Governance token rewards are redefining the value proposition of crypto Visa cards in 2024. Instead of passive cashback, users can now earn tokens that grant real voting power and protocol influence. But with dozens of cards, tier structures, and staking mechanics, maximizing these rewards demands a calculated, aggressive approach. Here’s how power users are stacking governance tokens and compounding their on-chain influence with the most competitive crypto rewards cards this year.

Leverage Crypto. com Visa Card’s Obsidian Tier for CRO Governance Rewards

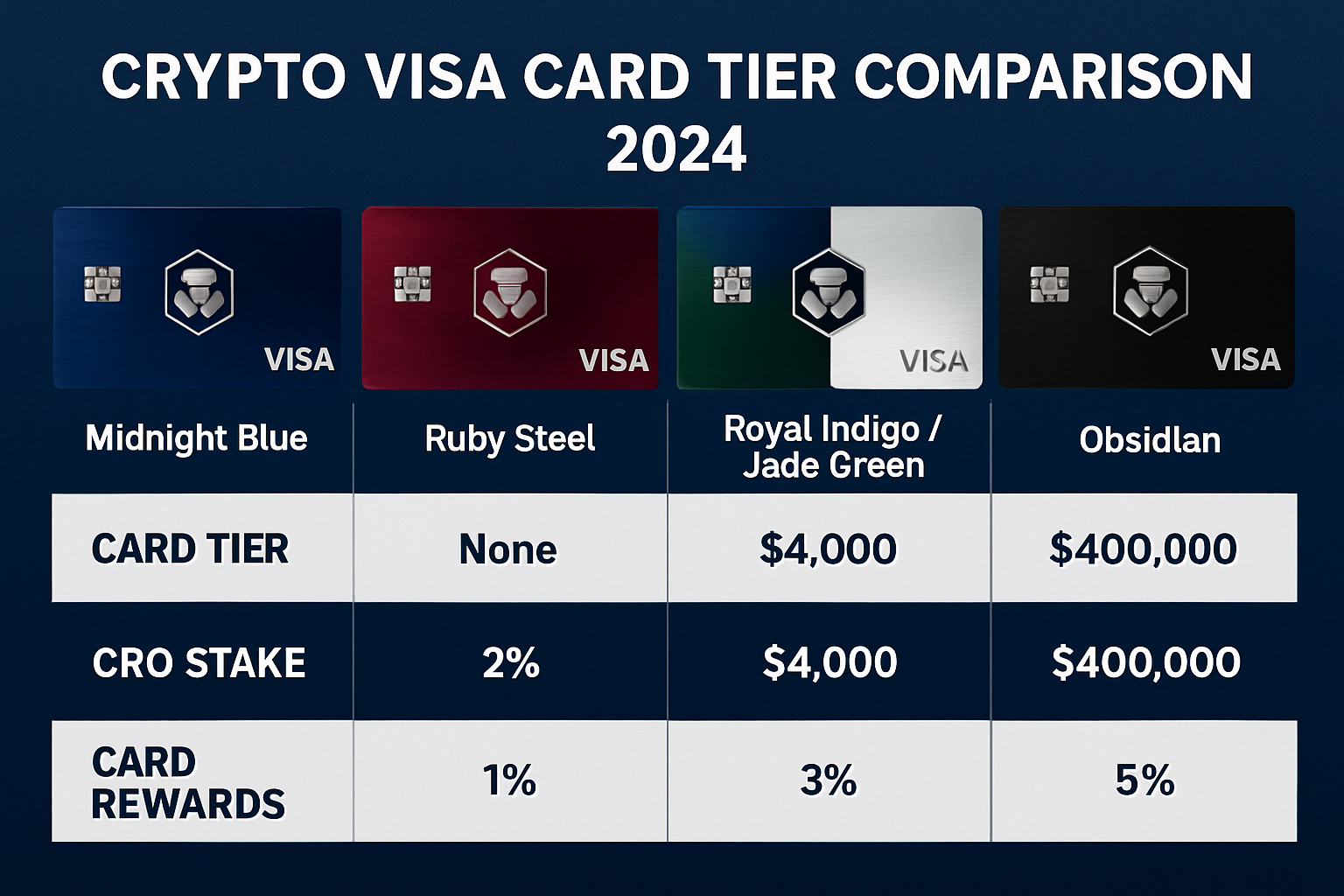

The Crypto. com Visa Card remains the industry leader for governance-focused rewards, especially at the upper echelons. By staking the required amount of CRO, you unlock the Obsidian tier, which delivers up to 5% back in CRO on every purchase. This isn’t just about high yield – every CRO earned can be staked on Cronos, granting you direct voting rights in network upgrades and on-chain proposals. With Crypto. com’s dynamic tier system, your governance influence scales with your spending and staking commitment.

Strategic users maximize value by:

- Staking the minimum CRO to reach Obsidian and maintain elite status

- Compounding CRO rewards via on-chain staking for additional yield

- Participating in Cronos governance to shape network direction

Utilize Gemini Credit Card for Flexible Crypto-to-Governance Conversion

If flexibility is your edge, the Gemini Credit Card is a top contender. It offers up to 4% back in instant crypto on every swipe. The real alpha? Gemini’s platform allows you to instantly convert your rewards into governance tokens such as UNI (Uniswap) or AAVE (Aave). This is a direct path to participating in DeFi protocol votes, without the friction of external swaps or bridges. For users who want to stay nimble across multiple governance ecosystems, this is a serious advantage.

To optimize:

- Select high-reward categories for maximum crypto accrual

- Convert earned crypto to governance tokens immediately to avoid market slippage

- Deploy tokens in protocol governance for voting or proposal creation

Maximize Coinbase Card Rewards and Convert to Governance Tokens

The Coinbase Visa Card offers up to 4% back in crypto on all purchases, with no staking requirements. What makes it powerful for governance hunters is the seamless swap feature within Coinbase – you can convert your rewards directly into governance tokens supported by the platform. This means your daily spend becomes a steady stream of governance capital, ready to be deployed in on-chain votes or protocol upgrades.

Key plays include:

- Targeting high-frequency purchases to maximize reward flow

- Regularly swapping earned crypto for governance tokens to compound voting power

- Monitoring new governance token listings on Coinbase for fresh opportunities

Top Crypto Visa Card Strategies for Governance Rewards (2024)

-

Leverage Crypto.com Visa Card’s Obsidian Tier for CRO Governance Rewards: Stake the required amount of CRO to unlock the highest Obsidian tier, earning up to 5% back in CRO. Stake your CRO rewards for governance participation on Cronos and additional yield.

-

Utilize Gemini Credit Card for Flexible Crypto Rewards: Earn up to 4% back in instant crypto on purchases, then convert rewards into governance tokens (like UNI or AAVE) via Gemini’s platform to participate in DeFi protocol voting.

-

Maximize Coinbase Card Rewards and Convert to Governance Tokens: Use the Coinbase Visa Card to earn up to 4% back in crypto. Swap your rewards for governance tokens directly within Coinbase to increase your voting power in supported protocols.

-

Stack Rewards with Binance Card and On-Chain Staking: Earn up to 8% BNB cashback with the Binance Visa Card, then stake BNB for governance rights in Binance Smart Chain projects, compounding both rewards and governance influence.

-

Optimize Tier Upgrades and Lockups for Enhanced Governance Rewards: Compare card tiers (Crypto.com, Binance, Gemini) and strategically lock up or stake tokens to unlock higher reward rates and exclusive governance token earning opportunities.

Stack Rewards with Binance Card and On-Chain Staking

The Binance Visa Card is built for aggressive earners. With up to 8% BNB cashback, it offers one of the highest raw yield rates in the market. But it’s not just about the cashback – staking your BNB unlocks voting rights in Binance Smart Chain (BSC) projects, letting you steer protocol decisions while compounding your returns. The synergy between card rewards, BNB staking, and BSC governance is unmatched for users chasing both profit and influence.

If you’re serious about maximizing governance token rewards, don’t miss our deep dive on strategies for optimizing crypto card rewards with governance tokens in 2024.

To fully leverage the Binance Card’s potential, focus on stacking BNB rewards and deploying them into on-chain staking pools. Not only does this amplify your yield through compounding, but it also increases your voting weight in BSC protocol governance. Timing is critical: monitor BNB reward payout cycles, and stake as soon as possible to maximize compounding intervals. This approach ensures that every dollar spent translates into both financial and governance capital.

Optimize Tier Upgrades and Lockups for Enhanced Governance Rewards

Tier structures are the hidden engine behind outsized governance token rewards. Whether it’s Crypto. com’s Obsidian, Binance’s Platinum, or Gemini’s top-tier status, strategic upgrades and token lockups unlock higher reward rates and exclusive governance earning opportunities. Calculated users compare card tiers side by side, weighing the upfront lockup costs against the projected increase in rewards and governance influence over time.

- Analyze each card’s tier requirements, focusing on the CRO, BNB, or Gemini Dollar lockup thresholds

- Factor in opportunity costs: what’s the real ROI of locking up tokens versus other DeFi strategies?

- Upgrade tiers only when the incremental governance rewards and perks outweigh the capital commitment

Remember, tier upgrades are not static. Market conditions change, and so do reward structures. Stay agile, review tier benefits quarterly, and don’t hesitate to rebalance your strategy if a new card or tier offers superior governance yield.

Power users are also leveraging real-time analytics and auto-compounding tools to track governance token earnings, optimize staking intervals, and monitor governance proposal calendars. The goal? Turn every transaction into an opportunity for on-chain influence and protocol-level yield.

Why Governance Token Rewards Matter in 2024

Unlike static cashback, governance token rewards are an active asset. They let you participate in protocol votes, propose upgrades, and even earn additional incentives through staking or delegation. As DeFi matures, the ability to influence and profit from protocol direction is a key edge. Crypto Visa cards that reward users with governance tokens are not just payment tools, they’re gateways to decentralized power and compounding on-chain returns.

If you want a more granular breakdown of which card and tier fits your risk profile, check out our detailed comparison at Top Crypto Rewards Cards Offering Governance Tokens in 2024.

“The future of DeFi belongs to those who control the votes. Crypto rewards cards are the new on-ramp to protocol governance. ”

Stay aggressive, stay informed, and make every swipe count toward your governance stack. The next wave of DeFi influence is already in your wallet.