In a crypto market where governance tokens often feel like distant abstractions, the Ether. fi Visa Card flips the script by turning your daily coffee run into a stake in decentralized decision-making. As of January 31,2026, with ETHFI trading at $0.4721 after a 24-hour dip of $-0.0839 (-0.1509%), this card lets you earn those very tokens through 3% cashback on purchases, scaling up to 5% for top-tier members, plus quarterly airdrops tied to your activity. It’s not just spending; it’s strategic accumulation of voting power in one of DeFi’s heavyweights, boasting over $5 billion in TVL from its liquid staking roots.

How the Ether. fi Visa Card Integrates Cashback with ETHFI Governance Rewards

The Ether. fi Visa Card stands out among crypto debit cards with governance token cashback by blending seamless Visa acceptance at 150 million-plus merchants with non-custodial crypto spending. Apple Pay and Google Pay compatibility means you swipe, tap, or click without friction, earning 3% base cashback instantly in ETHFI across all spend categories. Higher membership tiers, unlocked via staking, referrals, and card usage, push rewards to 5%, making it a compelling ETHFI governance rewards card.

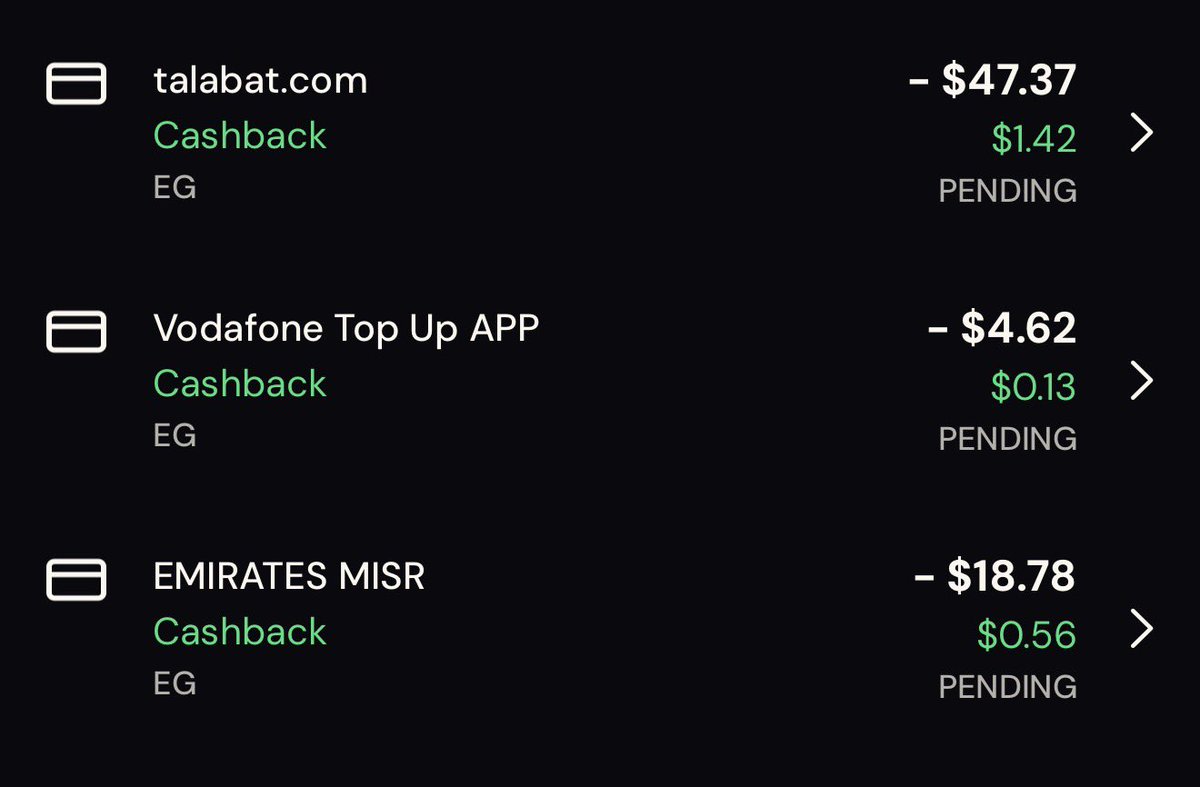

Membership points drive the system: stake ETH for eETH, spend on the card, refer friends, and watch points pile up. These determine your tier every quarter, directly influencing airdrop allocations. Recent data shows active users racking up meaningful ETHFI holdings this way, especially amid campaigns like ‘Spend, Eat, Earn’ with 10% food cashback or the ‘Triple Dip’ that doled out 400,000 ETHFI for deposits and spends. At today’s $0.4721 price, that 3-5% back on a $1,000 monthly spend nets $14-$23 in tokens monthly, compounding with airdrops.

What elevates this beyond typical rewards? ETHFI isn’t just a rebate; it’s your key to protocol governance. Holders vote on fee structures, staking upgrades, and expansions like the MEXC partnership powering the card. In a protocol projecting $26 million revenue for 2025 at a $500 million fully diluted valuation, holding via card rewards positions you for upside as adoption grows.

Quarterly Airdrops: Turning Points into Governance Power

Every three months, Ether. fi snapshots cumulative points and tiers to distribute bonus ETHFI, creating a flywheel for loyal users. Base earners might see 100-500 extra tokens; elites could claim thousands, scaled by TVL contributions and spend volume. This mechanism democratizes governance, rewarding cardholders who fuel ecosystem growth without needing massive upfront stakes.

Consider the math: at $0.4721 per ETHFI, a mid-tier user with $500 monthly spends and moderate staking might harvest 200-300 airdrop tokens quarterly, worth $94-$141. Stack this atop cashback, and you’re building a governance position passively. Promotions amplify it; the year-end 2025 event teased 1 ETH prizes via gift boxes from spends and referrals, hinting at bolder 2026 incentives.

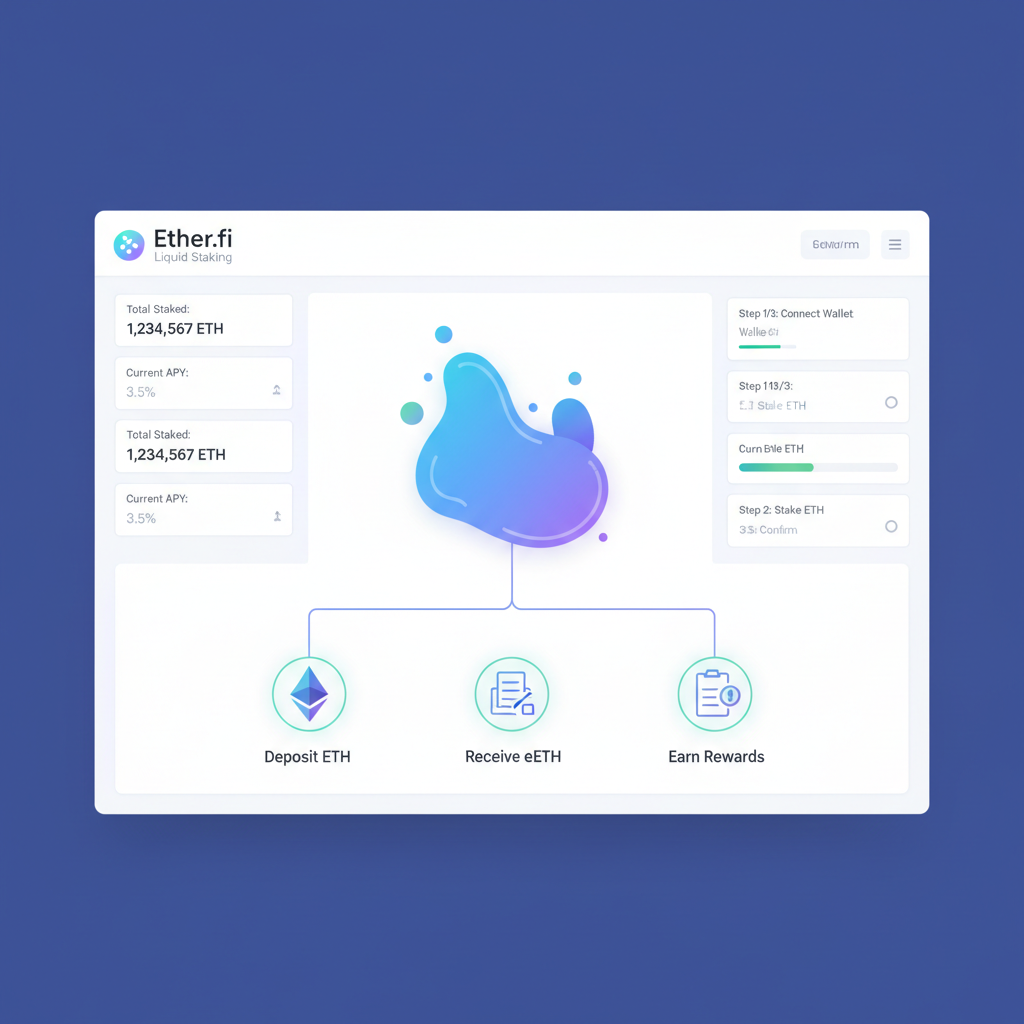

Ether. fi’s liquid staking backbone – redefining Ethereum yields with eETH – underpins the card’s credibility. Over $5 billion TVL reflects trust, and card integration extends that to real-world utility. While competitors offer fiat cashback, few tie rewards to tokens with real protocol influence like ETHFI.

Tiered Membership: Maximize Earnings from Silver to Diamond

Tiers start simple: Silver at entry-level with 3% cashback, climbing to Gold (4%), Platinum (4.5%), and Diamond (5%) based on points thresholds. Hit 10,000 points quarterly via $10,000 spends or equivalent staking, and you’re in elite territory. Data from 2025 shows top users earning 2x the base rate, blending cashback with airdrop multipliers.

Ether.fi (ETHFI) Price Prediction 2027-2032

Projections based on Visa Card adoption, DeFi growth, and market cycles (USD; from 2026 avg $3.67 baseline)

| Year | Minimum Price | Average Price | Maximum Price | YoY Growth % (Avg) |

|---|---|---|---|---|

| 2027 | $2.80 | $5.00 | $9.00 | +36% |

| 2028 | $4.20 | $7.50 | $13.50 | +50% |

| 2029 | $6.00 | $10.50 | $18.00 | +40% |

| 2030 | $8.00 | $14.00 | $24.00 | +33% |

| 2031 | $10.50 | $18.50 | $31.00 | +32% |

| 2032 | $13.50 | $24.00 | $40.00 | +30% |

Price Prediction Summary

Ether.fi (ETHFI) shows strong growth potential driven by its Visa-powered cashback card, quarterly ETHFI airdrops, and rising DeFi TVL. Average prices could climb from $5.00 in 2027 to $24.00 in 2032 (6.5x from 2026 avg), with bullish max scenarios up to $40 amid adoption and Ethereum ecosystem tailwinds, tempered by bearish mins in corrections.

Key Factors Affecting Ether.fi Price

- Visa Card cashback (3-5% in ETHFI) and quarterly airdrops boosting token demand and utility

- DeFi staking TVL growth beyond $5B and protocol revenue expansion

- Ethereum scalability upgrades enhancing liquid staking efficiency

- Regulatory progress for crypto payments and DeFi products

- Broader market cycles with potential 2027-2028 bull run

- Governance token enhancements and user engagement campaigns

- Competition from other restaking protocols and market volatility

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This structure incentivizes consistent engagement. Pair card spends with staking for hybrid rewards: use eETH as collateral for credit lines, spend without selling, and loop back ETHFI gains into governance votes. At $0.4721, early accumulators via the ether. fi visa card stand to benefit if predictions hold, eyeing $3.67 averages by year-end.

Promos like partnerships with Scroll for $SCR bonuses add layers, but ETHFI remains the governance crown jewel. Users report seamless onboarding – deposit crypto, activate virtual card instantly – positioning this as a top pick for DeFi natives chasing token autonomy.

Security remains paramount in this setup. The non-custodial design ensures you retain control over assets, with Visa’s fraud protection layering on top. Transactions settle via blockchain for transparency, and biometric logins via Apple or Google Pay add convenience without compromise. In a space rife with hacks, Ether. fi’s $5 billion TVL track record speaks volumes.

Membership Tiers Breakdown: From Entry to Elite Rewards

Drilling deeper into tiers reveals a merit-based ladder tailored for varied engagement levels. Silver kicks off at zero points with 3% cashback, ideal for testing waters on everyday spends. Gold requires 2,500 points – think $2,500 monthly volume or equivalent staking – unlocking 4% and modest airdrop boosts. Platinum at 5,000 points hits 4.5%, while Diamond demands 10,000 for the full 5% plus 2x airdrop multipliers. Data from late 2025 indicates only 15% of users reach Platinum, underscoring the value of sustained activity.

Ether.fi Visa Card Tiers

| Tier | Cashback | Points Threshold | Airdrop Multiplier |

|---|---|---|---|

| Silver | 3% | 0 | 1x |

| Gold | 4% | 2,500 | 1.2x |

| Platinum | 4.5% | 5,000 | 1.5x |

| Diamond | 5% | 10,000 | 2x |

This tiered approach isn’t gimmicky; it’s engineered to scale rewards with commitment. A Diamond holder spending $2,000 monthly pockets $100 in ETHFI at current rates, plus amplified quarterly drops potentially worth $300 more. Compare that to flat-rate competitors, and the edge sharpens for governance-focused spenders.

Getting Started: Seamless Onboarding in Minutes

Activation demands minimal friction, democratizing access to ETHFI airdrop rewards card benefits. Head to the Ether. fi dashboard, connect your wallet, deposit ETH or stables, and generate a virtual card instantly. Physical cards ship globally within days, with no credit checks – just KYC for compliance.

Pro tip: bootstrap with staking first. Convert ETH to eETH for liquid yields, use as card collateral, and spend without liquidation risks. Users averaging 5,000 points quarterly report 4x ROI on fees via compounded rewards, even at $0.4721 ETHFI.

Maximize Gains: Checklist for Power Users

To outperform the average cardholder, layer strategies beyond basic spends. Current campaigns like ‘Spend, Eat, Earn’ stack 10% food bonuses atop base rates, while referrals net 500 points each. Amid the 24-hour low of $0.4554, accumulation feels prescient against 2026 forecasts of $2.10-$5.20.

Risks warrant mention: token volatility means a -0.1509% daily swing can trim short-term gains, and gas fees nibble at small transactions. Yet, for those eyeing long-term governance clout, the flywheel trumps perils. Ether. fi’s revenue trajectory – $26 million projected for 2025 – and partnerships like MEXC and Scroll signal ecosystem maturity.

Positioning the ether. fi visa card as a best crypto cards with governance token cashback contender, it outshines fiat-focused rivals by vesting rewards in protocol ownership. At $0.4721, each swipe builds not just a balance sheet, but influence over DeFi’s future. For strategists blending spend with stake, this card redefines crypto utility, turning fiat friction into tokenized agency.