In February 2026, with Starknet’s STRK holding steady at $0.0483 amid a subtle 0.03% dip over the last 24 hours, governance token cashback on crypto rewards cards stands out as a strategic edge for DeFi participants. These cards transform routine purchases into dual yields: immediate rebates and voting power in protocol decisions. Unlike stablecoin rewards that merely preserve value, tokens like STRK, CRO, or MKR empower holders to shape ecosystem trajectories, from fee structures to grant allocations. For investors eyeing long-term resilience, this blend of liquidity and influence redefines everyday spending.

Crypto rewards cards paying in governance tokens bridge fiat convenience with DeFi autonomy, especially as platforms like Starknet mature. Recent market scans from CoinGecko and CoinLedger highlight surging adoption, with cards offering up to 8% back in tokens that unlock DAO participation. This isn’t speculative hype; it’s a calculated pivot toward protocols where spending directly amplifies your voice. Consider STRK’s role: at current levels, even modest cashback accumulates into meaningful stakes for on-chain proposals.

Why Prioritize Governance Token Cashback Over Fiat or Stable Rewards

Governance tokens elevate cashback beyond passive income. Holding CRO from a Crypto. com Visa Card, for instance, lets you vote on Cronos chain upgrades, potentially boosting your portfolio’s utility. This participatory layer fosters resilience; tokens tied to decision-making often appreciate through network effects. In contrast, USDC rebates from cards like Bleap sit idle without compounding governance perks. My 15 years in portfolio management underscore this: sustainable DeFi thrives on aligned incentives, where your grocery run influences liquidity incentives.

STRK exemplifies this potential. Trading between $0.0474 and $0.0502 recently, it rewards not just holders but active Starknet users. Cards mirroring this model, such as those distributing MKR or NEXO, position you at the nexus of spending and strategy. Data from Investorsobserver confirms most top cards now integrate platform tokens, signaling a 2026 shift toward DeFi governance rewards crypto cards.

Top crypto debit cards with cashback now include STRK and BRRR tokens, per Reddit discussions.

Breaking Down the Leaders: Crypto. com Visa and Binance Visa Cards

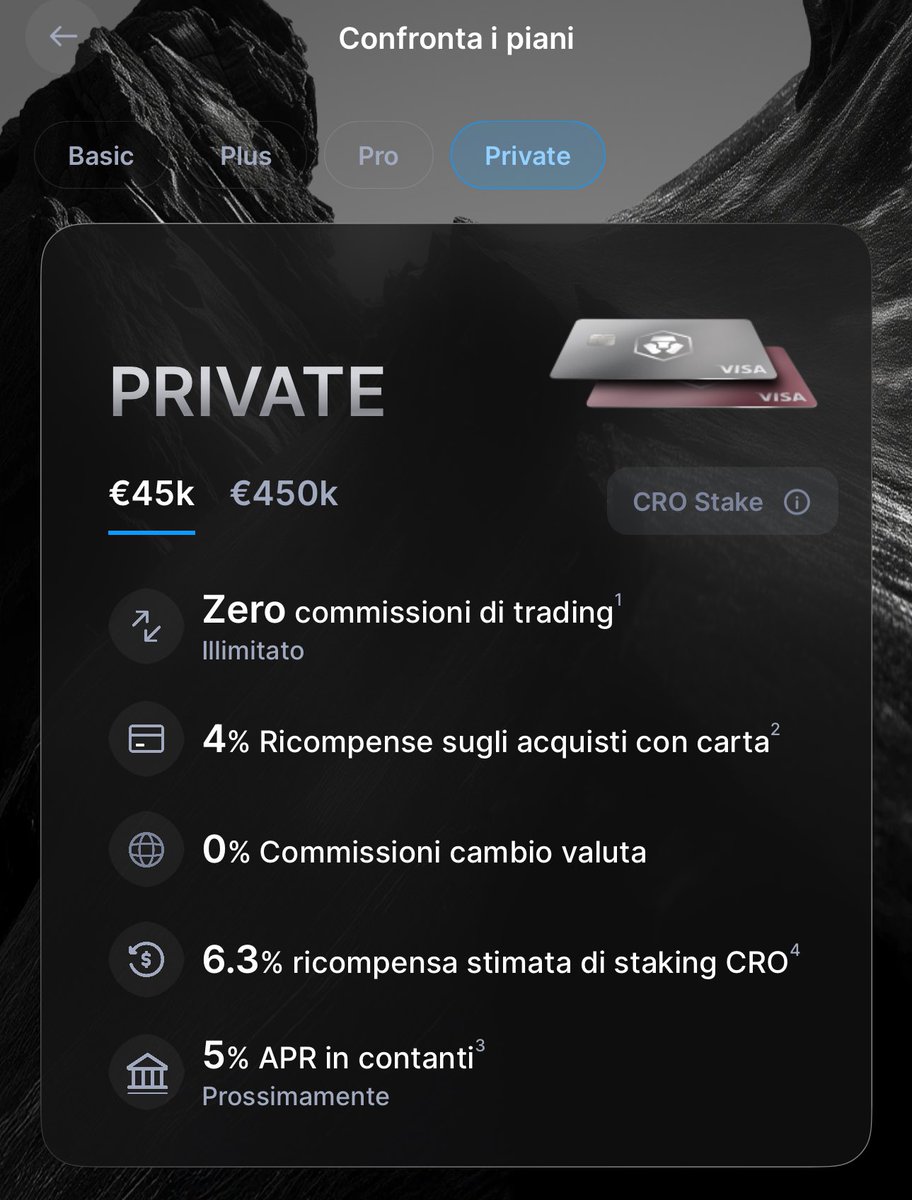

Crypto. com Visa Card tops the list for tiered CRO cashback, scaling from 1% to 8% based on stakes. At higher tiers, staking $1,000,000 CRO unlocks elite rewards, but even base levels suit strategic builders. CRO’s governance role in Cronos DAO means your cashback votes on integrations, like recent Starknet bridges. No annual fees and global Visa acceptance make it a calm choice for diversified spenders.

Binance Visa Card follows closely, rewarding in BNB with 3-9% rates, often boosted via SOL stakes per Binance updates. BNB holders govern Binance Smart Chain, influencing token launches and fee rebates. This card shines for high-volume traders, converting daily swipes into protocol sway. Both cards outperform in BYDFi rankings for bridging payments to digital assets.

Mid-Tier Powerhouses: Nexo, Wirex, and Plutus

Nexo Card delivers up to 2% in NEXO tokens or BTC, with NEXO granting votes on reward tweaks. It’s ideal for conservative portfolios, blending credit line access with governance. Wirex Visa Card pushes boundaries at 8% WXT cashback, convertible to other tokens; WXT’s dual utility drives platform votes. Plutus Mastercard caps at 3% PLU, a governance asset for ecosystem pivots.

These options cater to nuanced strategies. For STRK enthusiasts, Wirex’s flexibility echoes Starknet’s validity proofs, enabling cross-protocol plays. Koinly lists them among 2026’s best for low fees and usability. Check our full guide on governance token cashback for staking tips.

Starknet (STRK) Price Prediction 2027-2032

Forecasts for STRK governance token amid growing adoption in crypto rewards cards and DeFi ecosystems (Baseline: $0.0483 in Feb 2026)

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

|---|---|---|---|

| 2027 | 0.025 | 0.080 | 0.200 |

| 2028 | 0.100 | 0.300 | 0.800 |

| 2029 | 0.250 | 0.750 | 2.000 |

| 2030 | 0.500 | 1.200 | 3.000 |

| 2031 | 0.800 | 1.800 | 4.500 |

| 2032 | 1.200 | 2.500 | 6.000 |

Price Prediction Summary

STRK is poised for significant long-term growth from its 2026 low, driven by governance utility in rewards cards and Starknet L2 expansion. Expect volatility with bearish mins in early years and bullish maxes peaking in 2029 and 2032 cycles, potentially 50x+ from current levels by 2032 in optimistic scenarios.

Key Factors Affecting Starknet Price

- Increased demand from crypto rewards cards offering STRK cashback

- Starknet ecosystem growth and L2 scalability improvements

- Broader crypto market cycles (bull runs post-2028 halving)

- Regulatory clarity on DeFi governance tokens

- Competition from other L2s like Optimism and Arbitrum

- Adoption trends in governance participation and staking rewards

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Monolith Card rounds out this segment, paying MKR or ETH on DAI/ETH spends. MKR’s MakerDAO votes on stability fees align perfectly with macro hedges, a thoughtful pick amid volatility. As we eye Gnosis Pay and beyond, these cards collectively maximize token voting power in 2026.

Gnosis Pay Card integrates seamlessly with the Gnosis ecosystem, offering cashback in GNO tokens that holders use to vote on Safe wallet features and prediction markets. At up to 2% rewards, it appeals to those building modular DAOs, providing a quiet gateway to chain-agnostic governance. Bitpanda Visa Card follows with BEST token rebates around 1-2%, where BEST enables votes on exchange listings and fee models within Bitpanda’s growing Web3 hub. This card suits European users prioritizing regulatory clarity alongside DeFi influence.

Global Reach Leaders: OKX Visa and HTX Cards

OKX Visa Card stands out for 2-5% OKB cashback, with OKB governing the OKX Chain’s DEX parameters and launchpads. High limits and Apple Pay support make it strategic for frequent travelers, turning spends into votes on perpetuals incentives. HTX Card, formerly Huobi, delivers up to 4% in HT tokens, empowering decisions on lending pools and token burns. Both excel in MoneyZG’s 2026 rankings for limits and availability, echoing STRK’s $0.0483 stability with robust ecosystems.

2026 Comparison of Top Crypto Rewards Cards Offering Governance Token Cashback

| Card Name | Governance Token | Cashback Rates | Staking Tiers | Limits | Availability |

|---|---|---|---|---|---|

| Crypto.com Visa Card | CRO | 1% – 8% | Tiered (e.g., $1,000,000 CRO stake for 8%) | Varies by tier (ATM $200 – $10,000) | Available globally (select regions) |

| Binance Visa Card | BNB | 3% – 9% | Tiered BNB holdings / SOL stake boost | High spending limits | Available (select regions) |

| Nexo Card | NEXO | Up to 2% | Loyalty tiers (% of portfolio in NEXO) | No credit limit | Available (EU/US) |

| Wirex Visa Card | WXT | Up to 8% | Elite tier staking | Varies by tier | Available globally |

| Plutus Mastercard | PLU | Up to 3% | Tiered PLU holdings | Varies | Available (UK/EU) |

| Monolith Visa Debit Card | MKR / ETH | Varies | No staking required | Balance-based | Available |

| Gnosis Pay Card | GNO | 1% – 5% | Staking tiers | TBD | Available (EU) |

| Bitpanda Visa Card | BEST | 0.5% – 2% | Premium tiers | High limits | Available (EU) |

| OKX Visa Card | OKB | Up to 5% | VIP tiers | Varies by tier | Available (select regions) |

| HTX Card | HT | 1% – 6% | Tiered holdings | Varies | Available |

Across these ten cards, patterns emerge: tiered staking unlocks higher yields, while governance tokens like CRO, BNB, GNO, and OKB convert rebates into protocol equity. Monolith’s MKR focus hedges volatility, Plutus PLU fosters community pivots, and Wirex WXT offers conversion flexibility akin to Starknet’s layer-2 scalability.

Top Crypto Rewards Cards: Governance Token Cashback Rates, Staking & Fees (2026)

| Card Name | Governance Token | Cashback Rate | Staking Requirement | Annual Fee |

|---|---|---|---|---|

| Crypto.com Visa Card | CRO | 1% – 8% | Tiered CRO staking (e.g. $1,000,000 CRO for 8%) | $0 |

| Binance Visa Card | BNB | 3% – 9% | Tiered BNB staking (SOL stake for boosts) | $0 |

| Nexo Card | NEXO | Up to 2% | NEXO holding for voting rights | $0 |

| Wirex Visa Card | WXT | Up to 8% | Tiered rewards program | $0 |

| Plutus Mastercard | PLU | Up to 3% | PLU holding/tiers | $0 |

| Monolith Card | MKR / ETH | Varies (MKR or ETH) | None | $0 |

| Gnosis Pay Card | GNO (STRK/BRRR possible) | Up to 2% | GNO staking | $0 |

| Bitpanda Visa Card | BEST | Up to 2% | BEST staking | $0 |

| OKX Visa Card | OKB | Up to 5% | OKB lockup | $0 |

| HTX Card | HT | Up to 4% | HT holding | $0 |

Strategic Selection: Matching Cards to Your DeFi Profile

Choose based on spend volume and governance appetite. High-stakers favor Crypto. com’s 8% CRO pinnacle; traders lean Binance or OKX for BNB/OKB leverage. Conservative builders pick Nexo or Bitpanda for balanced NEXO/BEST exposure. Amid STRK’s 24-hour range of $0.0474-$0.0502, these cards accumulate stakes efficiently, amplifying votes without front-loading capital. Factor fees: most waive annuals, per CoinGecko, but watch FX spreads on international use.

Maximize via multi-card strategies. Pair Wirex’s high WXT with Gnosis Pay’s GNO for diversified voting across L1s and apps. Stake rewards promptly; Cronos DAO data shows compounded CRO outperforming holds by 15-20% annually. Our guide to maximizing governance token rewards details delegation tools for passive influence. This approach builds resilience, as governance participation correlates with token appreciation in mature protocols.

Regulatory tailwinds bolster 2026 viability. EU MiCA compliance on Bitpanda and Wirex ensures seamless spending, while U. S. users access Crypto. com tiers sans borders. Reddit threads affirm STRK/BRRR integrations, hinting broader adoption. For portfolios eyeing DeFi’s next phase, these crypto rewards cards governance tokens deliver not just cashback, but calibrated control.

Layer in restaking trends: upcoming EigenLayer ties could boost cards like Monolith with EIGEN, but today’s lineup suffices for strategic edges. With STRK at $0.0483, consistent swipes compound into DAO heft, fostering ecosystems where your input shapes yields. This fusion of utility and autonomy positions governance cashback as 2026’s understated powerhouse.