Crypto rewards cards have evolved beyond simple cashbacks and generic tokens. For DeFi enthusiasts, the real value now lies in leveraging governance token rewards to unlock both financial yield and a voice in decentralized protocols. In 2025, with governance tokens like UNI, AAVE, and COMP at the heart of leading DeFi platforms, maximizing your crypto card strategy means more than just accumulating digital assets, it’s about compounding influence, yield, and long-term upside.

Let’s break down three actionable strategies that put you in the driver’s seat of both your wallet and the future of DeFi protocols.

1. Choose Crypto Rewards Cards That Offer Direct Governance Token Payouts

The first step to maximizing your crypto card rewards is selecting cards that pay out directly in top-tier DeFi governance tokens, not just Bitcoin or Ethereum. Cards offering UNI (Uniswap), AAVE (Aave), or COMP (Compound) let you earn assets that have dual utility: they accrue value and grant you voting power over major protocol decisions. Every purchase becomes an investment in your financial autonomy within DeFi ecosystems.

Top Strategies to Maximize Crypto Card Governance Token Rewards

-

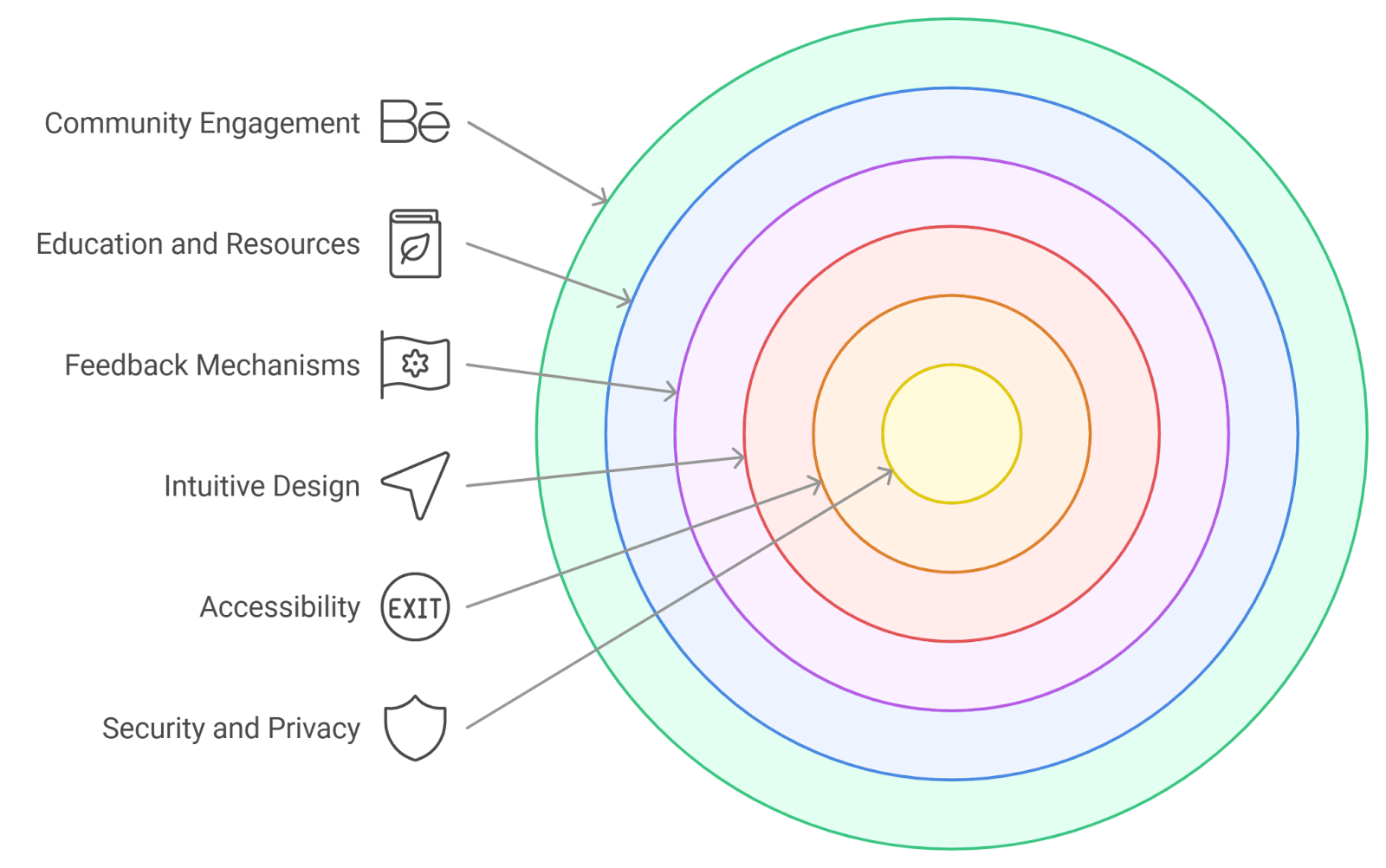

Choose Crypto Rewards Cards That Offer Direct Governance Token Payouts: Select cards that reward spending with top DeFi governance tokens such as UNI (Uniswap), AAVE (Aave), or COMP (Compound) instead of generic crypto like BTC or ETH. This ensures every purchase directly increases your governance power and potential for protocol rewards. For example, the Crypto.com Visa Card and Coinbase Card both periodically offer governance token rewards depending on market campaigns and user location.

-

Actively Participate in On-Chain Governance to Unlock Additional Incentives: Use your earned governance tokens to vote on proposals, participate in community initiatives, and engage with DeFi protocols. Many projects now offer bonus rewards, airdrops, or staking multipliers for active governance participants. For instance, Uniswap and Aave governance portals allow direct participation, and active voters may receive protocol-specific incentives.

-

Stake or Lend Earned Governance Tokens for Compound Rewards: After accumulating governance tokens through card rewards, deposit them into DeFi platforms that allow staking or lending. This strategy generates additional yield on top of card rewards and can grant access to exclusive protocol benefits or future token distributions. For example, Curve Finance lets users stake CRV for veCRV, boosting both rewards and governance power, while Aave enables lending of AAVE tokens for extra interest.

For example, with Aave (AAVE) currently trading at $277.41, each reward earned is not only a speculative asset but also a ticket to influence lending protocol parameters. Similarly, holding UNI (recently at $8.13) gives you direct input into Uniswap upgrades and fee structures. By focusing on cards that deliver these specific tokens as rewards, you’re stacking both potential gains and meaningful voting rights.

2. Actively Participate in On-Chain Governance to Unlock Additional Incentives

Earning governance tokens is only half the equation, using them actively within their respective protocols can unlock bonus incentives unavailable to passive holders. Many leading DeFi projects now reward users who vote on proposals or engage with community initiatives through additional airdrops, staking multipliers, or even exclusive access to protocol features. This trend is reshaping what it means to be an engaged participant in decentralized finance.

“Active participation in protocol governance doesn’t just shape the future of DeFi, it can also boost your personal yield through unique incentives. “

If you’ve earned COMP via your crypto card, for instance, using those tokens to vote on Compound protocol upgrades can grant eligibility for special staking pools or future token distributions. The same goes for UNI holders who take part in Uniswap’s community votes, these participants are often prioritized for experimental features or retroactive bonuses.

3. Stake or Lend Earned Governance Tokens for Compound Rewards

The final pillar of an optimized strategy is putting your earned governance tokens back to work through staking or lending platforms within DeFi. Rather than letting UNI or AAVE sit idle in your wallet, deposit them into supported protocols where they can earn additional yield, sometimes even unlocking further voting power or access to exclusive benefits.

- Staking: Platforms like Aave allow users to stake AAVE for security incentives and fee sharing.

- Lending: Lending out COMP on supported platforms generates passive interest while maintaining exposure to token appreciation.

- Boosted Rewards: Some ecosystems offer higher yields or special NFTs/access when governance tokens are staked for longer durations.

This compounding approach creates a flywheel effect: every dollar spent on your crypto card translates into more governance tokens, which then generate additional returns via staking/lending, and potentially even more influence through increased voting weight. For real-time price context, as of September 24th, 2025:

The synergy between earning and deploying governance token rewards is what sets advanced DeFi strategies apart from traditional cashback models.

If you want a deeper dive into maximizing these strategies step by step, including platform comparisons, see our expanded guide at /how-to-maximize-rewards-with-governance-token-crypto-cards-in-2025.

By compounding your governance token rewards across multiple layers, spending, governing, and staking, you tap into a powerful cycle that traditional loyalty programs simply can’t match. This approach turns everyday transactions into an engine for both passive income and active protocol influence. For DeFi enthusiasts, it’s not just about earning more crypto; it’s about shaping the platforms you use while unlocking new streams of value.

Why Compound Rewards Matter in Today’s DeFi Ecosystem

Compounding isn’t a buzzword; it’s the foundation of exponential growth in decentralized finance. When you stake or lend your earned governance tokens, you’re not only capturing additional yield but also potentially qualifying for future protocol upgrades or airdrops that reward long-term commitment. For example, Uniswap’s past retroactive UNI distributions favored active users and voters, while Aave stakers have enjoyed enhanced safety module rewards.

- UNI at $8.13: Staking UNI can boost your voting power and may unlock access to experimental Uniswap features.

- AAVE at $277.41: Staking AAVE not only earns security incentives but also increases your influence on protocol direction.

- MKR at $1,642.83: Locking MKR in MakerDAO governance gives you direct input into DAI stability mechanisms, and may earn fee shares as the protocol grows.

This multi-layered strategy is particularly effective now as protocols increasingly reward active contributors: whether through bonus staking multipliers, exclusive NFT drops, or prioritized access to new products. The more you participate, especially with tokens earned from your crypto rewards card, the greater your upside potential in both wealth and voice.

Staying Ahead: Monitoring Tokenomics and Protocol Changes

The DeFi landscape moves fast. To continue maximizing your crypto card rewards with governance tokens, stay updated on evolving tokenomics models and incentive structures. Protocols like Curve (CRV at $0.688535) or Synthetix (SNX at $0.721091) often adjust their staking requirements or introduce new bonus pools for engaged users.

“Knowledge is leverage in DeFi, understand each protocol’s reward mechanics to stay ahead of the curve. “

If you’re ready to compare the latest card offerings or want a deeper breakdown of on-chain participation strategies, explore our practical walkthroughs such as /which-crypto-rewards-cards-offer-on-chain-governance-voting.

Your Next Moves: Building an Empowered DeFi Portfolio

The intersection of crypto rewards cards and governance token strategies is still young, but already transformative for those who embrace it early. Whether you’re stacking UNI through daily spending, using AAVE to vote on lending pool changes, or staking COMP for layered yields, each move compounds your financial autonomy within DeFi.

If you’re looking to optimize every facet of this process, from choosing the right card to leveraging advanced staking platforms, check out our step-by-step guides at /how-to-maximize-defi-governance-participation-with-rewards-cards.