Crypto rewards cards are evolving rapidly, and in 2025, the most sophisticated users are zeroing in on governance tokens as the next frontier for compounding both yields and influence in the DeFi ecosystem. Unlike generic cashback or travel rewards, governance token payouts offer a unique combination: direct protocol ownership, voting rights, and the potential for exponential compounding through staking and yield strategies. For power users, the difference between passive participation and disciplined optimization can mean the difference between modest returns and true protocol influence. Below, we break down three advanced strategies that are reshaping how seasoned DeFi participants maximize their crypto card earnings with governance tokens.

1. Prioritize Crypto Cards Offering Direct Governance Token Rewards and Automated Staking

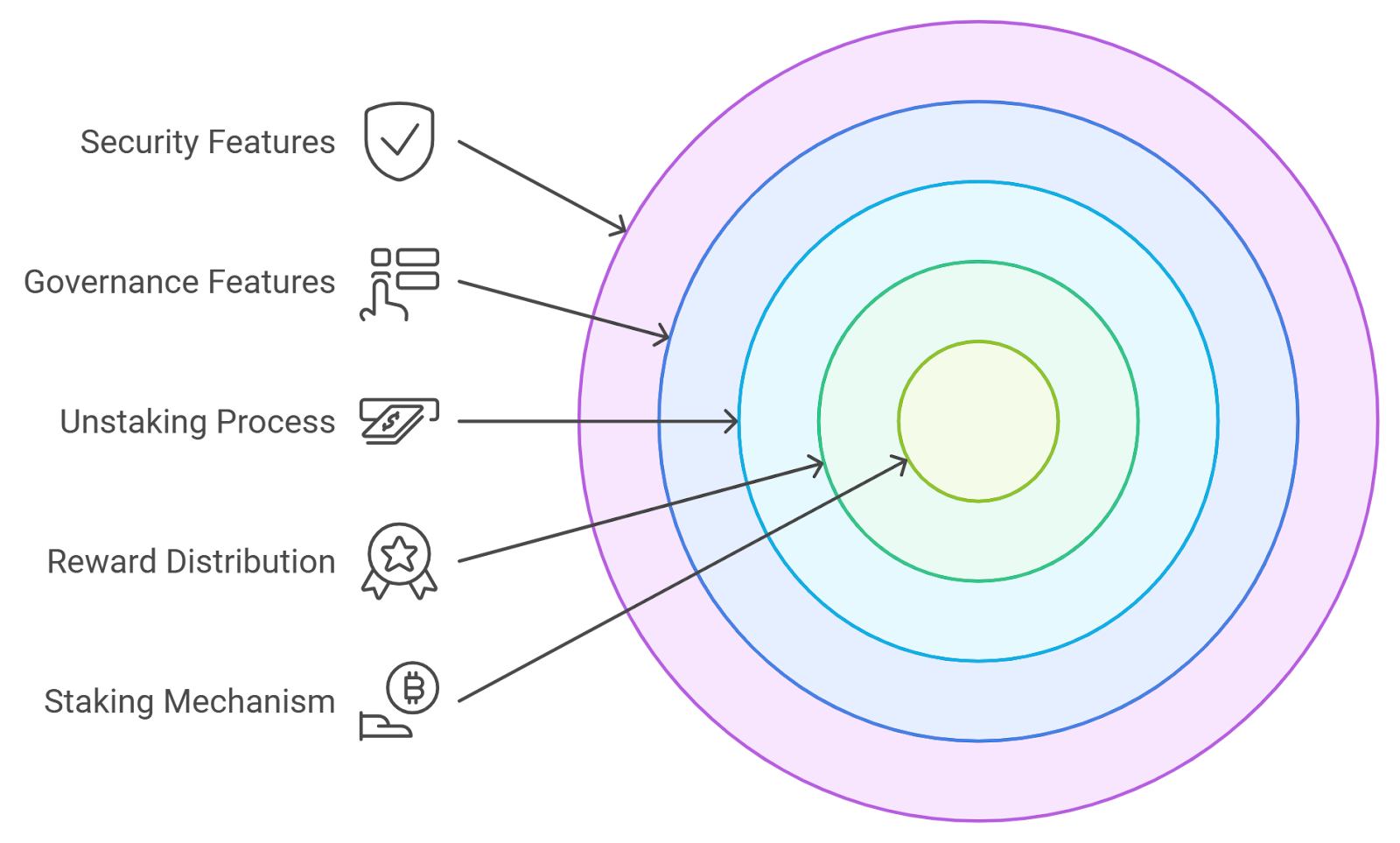

Not all crypto rewards cards are created equal. If your goal is to maximize both your financial returns and your influence over DeFi protocols, you must prioritize cards that pay out governance tokens directly (such as AAVE, UNI, or COMP) rather than generic stablecoins or platform-native points. The most competitive cards in 2025 now offer automated staking features: your earned tokens are staked on-chain immediately, compounding your rewards without manual intervention. This automation not only saves time but also ensures you capture every possible yield cycle and voting window.

Top Strategies to Maximize Crypto Card Governance Rewards

-

Prioritize Crypto Cards Offering Direct Governance Token Rewards and Automated Staking: Select cards from leading platforms such as Crypto.com Visa Card (CRO), Nexo Card (NEXO), and Binance Card (BNB) that provide rewards directly in governance tokens. Look for features like auto-stake or auto-compound, which automatically stake your earned tokens to maximize yield and governance power without manual intervention.

-

Leverage Tiered Rewards Structures by Increasing On-Chain Activity and Card Usage: Many crypto cards, including Nexo Card and Crypto.com Visa Card, offer tiered reward systems. By increasing your on-chain activity (such as staking more tokens or using the card for larger transactions), you unlock higher reward rates and exclusive governance privileges. Regularly review your eligibility for higher tiers to optimize your earning potential.

-

Reinvest Earned Governance Tokens into Protocol Staking or Yield Farming for Compounding Influence: After receiving governance token rewards, immediately stake them within their respective protocols (e.g., stake CRO on Cronos, NEXO on Nexo, or BNB on Binance). This not only compounds your potential returns but also increases your voting power, enabling greater influence over protocol decisions and access to additional incentive programs.

When evaluating cards, look for those with transparent smart contract integrations and a proven track record of on-chain distribution. Some platforms even provide real-time dashboards to monitor your staked balances and voting power. Choosing the right card is the foundation of a disciplined crypto rewards strategy. For a detailed breakdown of top options, see our comprehensive comparison of governance token rewards cards.

2. Leverage Tiered Rewards Structures by Increasing On-Chain Activity and Card Usage

Many governance token rewards cards now offer tiered rewards systems: the more you spend, stake, or interact with the platform, the higher your rewards rate and governance power. These tiers often unlock:

- Higher APYs on staked governance tokens

- Access to exclusive governance proposals or VIP voting rounds

- Priority protocol fee rebates and airdrops

To ascend tiers efficiently, focus on consolidating your spending and DeFi activity through a single ecosystem when possible. This not only accelerates tier progression but also amplifies your voting clout within the protocol. For users with significant transaction volume or DeFi engagement, the compounding benefits of higher tiers can be substantial, especially as protocols reward active participation with bonus tokens or multipliers.

If you’re looking for actionable guidance on optimizing on-chain activity for governance token accrual, our strategy guide for DeFi participants offers step-by-step tactics.

3. Reinvest Earned Governance Tokens into Protocol Staking or Yield Farming for Compounding Influence

Simply earning governance tokens isn’t enough, power users reinvest these assets through strategic staking and yield farming to create a virtuous cycle of compounding returns and influence. By restaking your rewards, you:

- Increase your share of future protocol rewards distributions

- Boost your voting weight in governance proposals

- Qualify for additional loyalty bonuses or protocol incentives

Some advanced users even deploy earned tokens into liquidity pools or lending protocols that pay additional yield in governance tokens, multiplying both their financial and governance returns. The key is disciplined reinvestment, automating this process where possible to avoid missed compounding cycles. For more details on optimizing compounding strategies, check out our deep dive into 2025’s best practices.

To truly maximize your crypto rewards card strategies, it’s critical to approach governance token accumulation with a mindset rooted in compounding and protocol engagement. The most successful power users treat every earned governance token as a building block for both future yield and lasting influence. Below, we explore how disciplined compounding transforms sporadic rewards into a growing on-chain presence that pays dividends well beyond the initial payout.

Automate Reinvestment for Uninterrupted Compounding

Manual reinvestment is a bottleneck for most users. If you want to outpace the average cardholder, leverage platforms that support automated reinvestment of governance token rewards. This can mean setting up smart contract triggers that immediately restake your earnings or using card-linked DeFi interfaces that auto-route rewards into high-yield staking pools. The result is a seamless compounding engine that scales your protocol influence and reward stream without requiring constant oversight.

Protocols that integrate auto-compounding features often provide detailed analytics, letting you project your future governance power and potential yield based on your current reinvestment rate. This data-driven approach is essential for adjusting your strategy as market conditions or protocol incentives evolve. For a hands-on walkthrough, refer to our step-by-step guide for DeFi enthusiasts.

Case Study: Compounding Governance Influence in Action

Consider a user who earns $500 worth of governance tokens monthly through a top-tier crypto card. By immediately restaking these rewards, they not only earn additional token yield but also see their voting power snowball over time. As their staked balance increases, so does their eligibility for exclusive governance proposals, protocol airdrops, and higher APY tiers. This feedback loop is the essence of disciplined DeFi participation.

It’s worth noting that the compounding effect isn’t limited to a single protocol. By diversifying across multiple governance token cards and reinvesting in various pools, you can hedge risk while optimizing for the best available yields and governance perks across DeFi’s most robust platforms.

Actionable Checklist: Maximize Your Governance Token Rewards

Staying disciplined with these strategies will keep you ahead of shifting DeFi trends. Markets move quickly, and new reward structures are constantly introduced. Monitor your card’s terms, stay active in protocol governance, and always be ready to pivot your reinvestment approach as new opportunities arise.

For those aiming to graduate from passive earning to protocol leadership, these advanced strategies are essential. The future of DeFi belongs to users who not only accumulate governance tokens but also wield them with intent, compounding influence, yield, and decision-making power with every transaction.