Crypto rewards cards are revolutionizing how newcomers interact with decentralized finance (DeFi), making it possible to earn governance tokens just by swiping for coffee or groceries. If you’re searching for a beginner guide to governance tokens and want to maximize your rewards with minimal friction, you’re in the right place. Let’s break down what governance tokens are, how they work, and why earning them via crypto rewards cards is one of the smartest moves in today’s market.

What Are Governance Tokens and Why Should Beginners Care?

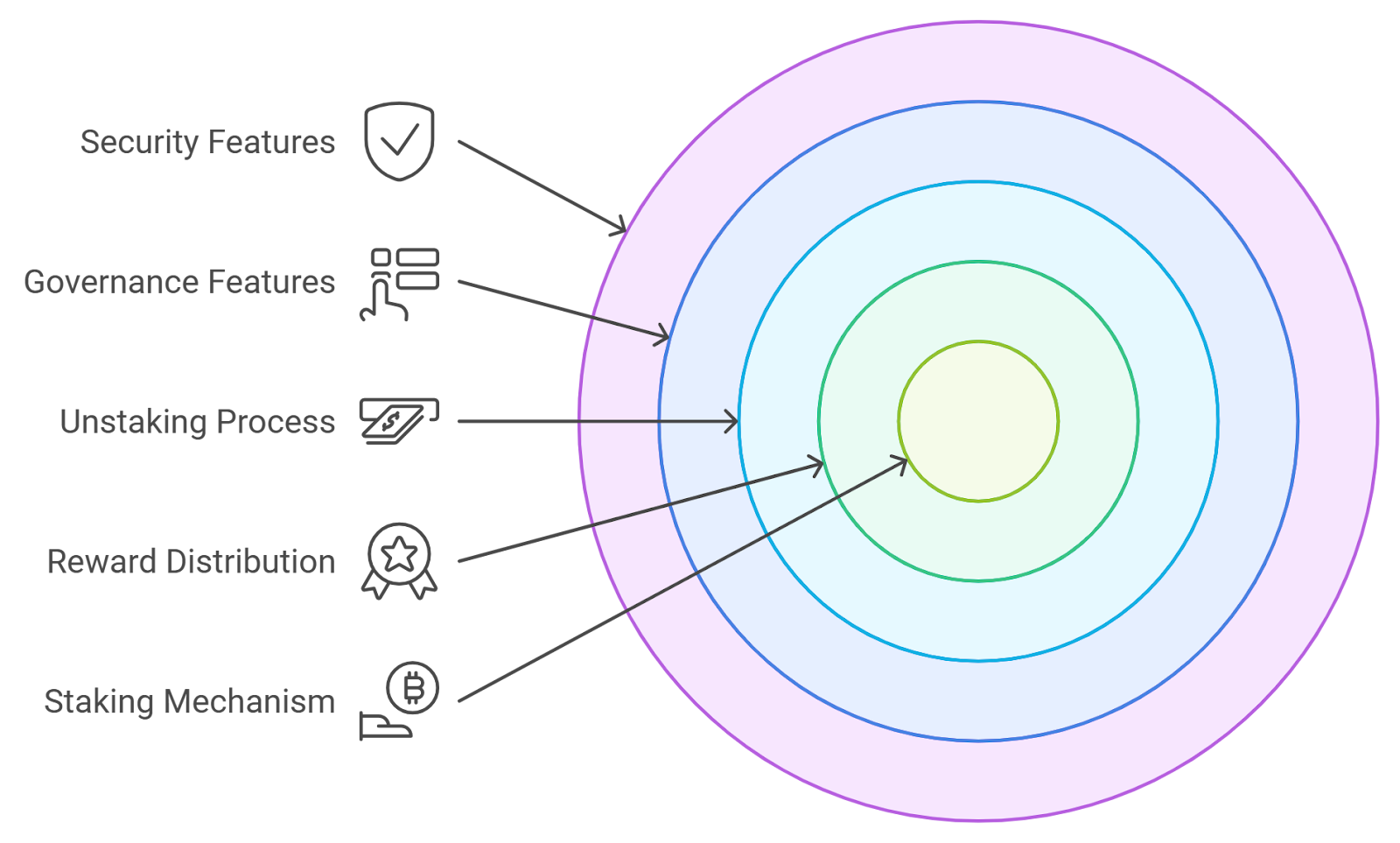

Governance tokens are digital assets that give holders voting power over blockchain protocols. Unlike traditional loyalty points or cashback, these tokens let you steer the future of DeFi projects by voting on upgrades, fees, or even protocol direction. For example, holding UNI lets you vote on Uniswap proposals; holding COMP gives you a say in Compound’s treasury allocations. According to Coinbase, governance token holders participate directly in decision-making, making these assets more than just speculative tools, they’re tickets to real influence.

How Crypto Rewards Cards Put Governance Tokens in Your Pocket

The new wave of crypto rewards cards for beginners gives users direct access to tokenized governance simply by spending. These cards function like standard debit or credit cards but reward your purchases with cryptocurrencies, sometimes including top governance tokens like UNI, AAVE, or MKR. Instead of earning bland airline miles, you accumulate assets that can be staked, used for liquidity mining, or voted with on protocol proposals.

This is a major upgrade over traditional rewards mechanisms:

Key Differences: Traditional vs. Crypto Card Governance Rewards

-

Reward Type: Traditional credit cards offer cash back, airline miles, or points redeemable for goods and services. Crypto rewards cards can issue governance tokens (e.g., Uniswap’s UNI, Compound’s COMP), granting holders voting rights in DeFi protocols.

-

Utility of Rewards: Traditional rewards are primarily for personal consumption (travel, merchandise, statement credits). Governance tokens enable active participation in protocol decisions—such as voting on upgrades or fee changes—directly influencing blockchain projects.

-

Value Volatility: Traditional rewards have fixed or predictable value. Governance tokens are subject to crypto market volatility, with values fluctuating based on market demand and protocol performance.

-

Potential Earnings: Traditional rewards rarely appreciate in value. Governance tokens may offer additional yield through staking, liquidity mining, or airdrops, potentially increasing overall returns beyond the initial reward.

-

Regulatory Landscape: Traditional credit card rewards are well-regulated and standardized. Governance token rewards operate in a rapidly evolving regulatory environment, with compliance requirements varying by jurisdiction.

-

Participation Requirement: Traditional rewards require no further action after earning. Governance tokens demand user engagement—holders must participate in voting or staking to unlock full benefits.

The best part? You don’t need deep technical knowledge or large capital outlays. Just use your card as usual and watch your wallet fill up with tokens that give you real voice in DeFi communities.

Step-by-Step: Start Earning Governance Tokens with Crypto Cards

1. Research Available Crypto Rewards Cards: Not all cards offer governance tokens; some stick to Bitcoin or stablecoins. Prioritize those that pay out UNI, COMP, MKR, AAVE or similar assets linked directly to active protocols.

2. Compare Protocols and Token Utility: Each token comes with its own set of rights and potential yield opportunities, staking APYs vary widely between projects.

3. Apply and Integrate: Get approved for your chosen card and link it with your preferred crypto wallet.

4. Spend and Accumulate: Use the card daily; track your growing stash of governance tokens via the issuer’s dashboard.

5. Participate in DeFi Governance: Once earned, use these tokens to vote on proposals, often directly from your wallet interface.

If you want more details about how these systems work under the hood, and why earning through spending beats passive holding, check out this primer from Coinbase.

Navigating Risks and Maximizing Rewards

Earning governance tokens through spending isn’t risk-free. Token values can swing wildly; regulatory changes may impact availability; security is always paramount. But if you combine smart research with robust security practices (hardware wallets are non-negotiable), you’ll be positioned not just as an investor but as an active participant in shaping tomorrow’s financial rails.