Decentralized Finance (DeFi) has evolved beyond simple yield farming and staking. Today, the most forward-thinking crypto users are leveraging crypto rewards cards that distribute governance tokens, transforming everyday spending into real influence over top DeFi protocols. This shift empowers users to not only earn passive income but also actively participate in shaping decentralized platforms. If you are looking to maximize your DeFi governance participation, understanding and implementing the right strategies with these cards is essential.

Choose Crypto Rewards Cards That Offer Direct Governance Token Payouts

The landscape of crypto rewards cards is expanding rapidly, but not all cards are created equal for those seeking meaningful DeFi participation. Many cards offer generic cashback in stablecoins or popular cryptocurrencies like Bitcoin or Ethereum. While these options have their place, they don’t translate directly into voting power within DeFi ecosystems.

Instead, focus on selecting cards that reward you with governance tokens from leading protocols such as UNI (Uniswap), AAVE (Aave), or COMP (Compound). These tokens grant holders the ability to propose and vote on protocol changes, aligning your financial incentives with the growth and development of the platforms themselves. For example, earning UNI through your card means every transaction increases your stake in Uniswap’s future direction.

Top Strategies to Maximize DeFi Governance with Rewards Cards

-

Choose Crypto Rewards Cards That Offer Direct Governance Token Payouts: Opt for cards that reward users with governance tokens from leading DeFi protocols, such as Uniswap (UNI), Aave (AAVE), and Compound (COMP), instead of generic crypto or cashback. This approach ensures your everyday spending directly increases your voting power and influence in major DeFi projects.

-

Stake Earned Governance Tokens for Compounded Rewards and Voting Rights: After collecting governance tokens via your rewards card, stake them on established DeFi platforms like Aave and Compound. Staking not only allows you to earn additional yield but also unlocks the ability to participate in protocol governance, maximizing both your passive income and decision-making influence.

-

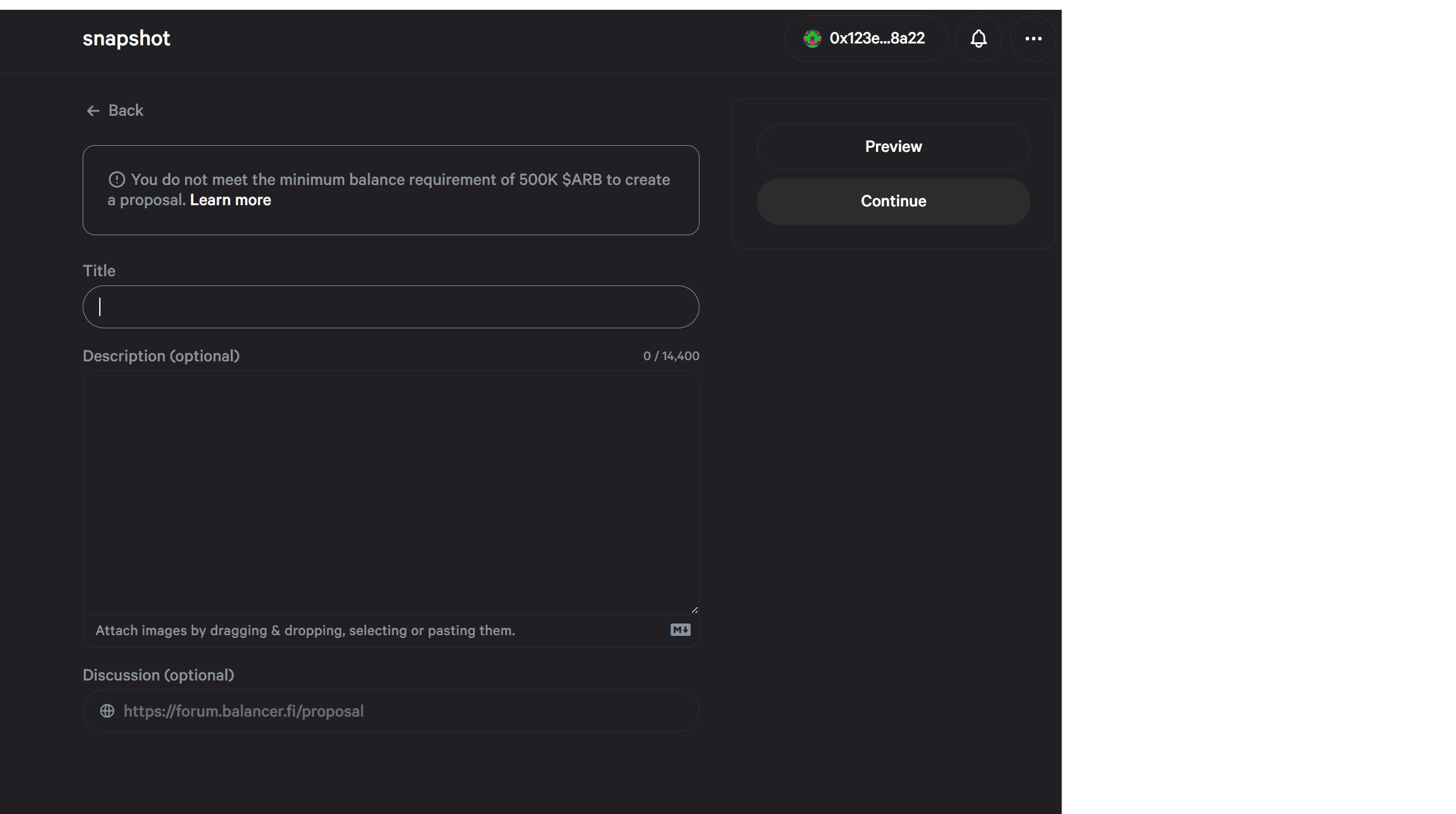

Actively Participate in Governance Proposals Using Card-Earned Tokens: Stay engaged with governance forums and proposal platforms such as Snapshot and Tally for the protocols whose tokens you’ve accumulated. Use your rewards to vote on key issues like upgrades, fee structures, and new features, ensuring your participation has a tangible impact on the direction of DeFi projects.

The direct payout of governance tokens ensures that your spending doesn’t just accumulate value passively; it actively increases your voting power and influence in DeFi projects. This is an important distinction for anyone serious about decentralized decision-making and protocol evolution.

Stake Earned Governance Tokens for Compounded Rewards and Voting Rights

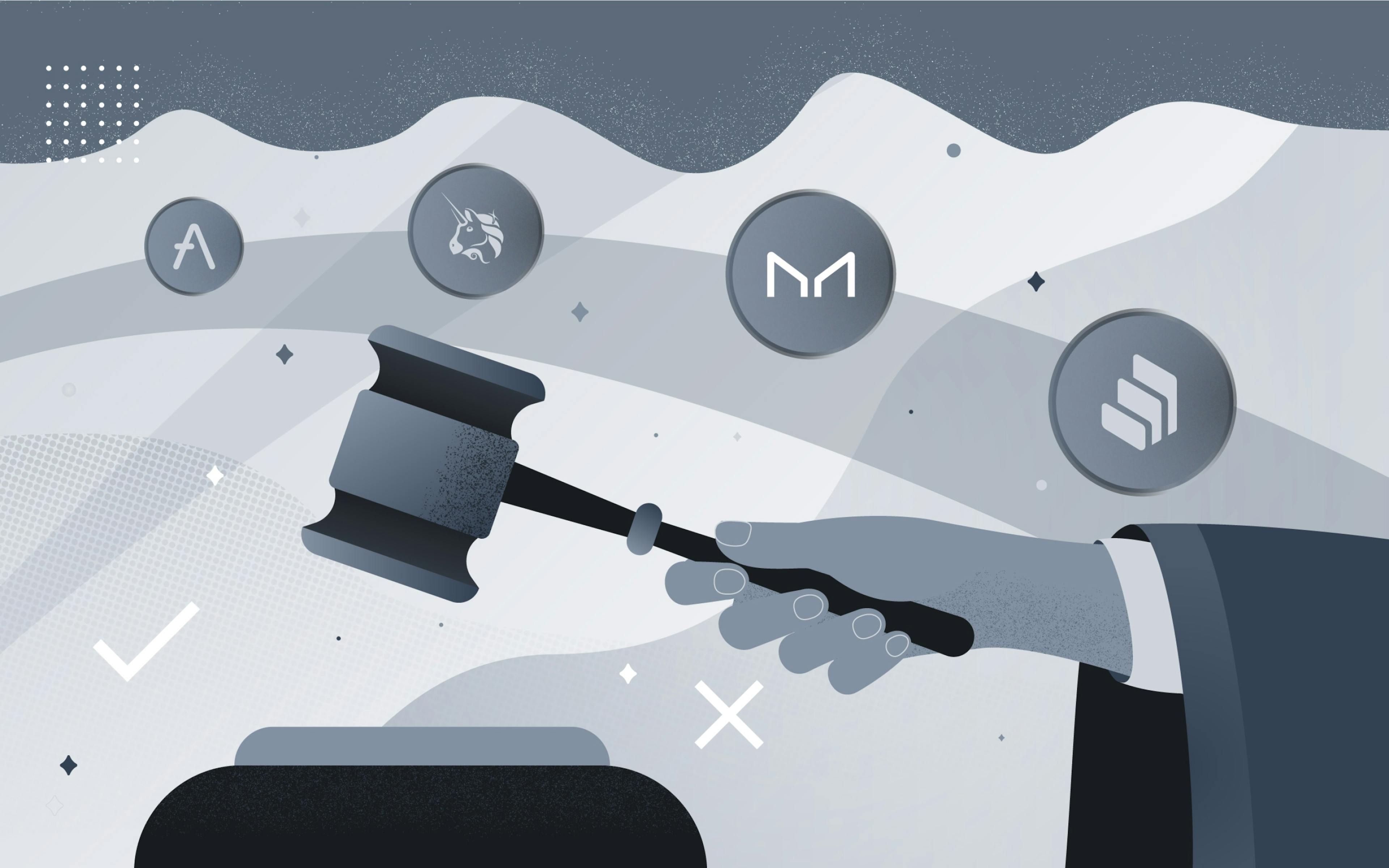

Earning governance tokens is only the beginning. To truly maximize their impact, consider staking these tokens on supported DeFi platforms. Staking serves two critical purposes:

- Compounded Rewards: Platforms like Aave and Compound offer interest or yield when you stake their native tokens. This means your card-earned UNI, AAVE, or COMP can generate additional income simply by being locked into a protocol.

- Unlocking Voting Privileges: Most DeFi projects require tokens to be staked in order to participate in official governance votes. Staking ensures long-term commitment to the ecosystem while providing direct access to decision-making processes.

This approach mirrors best practices across both traditional finance and modern DeFi: reinvest your earnings for compounding growth while maintaining an active role in oversight and strategic direction.

Actively Participate in Governance Proposals Using Card-Earned Tokens

The final step – but arguably the most impactful – is to put your accumulated voting power to work. With steady accrual of governance tokens from card rewards and additional staking yields, you’re now positioned as an engaged participant rather than a passive holder.

Regularly monitor relevant governance forums, such as Snapshot or Tally, which serve as hubs for proposals related to upgrades, fee structures, new features, or treasury allocations within leading protocols. Use your earned tokens to vote on these matters; even small holders can sway outcomes when voter turnout is low – a common challenge in many DAOs today (source). Not only do you help steer platform evolution, but some protocols also reward active voters with further incentives or bonus distributions for high engagement rates.

Strategies to Maximize DeFi Governance Participation

-

Choose Crypto Rewards Cards That Offer Direct Governance Token Payouts: Select rewards cards that distribute governance tokens from leading DeFi protocols such as Uniswap (UNI), Aave (AAVE), or Compound (COMP) instead of generic crypto or cashback. This approach ensures your everyday spending directly increases your voting power and influence in DeFi governance.

-

Stake Earned Governance Tokens for Compounded Rewards and Voting Rights: After accumulating governance tokens via your rewards card, stake them on supported DeFi platforms like Aave or Compound. Staking not only accrues additional yield but also unlocks voting privileges, allowing you to participate in protocol decisions while maximizing returns.

-

Actively Participate in Governance Proposals Using Card-Earned Tokens: Regularly monitor governance forums and proposal platforms such as Snapshot or Tally for the projects whose tokens you’ve earned. Cast your votes on protocol upgrades, fee structures, and new features to maximize the utility and impact of your rewards.

Staying proactive is crucial. Set reminders to check governance platforms at regular intervals, subscribe to protocol updates, or join community channels where proposals are discussed in real time. This ensures you never miss a significant vote or incentive opportunity. Remember, active participation is not just about casting a single vote; it’s about building a track record of engagement that can unlock additional rewards and recognition within the DeFi ecosystem.

Some leading protocols, like Uniswap, have started offering tangible incentives for delegates and voters who maintain high participation rates, sometimes as much as $6,000 monthly in UNI for those who consistently contribute (source). This trend signals a broader movement toward rewarding not just token holding but meaningful governance activity. By leveraging your crypto rewards card to accumulate and stake governance tokens, you position yourself to benefit from these evolving incentive structures.

Strategies to Maximize DeFi Governance with Rewards Cards

-

Choose Crypto Rewards Cards That Offer Direct Governance Token Payouts: Select cards that reward users with governance tokens from leading DeFi protocols (e.g., UNI, AAVE, COMP) rather than generic crypto or cashback. This ensures your card spending directly increases your voting power and influence in DeFi projects. For example, some crypto rewards cards now partner with platforms like Uniswap or Aave to distribute their native governance tokens as rewards.

-

Stake Earned Governance Tokens for Compounded Rewards and Voting Rights: After accumulating governance tokens via rewards cards, stake them on supported DeFi platforms to earn additional yield and unlock voting privileges. Platforms like Aave and Compound allow staked tokens to accrue interest while enabling participation in protocol governance. This strategy not only grows your holdings but also strengthens your voice in key decisions.

-

Actively Participate in Governance Proposals Using Card-Earned Tokens: Regularly monitor governance forums and proposal platforms (such as Snapshot or Tally) for the protocols whose tokens you’ve earned. Use your accumulated tokens to vote on upgrades, fee structures, and new features, maximizing the utility and impact of your rewards. Active participation can also qualify you for additional incentives on some platforms, like Uniswap’s delegate rewards.

Integrating Card Strategies Into Your DeFi Routine

To maximize DeFi governance participation using crypto rewards cards, consistency and discipline are paramount. Here’s how you can integrate these strategies into your financial routine for optimal results:

- Automate Token Transfers: Set up automatic transfers from your card’s wallet to your preferred staking platforms so earned governance tokens don’t sit idle.

- Schedule Governance Reviews: Block out time weekly or biweekly to review new proposals on Snapshot or Tally and assess which initiatives align with your interests and values.

- Document Your Participation: Keep a log of votes cast and outcomes influenced. Over time, this record can help you refine your approach and demonstrate your impact within the community, potentially qualifying you for delegate roles or special recognition.

The synergy between disciplined spending, strategic staking, and active proposal engagement transforms crypto rewards cards from mere cashback tools into vehicles for decentralized influence. As more platforms experiment with innovative incentive models, addressing low voter turnout by offering bonus distributions or exclusive access, the value proposition for active participants only grows stronger.

Why This Matters Now

The evolution of crypto rewards cards parallels the maturation of DeFi itself: both are moving toward deeper user empowerment and shared ownership. By focusing on cards that pay out direct governance tokens, diligently staking those assets, and engaging in protocol governance, you’re not just optimizing yield, you’re shaping the future of decentralized finance itself.

If you’re serious about maximizing DeFi governance participation while earning on everyday spending, these strategies offer a clear path forward, one where financial autonomy meets real-world impact.