As crypto rewards cards evolve, savvy users are discovering that governance token cashback can do far more than pad a digital wallet. These tokens are your ticket to real influence in decentralized finance (DeFi) ecosystems, and with the right approach, you can compound both your financial and participatory returns. Let’s break down the top five actionable strategies for maximizing your crypto rewards card governance token earnings, using today’s most competitive offerings as our guide.

Choose Crypto Rewards Cards Offering Direct Governance Token Cashback

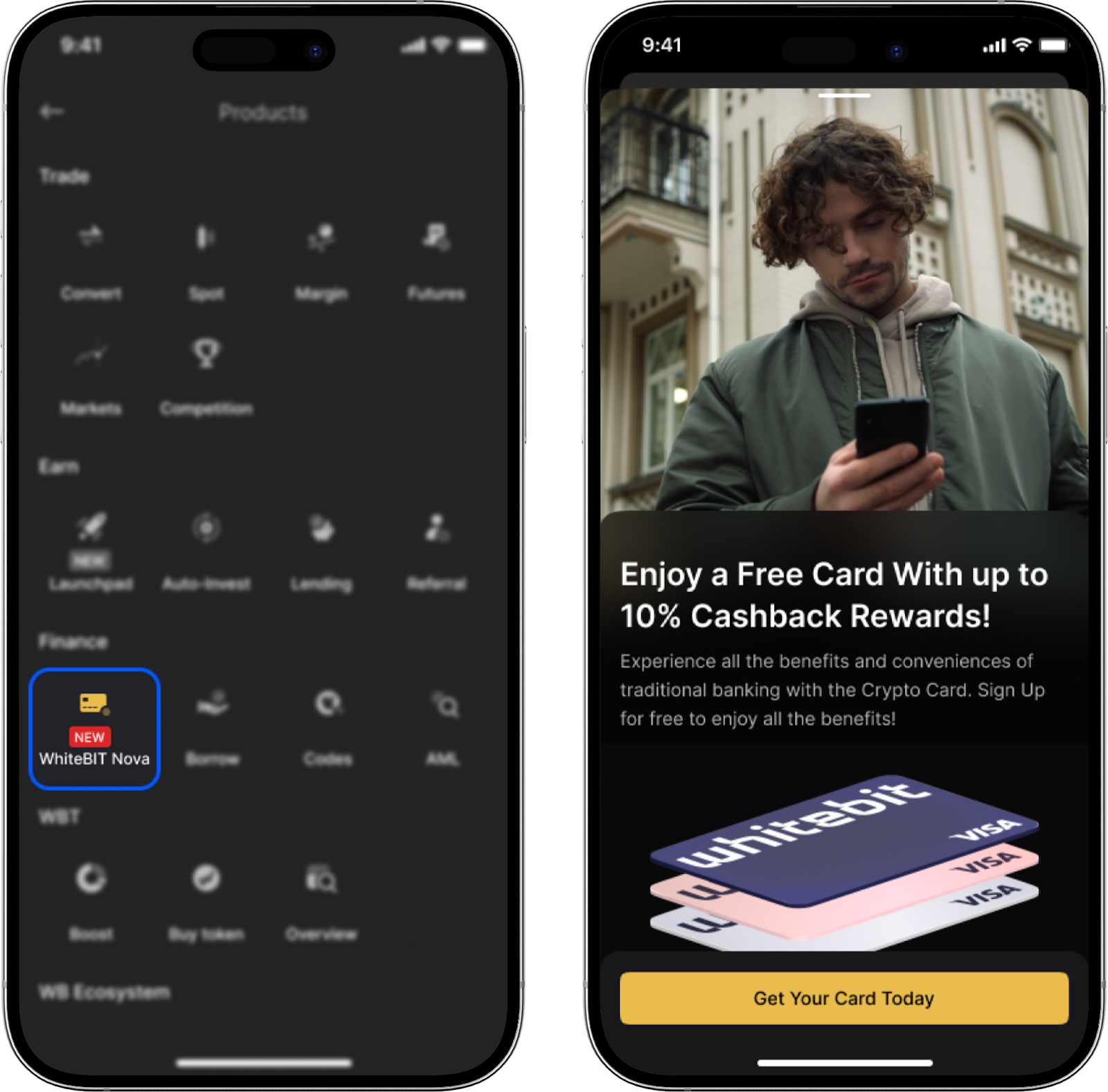

To unlock the full potential of DeFi participation, start by selecting cards that pay out directly in governance tokens rather than generic cryptocurrencies. The Gnosis Pay Card and EtherFi Cash Card are standout options in 2025, providing users with immediate exposure to tokens that grant both rewards and voting rights. This approach removes conversion friction and ensures every purchase moves you closer to meaningful influence within leading protocols.

For a comprehensive comparison of top governance token cashback cards, see our curated guide.

Stake Earned Governance Tokens to Unlock Additional Yield and Voting Power

Once you accumulate governance tokens through everyday spending, don’t let them idle in your wallet. Staking these tokens is essential for maximizing yield and activating their full utility. For example, staking Gnosis (GNO) or EtherFi (ETHFI) tokens not only earns you additional yield (often in the 5-15% APR range, depending on protocol dynamics) but also boosts your voting power within the platform. This dual benefit compounds your rewards, especially if you reinvest staking yields into further governance activities or additional purchases.

For a deeper dive into staking strategies for DeFi power users, explore our advanced guide.

Regularly Monitor and Optimize Spending Categories That Offer Enhanced Cashback Rates

Not all spending is created equal when it comes to crypto rewards card governance token earnings. Many top cards, including Gnosis Pay and EtherFi Cash Card, feature rotating or targeted categories (like dining, travel, or digital subscriptions) where cashback rates can be significantly higher. By aligning your spending with these high-reward categories, you can amplify the volume of governance tokens earned per dollar spent. It pays to review your card’s reward calendar monthly and adjust your habits accordingly, small tweaks in purchasing behavior can lead to outsized gains over time.

Why Governance Token Cashback Cards Are Gaining Momentum in 2025

The surge in demand for governance token cashback cards is no accident. As DeFi protocols expand their utility and community involvement, holding governance tokens is no longer just about speculation, it’s about shaping the future of entire ecosystems. Cards like Gnosis Pay and EtherFi Cash Card offer a direct onramp into this world, rewarding everyday purchases with assets that open doors to yield farming, protocol upgrades, and even revenue sharing.

Top 5 Strategies to Maximize Governance Token Cashback

-

Choose Crypto Rewards Cards Offering Direct Governance Token CashbackOpt for cards like Gnosis Pay Card and EtherFi Cash Card, which provide cashback directly in governance tokens. This ensures your rewards are immediately usable within DeFi ecosystems, unlocking compounding opportunities from the start.

-

Stake Earned Governance Tokens to Unlock Additional Yield and Voting Power in DeFi ProtocolsAfter accumulating governance tokens, stake them on their native platforms (e.g., Gnosis Chain, EtherFi) to earn extra yield and gain voting rights. Staking not only increases your passive income but also lets you help shape the platform’s future.

-

Regularly Monitor and Optimize Spending Categories That Offer Enhanced Cashback Rates in Governance TokensMany crypto cards feature higher cashback rates for specific categories like dining or travel. Track these categories and adjust your spending to maximize governance token rewards, ensuring every purchase delivers optimal value.

-

Participate Actively in Governance Proposals Using Your Accumulated Tokens to Influence Protocol Rewards DistributionUse your governance tokens to vote on proposals within DeFi protocols. Active participation can influence how rewards are allocated, potentially increasing future cashback rates or introducing new earning mechanisms.

-

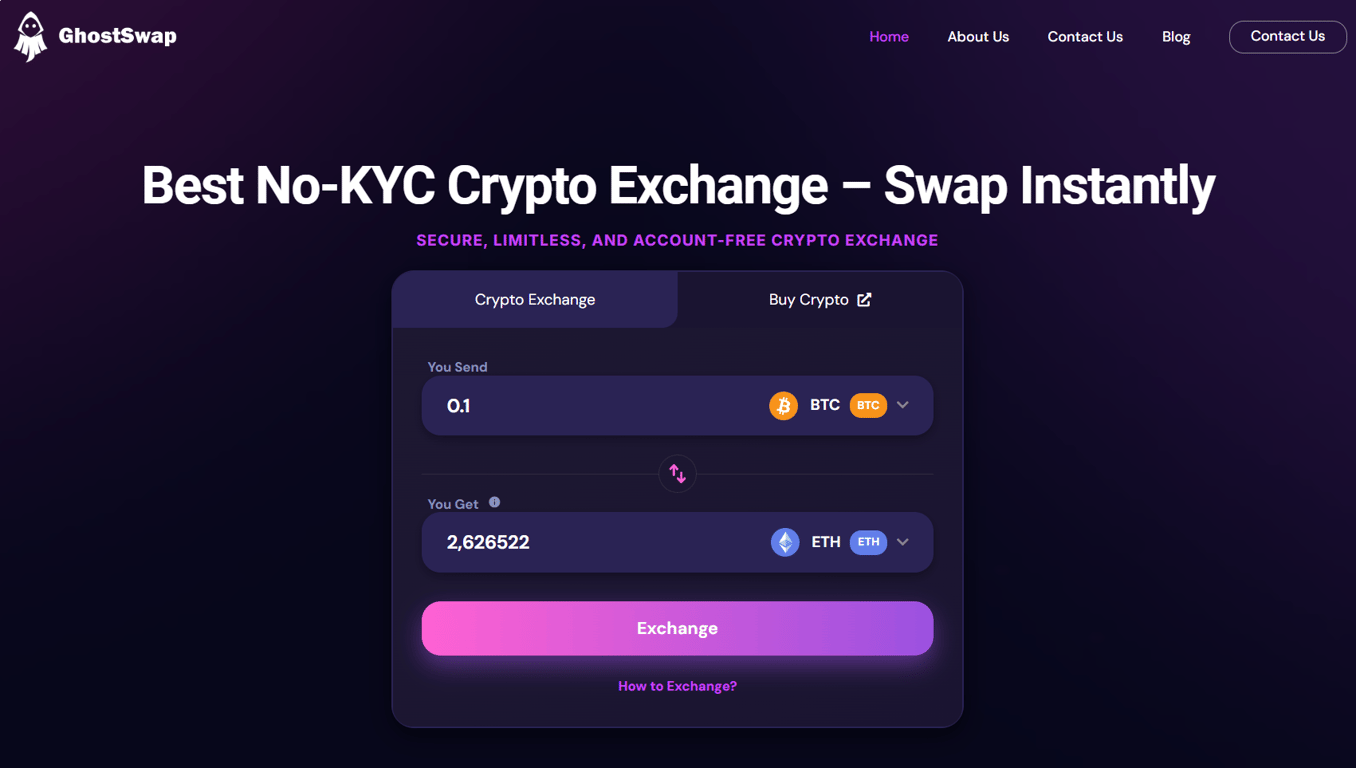

Utilize Automated Tools or Platforms to Convert Non-Governance Cashback (e.g., BTC, ETH) into Governance Tokens for Compounding BenefitsLeverage platforms like 1inch or Uniswap to swap cashback earned in BTC or ETH into governance tokens. This strategy compounds your exposure to DeFi rewards and governance opportunities.

In the next section, we’ll explore how active participation in governance proposals and automated conversion tools can further accelerate your compounding journey. For now, focus on selecting the right card, staking diligently, and optimizing every transaction for maximum impact.

Participate Actively in Governance Proposals Using Your Accumulated Tokens

One of the most overlooked benefits of governance token cashback is the power to shape protocol direction. Once you’ve built up a meaningful balance of governance tokens from your card rewards, make it a habit to engage with your protocol’s governance forums and voting platforms. Whether it’s Gnosis DAO, EtherFi, or another DeFi protocol, your tokens grant you a direct say in proposals that affect rewards distribution, protocol upgrades, and ecosystem incentives. Active participation can unlock exclusive airdrops or bonus rewards for voters, and in some cases, protocols allocate additional yields to those who consistently vote.

For step-by-step instructions on how to turn your rewards into governance influence, visit our participation guide.

Utilize Automated Tools to Convert Non-Governance Cashback into Governance Tokens

While some cards pay out directly in governance tokens, others still offer cashback in BTC, ETH, or stablecoins. Don’t let this limit your compounding strategy. Leverage automated tools or DeFi platforms that enable you to convert non-governance rewards into governance tokens with minimal friction. Platforms like Yearn, 1inch, or custom Zapier workflows can automate this process, ensuring that every bit of your cashback is working toward greater governance exposure. This approach is especially useful for users with multiple cards or those seeking to diversify across several DeFi protocols. Over time, automated conversion can significantly boost both your yield and your voting power, without requiring constant manual intervention.

Comparison of Top Crypto Rewards Cards Offering Governance Token Cashback (2025)

| Card Name | Governance Token Cashback Rate | Token Type | Staking Available | Key Features |

|---|---|---|---|---|

| Gnosis Pay Card | Up to 3% in GNO | GNO (Gnosis) | Yes | Direct governance token rewards; DeFi integration; voting rights |

| EtherFi Cash Card | Up to 2.5% in ETHFI | ETHFI (EtherFi) | Yes | Governance participation; DeFi staking; flexible spending |

| Crypto.com Visa Card | Up to 8% in CRO | CRO (Cronos) | Yes | Highest cashback tier; staking boosts rewards; ecosystem perks |

| Nexo Credit Card | Up to 2% in NEXO or 0.5% in BTC | NEXO (Nexo) | Yes | Flexible token choice; instant cashback; collateralized credit |

| Gemini Credit Card | Up to 3% in Gemini Dollar (GUSD) | GUSD (Gemini Dollar) | No | Stablecoin rewards; no annual fee; instant crypto rewards |

As the DeFi landscape matures, maximizing crypto rewards card earnings is as much about strategic participation as it is about tactical spending. By combining the five strategies above, selecting direct governance token cards, staking for yield and power, optimizing spending categories, engaging in active governance, and automating conversions, you position yourself at the intersection of financial autonomy and decentralized influence.

For those just beginning, our beginner’s guide offers a gentle ramp into these strategies, while advanced users can explore more nuanced compounding techniques in our active DeFi participant guide.

With the right combination of discipline and engagement, your crypto rewards card can become a powerful engine for both wealth creation and decentralized governance. As protocols and card offerings evolve, staying informed and adaptable will ensure your strategy remains ahead of the curve.