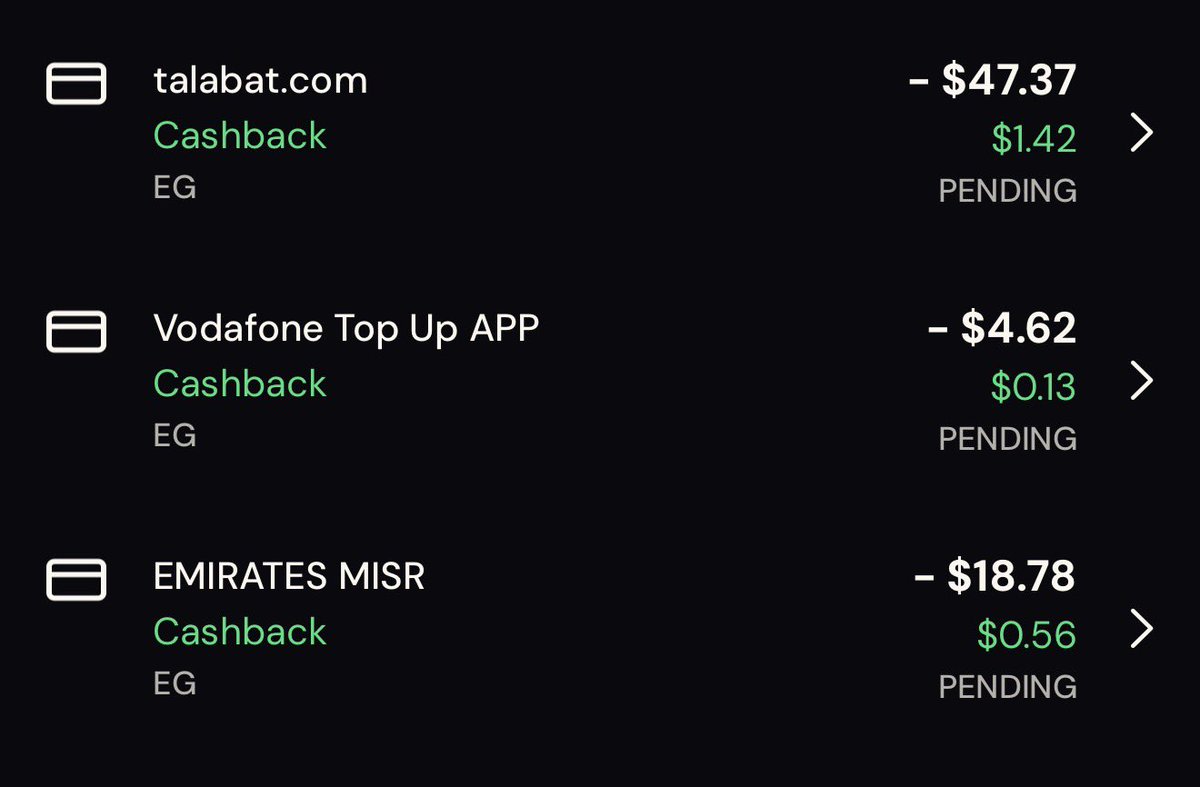

At the heart of the ether. fi visa card experience lies the Membership Points System, a dynamic ladder that resets monthly and fuels quarterly ETHFI distributions. Rack up points through staking ETH, diving into Liquid Vaults, or swiping your Ether. fi Cash Card. These activities aren’t isolated; linking external wallets ensures every move counts toward your tier. Entry-level folks start basic, but aim higher: Luxe members with an active card snag 20% cashback on up to $300 in purchases over 30 days. That’s real ETHFI governance rewards card potential right in your pocket, non-custodial and ready for Apple Pay or Google Pay.

Ether. fi’s protocol extends credit based on blockchain criteria, making rewards feel earned and aligned with DeFi principles.

Why does this matter? In a market where ETHFI hovers at $0.5424, each token earned positions you to vote on protocol upgrades, fee structures, and growth initiatives. It’s financial autonomy wrapped in Visa convenience, far beyond traditional cashback that evaporates.

Cashback Tiers That Reward Strategic Spending

Dive deeper into the rewards structure, and you’ll see why this stands out among rewards cards with governance tokens. All cardholders enjoy baseline perks, but tiers amplify them. Basic users might see 3-4% returns echoing 2025 promos, while top tiers like Luxe push boundaries with that 20% cap. Spend wisely on groceries, fuel, or travel, and watch ETHFI accrue directly, bolstered by partnerships like Scroll’s $SCR for extra layers.

Current market vibes? ETHFI’s $0.5424 price reflects resilience amid a 24-hour dip from $0.5786 high to $0.5293 low. Yet, forecasts paint a brighter 2026 picture, with projections eyeing $2.10 to $5.20 ranges. Imagine cashback compounding at those levels; it’s motivation to spend smart and stake harder.

Ether.fi (ETHFI) Price Prediction 2027-2032

Forecasts based on Visa Card adoption, DeFi growth, TVL expansion, and crypto market cycles (from 2026 baseline: Min $2.10, Avg $3.67, Max $5.20)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev Year) |

|---|---|---|---|---|

| 2027 | $2.80 | $5.20 | +42% | |

| 2028 | $4.00 | $7.80 | +50% | |

| 2029 | $5.50 | $11.20 | +44% | |

| 2030 | $7.50 | $15.80 | +41% | |

| 2031 | $10.50 | $22.00 | +39% | |

| 2032 | $14.00 | $30.50 | +39% |

Price Prediction Summary

ETHFI prices are projected to grow progressively from 2027-2032, fueled by widespread Visa Card adoption earning governance tokens, rising TVL beyond $5B, DeFi innovations, and bullish market cycles. Average prices could 8x from 2026 baseline by 2032, with min/max reflecting bearish corrections and adoption-driven bull runs.

Key Factors Affecting Ether.fi Price

- Increased Visa Card usage with ETHFI cashback rewards (up to 20% for premium tiers)

- DeFi staking growth and $5B+ TVL expansion

- Ethereum ecosystem synergies and liquid staking demand

- Regulatory clarity for crypto debit cards and governance tokens

- Overall crypto bull cycles post-2026 recovery

- Partnerships with Visa, Apple/Google Pay, and exchanges like MEXC

- Competition from other protocols and market volatility

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Why Ether. fi Card Outshines Traditional Crypto Debit Options

What sets the Ether. fi Visa Card apart in 2026? It’s the governance angle. Unlike debit cards dumping stablecoins or minor tokens, here you’re earning ETHFI, the key to ether. fi’s DAO. With $26 million revenue projected from prior years scaling up, and a fully diluted value underscoring 20x potential, your spending fuels not just personal gains but protocol momentum. Apple/Google Pay readiness means zero friction, while global Visa acceptance erases borders.

- Non-custodial control: Your assets stay yours, no middleman locks.

- Tiered incentives: Climb from basic to Luxe for exponential ETHFI boosts.

- Points synergy: Staking plus spending multiplies rewards quarterly.

Enthusiasts, this is your cue to integrate. Link that wallet, activate the card, and transform routine transactions into governance firepower. The path to maximized ether. fi card airdrops 2026 starts with today’s swipe.

Ready to turn that potential into action? Let’s break down how everyday spending aligns with DeFi’s deeper layers, where ETHFI at $0.5424 isn’t just a holding, it’s a vote in ether. fi’s future.

Governance Power: Beyond Cashback to Protocol Influence

Earning ETHFI through the Visa Card does more than pad your wallet; it hands you the reins of a protocol with billions in TVL. Picture proposing fee tweaks or vault expansions, all powered by tokens from your coffee swipes. In 2026, as ETHFI holds steady at $0.5424 despite a minor 24-hour dip, this setup democratizes influence. Top-tier Luxe members, fueled by consistent card use, amplify their voice in quarterly distributions. It’s opinionated DeFi: why settle for fleeting rewards when you can shape the ecosystem earning them?

Ether.fi Visa Card Rewards Tiers (2026)

| Tier | Cashback % | Monthly Spend Limit | ETHFI Governance Perks |

|---|---|---|---|

| Basic | 3% | $100 | Earn ETHFI governance tokens via cashback; eligible for protocol governance participation |

| Pro | 10% | $200 | Earn ETHFI governance tokens via cashback; eligible for protocol governance participation |

| Luxe | 20% | $300 | Earn ETHFI governance tokens via cashback; eligible for protocol governance participation |

This tiered system, synced with membership points, rewards strategy over volume. Stake ETH for base points, then layer on card spends for multipliers. External wallet links capture it all, preventing missed opportunities. At $0.5424, each percentage point cashback translates to tangible governance weight, especially with projections hinting at $3.67 averages later this year.

Strategic Tips to Stack ETHFI Like a Pro

I’ve seen users double their yields by timing spends around point resets and promos, like the recent year-end gift boxes offering ETH prizes. Focus on high-impact categories: groceries and fuel often qualify without luxury caps. Pair with Liquid Vaults for passive points, creating a flywheel where spending begets staking begets more spending power. In a market where ETHFI dipped to $0.5293 today but rebounded from lows, this resilience mirrors the card’s design, built for long-term holders.

These habits compound. One user shared climbing to Luxe in weeks, netting 20% on $300 spends, all while voicing on DAO proposals. It’s motivating proof: your Visa Card isn’t spending crypto, it’s investing in autonomy.

Getting Started: Your Step-by-Step Path to ETHFI Rewards

No gatekeeping here. The Ether. fi Visa Card application is streamlined for DeFi natives and newcomers alike, emphasizing non-custodial security from day one.

Once live, integrate seamlessly. Global Visa reach means 150 million merchants, from Tokyo cafes to U. S. supermarkets. Rewards hit your wallet instantly in ETHFI, ready for governance or holding at $0.5424. Pro tip: Time activations around promos for bonus points, echoing 2025’s 4% cashback launches now evolved into tiered governance gold.

Zoom out, and the Ether. fi Visa Card emerges as a 2026 standout among crypto debit options. Where others chase stablecoin scraps, this delivers ETHFI governance firepower, backed by $5 billion TVL and revenue scaling past $26 million benchmarks. At $0.5424, with highs at $0.5786 fresh in memory, it’s primed for upside. Spend intentionally, participate boldly, and watch routine purchases propel you into DeFi’s driver’s seat. Your next transaction could be the one that tips the scales.