In 2025, the intersection of crypto rewards cards and governance tokens is transforming how DeFi users maximize both daily spending rewards and their influence in decentralized protocols. With governance tokens like Uniswap’s UNI trading at $9.17 as of September 20,2025, the opportunity to earn, stake, and vote through your credit card rewards has never been more compelling. Here’s how to strategically optimize your crypto card usage for governance token rewards this year.

Why Governance Token Rewards Matter in 2025

Governance tokens are not just speculative assets; they’re your ticket to actively shaping the future of DeFi platforms. Holders can propose and vote on upgrades, fee structures, or reward distributions. Cards that offer these tokens as rewards let you participate directly in protocol governance while earning on everyday purchases. This dual benefit is why savvy users are prioritizing crypto rewards cards 2025 that feature governance token payouts.

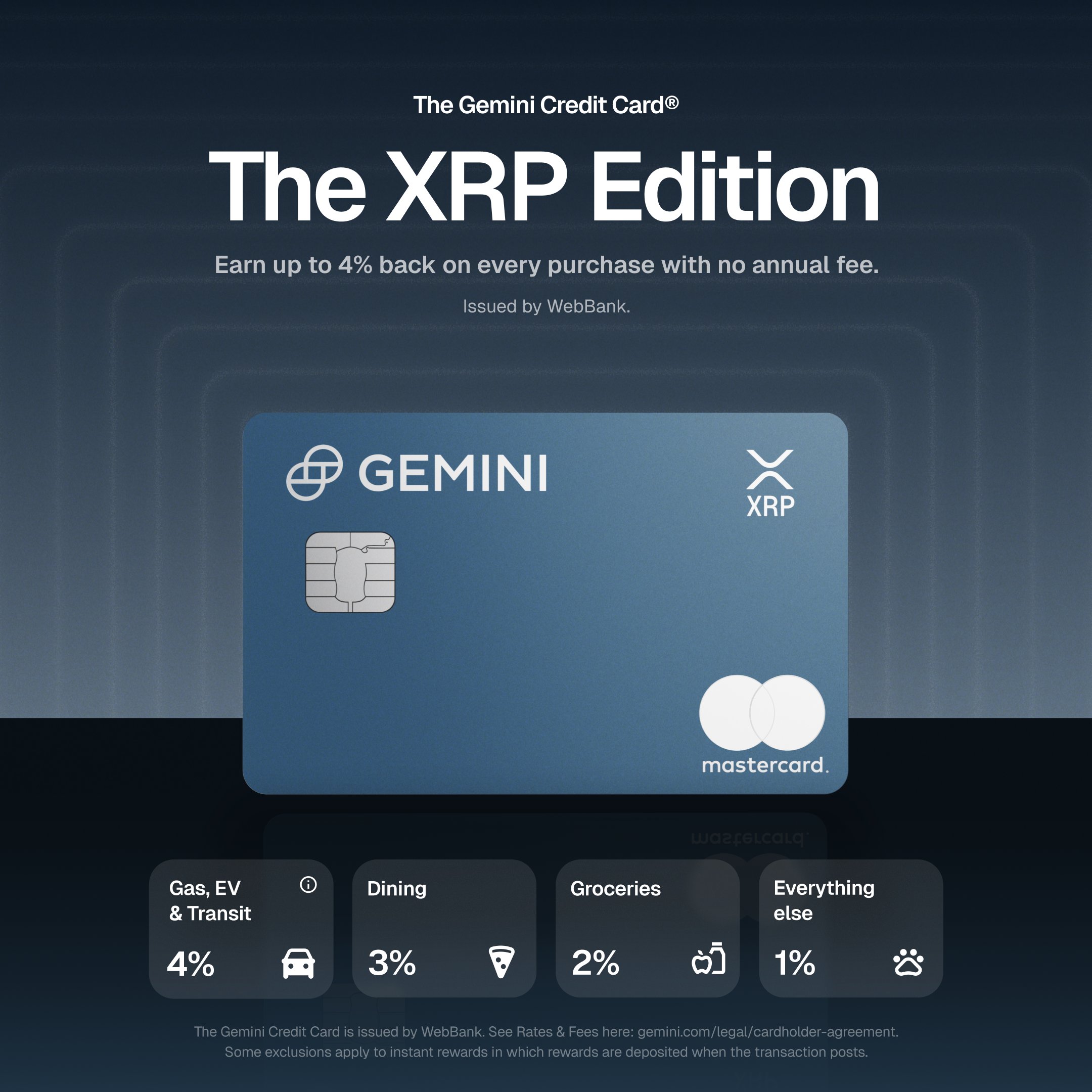

The market is competitive: most cards cap out at 3% back, but the Gemini Credit Card® stands out with up to 4% instant crypto-back on select categories. The Nexo Card, meanwhile, lets users earn NEXO tokens, offering a direct path into protocol voting and yield enhancements.

The 6 Best Crypto Rewards Cards for Maximizing Governance Token Earnings

Top 6 Crypto Rewards Cards for 2025

-

Gemini Credit Card®: Earn up to 4% back in crypto instantly on dining, 3% on groceries, and 2% on all other purchases. Rewards are deposited directly into your Gemini account, with support for over 60 cryptocurrencies. No annual fee and instant reward delivery set this card apart for 2025.

-

Crypto.com Visa Signature Card: Offers up to 5% back in CRO rewards (depending on card tier) and unlocks additional perks like Spotify, Netflix, and airport lounge access. Staking CRO (Crypto.com’s native token) can boost your rewards and governance participation.

-

Coinbase Card: Seamlessly connects to your Coinbase account, letting you spend crypto anywhere Visa is accepted and earn up to 4% back in crypto rewards. Choose from a range of supported tokens, including governance tokens like UNI and AAVE, for flexible rewards.

-

Venmo Credit Card (with crypto rewards option): Earn up to 3% back in crypto on your top spend category, automatically purchasing your choice of Bitcoin, Ethereum, Litecoin, or Bitcoin Cash. Managed directly in the Venmo app for ease and transparency.

-

Nexo Card (with governance token rewards): Spend without selling your crypto and earn up to 2% back in NEXO Tokens or Bitcoin. NEXO Tokens grant governance rights in the Nexo ecosystem, letting you influence platform decisions while earning rewards.

-

Curve Crypto Rewards Card: Consolidate multiple cards into one and earn crypto rewards on every purchase. Curve’s platform supports cashback in Bitcoin and other tokens, and offers integrations with DeFi protocols for enhanced governance participation.

Let’s break down what makes each card a top pick for DeFi-focused users:

- Gemini Credit Card®: Up to 4% instant crypto-back on dining and groceries. Supports a wide range of assets including select governance tokens.

- Crypto. com Visa Signature Card: Flexible staking options let you boost CRO rewards, convertible into various governance tokens or used within the platform’s DeFi suite.

- Coinbase Card: Earn crypto-back on every purchase with seamless conversion to supported governance tokens like UNI and MKR.

- Venmo Credit Card: With its crypto rewards option, users can opt to receive supported coins, including some that function as governance tokens, directly into their Venmo wallets.

- Nexo Card: Unique for its NEXO token earnings; holders can stake these for higher yields or cast votes on ecosystem proposals.

- Curve Crypto Rewards Card: Aggregates multiple cards/accounts while letting you choose which asset (including certain governance tokens) you want as your reward currency.

Tactics to Maximize Your Crypto Cashback Governance Tokens

If your goal is not just passive earning but active participation in decentralized finance, here are proven strategies for maximizing your card-based governance token accruals:

- Select the Right Spending Categories: Focus high-volume purchases on cards like Gemini or Crypto. com where category bonuses apply, this amplifies both your immediate cashback and long-term voting power as you accumulate more tokens.

- Diversify Across Multiple Cards: Use a combination of the six best DeFi credit cards listed above. This spreads risk and gives access to different reward structures, some may offer higher rates in certain categories or unique staking/yield features tied to their native token ecosystems.

- Aggressively Stake Earned Tokens: Platforms such as Nexo allow you to stake earned NEXO for boosted yields or enhanced voting rights. Similarly, convert Coinbase or Curve rewards into UNI ($9.17) or MKR for additional DeFi utility via staking pools or DAO participation.

The Power of Participation: Voting With Your Wallet

Your role doesn’t end with earning; it begins there. By holding and staking governance tokens earned from top-tier cards like Gemini or Nexo, you gain real influence over protocol direction, potentially shaping future reward rates or new features that benefit all users. Active participation also exposes you to bonus incentives offered during major DAO votes or community initiatives.

Uniswap (UNI) Price Prediction 2026-2031

Professional Price Forecast for UNI Based on 2025 Market Context and Governance Token Utility

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $7.80 | $10.20 | $14.50 | +11% | Potential post-2025 market correction and regulatory uncertainty could add volatility, but increased card rewards adoption supports demand. |

| 2027 | $8.60 | $12.80 | $18.90 | +25% | Recovery phase: Broader DeFi adoption, improved reward structures, and new governance features drive use-case expansion. |

| 2028 | $10.40 | $15.00 | $22.50 | +17% | Bullish market cycle expected; UNI benefits from growth in crypto credit card usage and protocol upgrades. |

| 2029 | $12.30 | $17.40 | $25.80 | +16% | Sustained DeFi integration with mainstream finance; competition rises but UNI maintains strong network effects. |

| 2030 | $13.90 | $19.60 | $29.40 | +13% | Stable regulatory environment and maturing DeFi sector; governance utility cements UNI’s position. |

| 2031 | $12.50 | $18.20 | $27.00 | -7% | Potential market correction or saturation; increased competition and possible protocol changes introduce downside risk. |

Price Prediction Summary

Uniswap (UNI) is expected to experience moderate growth through 2030, driven by the increasing integration of governance tokens into crypto card rewards and broader DeFi adoption. While regulatory and competitive pressures may introduce volatility, UNI’s strong protocol utility and active governance community are likely to support price appreciation over the next several years. Investors should expect both bullish and bearish scenarios, especially as market cycles and regulations evolve.

Key Factors Affecting Uniswap Price

- Broader adoption of crypto card rewards programs using governance tokens like UNI.

- Regulatory developments, especially in major markets like the US and EU.

- Technological advancements in DeFi protocols and improved governance participation.

- Growth of competing governance tokens and new DeFi entrants.

- Macro market cycles and risk sentiment towards crypto assets.

- Integration of staking/yield models (e.g., veToken mechanics) boosting token utility.

- Potential for new protocol upgrades or reward mechanisms proposed via governance.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

It’s not just about the numbers on your statement, staking and voting with governance tokens unlocks new layers of value. For example, when you stake NEXO earned through the Nexo Card, you could receive higher yields or even exclusive access to platform upgrades. Similarly, using your Coinbase Card rewards to accumulate UNI at $9.17 lets you participate in Uniswap’s major decisions, directly impacting how liquidity incentives and trading fees are structured.

Smart Stacking: Layering Rewards for Maximum Impact

The most successful DeFi users in 2025 are those who layer their strategies:

- Rotate spending between cards like Gemini and Crypto. com Visa Signature to capture the highest category bonuses each month.

- Convert flexible crypto-back rewards (from Curve or Venmo) into governance tokens with the best upside or staking utility.

- Monitor real-time token prices, such as UNI at $9.17, to time conversions or staking actions for maximum effect.

- Vote in DAOs whenever possible, as many protocols now offer extra rewards for active participants during key governance periods.

Risk Management and Regulatory Awareness

The regulatory landscape remains fluid in late 2025. As the U. S. SEC signals new rules affecting crypto token rewards and DeFi participation, it’s essential to stay compliant. Choose cards like Coinbase or Gemini that have robust compliance frameworks and clear reporting tools for your tax records. Diversifying across multiple cards also buffers against sudden changes in reward structures due to regulation.

If you’re seeking a step-by-step walkthrough on getting started with crypto rewards cards focused on governance tokens, check out our comprehensive guide: Beginner’s Guide to Earning Governance Tokens with Crypto Rewards Cards.

The community is a powerful resource, many top earners regularly share their workflows for stacking card bonuses, optimizing staking schedules, and staying ahead of market shifts. Engage in forums or social channels dedicated to these six cards; often, early insights on new features or reward boosts surface here first.

Which crypto rewards card gave you the best governance token earnings in 2025?

With governance tokens like Uniswap’s UNI trading at $9.17 and DeFi rewards programs evolving fast, we’re curious: Which of the top crypto rewards cards helped you maximize your governance token earnings this year? Share your experience!

The bottom line? The right combination of savvy spending, strategic staking, and active voting can turn everyday purchases into meaningful influence over DeFi’s future direction, and potentially boost your returns far beyond traditional cashback rates. As governance tokens like UNI hold steady at $9.17 and protocols continue evolving, those who maximize their card strategies today will be best positioned to benefit from tomorrow’s decentralized finance landscape.