The intersection of crypto rewards cards and governance token rewards is redefining how investors and enthusiasts engage with digital assets in 2024. As the DeFi landscape matures, maximizing crypto card rewards with a focus on governance tokens is no longer just about accumulating points or cashback – it’s about gaining real influence, yield, and autonomy in decentralized ecosystems. With Uniswap’s UNI trading at $9.10 as of September 21,2025, and leading platforms like Aave and MakerDAO expanding user participation, the potential for everyday spenders to become protocol stakeholders has never been more accessible.

Unlocking the Power of Governance Token Rewards

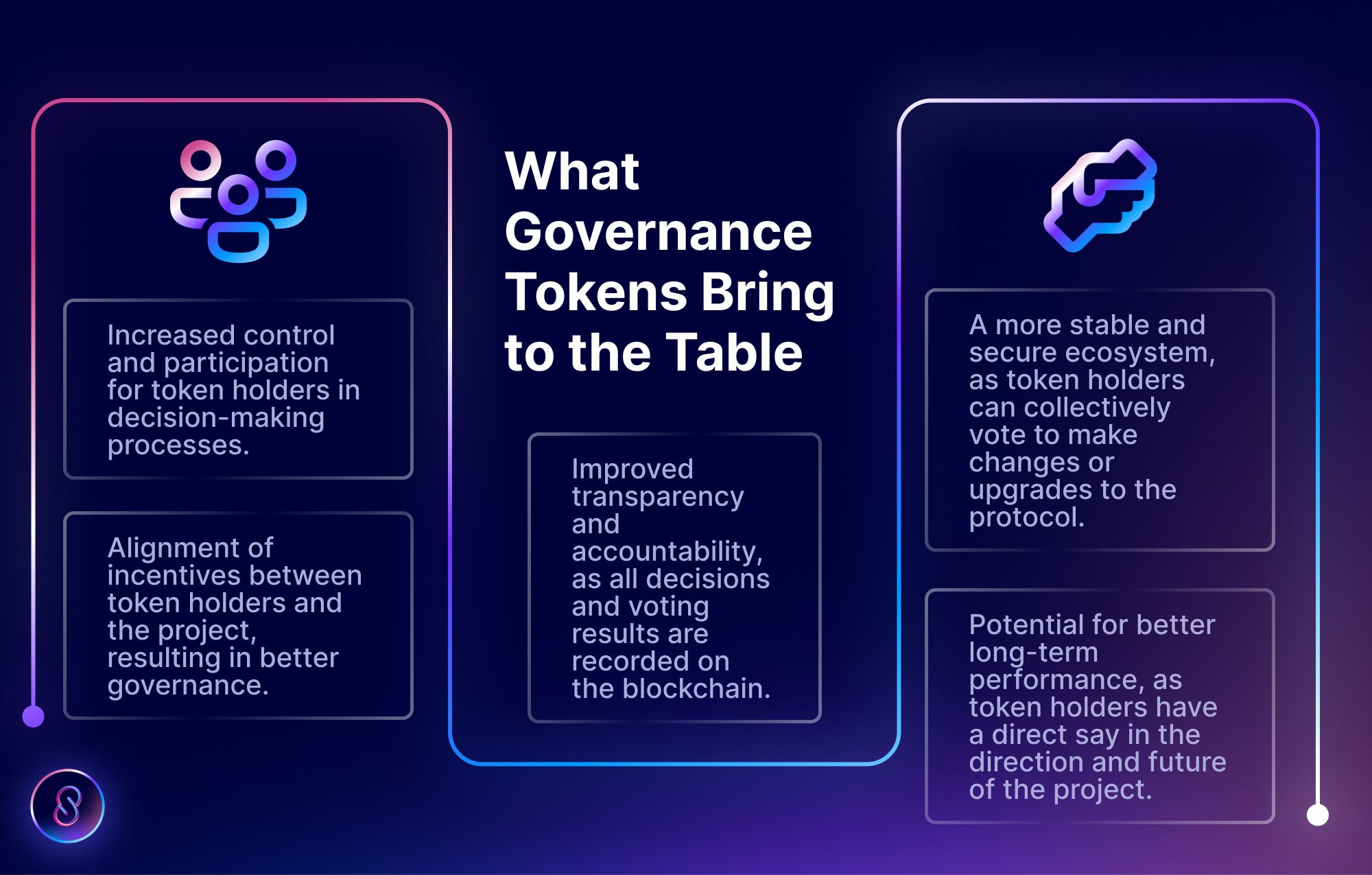

Governance tokens like UNI, AAVE, and MKR empower holders to vote on crucial protocol decisions – from fee structures to treasury management. When these tokens are earned as rewards through crypto cards, users gain both financial upside and a direct voice in decentralized governance. But how can you truly maximize these opportunities? Below we break down five actionable strategies tailored for 2024’s evolving crypto card landscape.

Top Strategies to Maximize Crypto Card Rewards with Governance Tokens

-

Choose Crypto Cards Offering Direct Governance Token Rewards: Select reputable crypto cards—such as the Gemini Credit Card or Crypto.com Visa Card—that allow you to earn rewards in governance tokens like Uniswap (UNI), Aave (AAVE), or MakerDAO (MKR). This direct approach lets you accumulate tokens with real protocol influence as you spend.

-

Prioritize High-Reward Categories and Optimize Spend: Maximize your earnings by focusing spending on card categories with the highest crypto rewards. For example, the Gemini Credit Card offers up to 4% back on dining, paid instantly in crypto. Align your everyday purchases to these categories and monitor rotating offers for boosted governance token rewards.

-

Stake Earned Governance Tokens for Additional Yield and Voting Power: Platforms like Uniswap and Aave enable you to stake your earned tokens, generating passive income and amplifying your influence in protocol decisions. For instance, staking UNI at its current price of $9.10 (as of September 21, 2025) can unlock further yield and governance rights.

-

Actively Participate in Governance Proposals to Influence Protocol Rewards: Use your governance tokens to vote on proposals within DeFi protocols. Many platforms, such as MakerDAO, incentivize active participation with additional rewards or enhanced staking yields, empowering you to shape the future of decentralized finance while boosting your returns.

-

Monitor Tokenomics and Switch Cards as Reward Structures Evolve: Stay vigilant about changes in card reward programs and protocol tokenomics. Regularly compare offerings from major cards like Coinbase Card and Crypto.com Visa Card to ensure you’re earning the most valuable governance tokens, and be ready to switch as new opportunities arise.

- Choose Crypto Cards Offering Direct Governance Token Rewards

- Prioritize High-Reward Categories and Optimize Spend

- Stake Earned Governance Tokens for Additional Yield and Voting Power

- Actively Participate in Governance Proposals to Influence Protocol Rewards

- Monitor Tokenomics and Switch Cards as Reward Structures Evolve

1. Choose Crypto Cards Offering Direct Governance Token Rewards

The first step is selecting a card that pays out rewards in governance tokens rather than generic cryptocurrencies or fiat equivalents. Options like the Crypto. com Visa Signature Card or Gemini Credit Card® may allow users to earn UNI or AAVE directly on purchases. This direct accrual streamlines your path from spender to stakeholder.

To compare top choices side by side, look for up-to-date reviews focusing on which cards offer governance token rewards versus those limited to Bitcoin or stablecoins. Remember that reward rates can fluctuate – for example, some cards currently offer up to 4% back in crypto on select categories (Source: Milk Road), but not all support governance tokens specifically.

2. Prioritize High-Reward Categories and Optimize Spend

Once you’ve chosen a card offering governance token rewards, maximize your earnings by aligning your spending with high-reward categories. Many crypto cards provide enhanced rates for specific types of purchases such as dining, travel, or groceries. For instance:

- If your card offers 3% back in UNI for dining but only 1% elsewhere, channel your restaurant expenses through that card.

- If you have multiple cards with different category bonuses (e. g. , one excels at travel while another at online shopping), coordinate usage based on where each delivers the highest governance token yield.

This approach requires regular review of your spending habits alongside current reward structures – especially since leading cards frequently update their terms based on market dynamics.

The Next Level: Staking Earned Tokens and Active Governance Participation

Earning governance tokens through spending is just the beginning. The true value emerges when you leverage these assets within their native protocols:

- Stake Earned Governance Tokens for Additional Yield and Voting Power: Most DeFi platforms allow you to stake tokens like UNI directly from your wallet after earning them via your crypto rewards card. This not only generates passive income through staking yields but also amplifies your voting influence within the protocol.

- Actively Participate in Governance Proposals to Influence Protocol Rewards: Many protocols incentivize active voters with bonus distributions or enhanced staking returns. By participating in key votes or discussions using your staked tokens, you can shape future reward structures while potentially earning extra incentives.

This dual strategy transforms everyday purchases into compounding benefits – both financial (via yield) and participatory (via decentralized decision-making).

Uniswap (UNI) Price Prediction 2026-2031

Professional Forecast Based on 2025 Market Conditions, DeFi Adoption, and Governance Token Integration

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $7.80 | $10.20 | $13.50 | +12% | Continued DeFi adoption; minor regulatory headwinds; strong governance participation |

| 2027 | $8.10 | $11.30 | $15.80 | +10.8% | Increased integration with crypto cards; more staking incentives; moderate competition |

| 2028 | $7.60 | $12.40 | $17.90 | +9.7% | Market correction phase; regulatory clarity improves; UNI use cases expand |

| 2029 | $9.00 | $14.10 | $21.20 | +13.7% | Bullish cycle; DeFi mainstreams; governance tokens see premium demand |

| 2030 | $10.50 | $16.80 | $25.00 | +19.1% | Major DeFi protocols consolidate; UNI entrenched as leading governance token |

| 2031 | $9.90 | $18.50 | $28.30 | +10.1% | Mature DeFi ecosystem; regulatory acceptance; competition from new governance models |

Price Prediction Summary

Uniswap (UNI) is projected to see steady growth from 2026-2031, with average prices rising from $10.20 in 2026 to $18.50 by 2031. The integration of governance tokens with crypto card rewards and continued DeFi innovation are expected to drive demand. However, volatility remains due to regulatory and competitive pressures, with min-max ranges reflecting both bullish and bearish scenarios each year.

Key Factors Affecting Uniswap Price

- DeFi adoption rates and mainstream usage of governance tokens like UNI

- Expansion and innovation in crypto card rewards programs offering UNI

- Evolution of staking and vote-escrowed (veToken) models increasing token lock-up and reducing circulating supply

- Global regulatory developments impacting DeFi and crypto rewards

- Competition from other DeFi protocols and governance tokens (AAVE, MKR, etc.)

- Overall crypto market cycles and macroeconomic trends

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Strategically staking your governance tokens not only unlocks protocol yields but also positions you as an active participant in the evolving landscape of decentralized governance. As more protocols experiment with vote-escrowed models and dynamic reward pools, stakers who lock in their tokens for longer durations often receive enhanced yield multipliers and greater voting rights. This can be especially impactful for users holding UNI at its current price of $9.10, as vote weight and yield scales with both token quantity and lockup period.

4. Monitor Tokenomics and Switch Cards as Reward Structures Evolve

The crypto rewards card market is highly dynamic, with issuers frequently adjusting reward rates, supported tokens, and staking requirements. To stay ahead, regularly assess the health of each protocol’s tokenomics, this includes inflation schedules, emission rates, fee distribution mechanisms, and community engagement. If a card’s governance token reward becomes less attractive due to declining yields or unfavorable changes in protocol economics, don’t hesitate to pivot.

Switching cards or diversifying your portfolio across multiple issuers can help you capture evolving opportunities while minimizing exposure to underperforming programs. For example, if one provider reduces UNI rewards or shifts focus away from governance tokens, explore alternatives that maintain strong alignment with DeFi participation and offer robust governance incentives.

5. Actively Participate in Governance Proposals to Influence Protocol Rewards

Governance tokens are more than just passive assets, they grant you a seat at the table where critical decisions are made. By voting on proposals or even submitting your own, you can help shape everything from future reward rates to protocol upgrades and treasury allocations. Many protocols now incentivize active voters by distributing bonus tokens or offering higher staking yields for those who consistently participate in governance events.

This participatory approach not only increases your potential returns but also strengthens the overall ecosystem by fostering engaged communities. Your voice can directly impact whether a protocol continues to offer competitive rewards through crypto cards, making decentralized governance a powerful tool for both personal gain and collective progress.

Checklist: 5 Strategies to Maximize Crypto Card Rewards with Governance Tokens

-

Choose Crypto Cards Offering Direct Governance Token Rewards: Select reputable crypto cards—such as the Gemini Credit Card® or Crypto.com Visa Card—that let you earn governance tokens (e.g., Uniswap’s UNI, Aave’s AAVE) as rewards for everyday spending.

-

Prioritize High-Reward Categories and Optimize Spend: Maximize your earnings by focusing spending on categories with the highest crypto cashback rates (up to 4% back on select cards like Gemini), and ensure your purchases align with the card’s bonus categories.

-

Actively Participate in Governance Proposals to Influence Protocol Rewards: Use your governance tokens to vote on key proposals within protocols such as Uniswap or MakerDAO, potentially earning extra incentives and shaping future reward structures.

-

Monitor Tokenomics and Switch Cards as Reward Structures Evolve: Regularly assess the reward rates, tokenomics, and security of both your crypto cards and the underlying protocols. Stay agile by switching to cards or platforms that offer superior governance token rewards as the market changes.

Empowering Yourself in Decentralized Finance

By applying these five strategies, choosing direct governance token rewards, optimizing spend categories, staking earned tokens, engaging in active governance, and continuously monitoring tokenomics, you put yourself at the forefront of financial innovation in 2024. The synergy between crypto rewards cards and governance token rewards is enabling everyday users to earn real yield while shaping the direction of DeFi itself.

If you’re new to this space or want a deeper dive into optimizing your setup from scratch, our Beginner’s Guide to Earning Governance Tokens with Crypto Rewards Cards offers step-by-step instructions tailored for all experience levels.

The future belongs to those who actively participate, both as investors and as contributors, in decentralized ecosystems. As protocols evolve and new card offerings emerge, staying informed will be key to maximizing your influence and financial autonomy through crypto card strategies centered on governance tokens.