Governance tokens have become the cornerstone of modern DeFi participation, offering not just economic rewards but also a direct voice in protocol evolution. For active users, the emergence of crypto rewards cards that distribute governance token rewards presents a unique opportunity: you can earn, stake, and participate in decentralized decision-making all through your everyday spending. But how do you truly maximize these benefits in the fast-evolving DeFi landscape?

1. Select Crypto Rewards Cards That Offer High-Yield Governance Token Rewards

Your choice of card is foundational to your strategy. Not all crypto rewards cards are created equal, some focus on stablecoins or native exchange tokens, while others directly offer high-yield governance token rewards such as COMP, MKR, or AAVE. Prioritize cards that align with your preferred protocols and offer transparent reward rates. For example, if you’re deeply involved in MakerDAO’s ecosystem, a card rewarding MKR will not only boost your holdings but also amplify your voting power within the DAO.

Top Strategies to Maximize Governance Token Card Rewards

-

Select Crypto Rewards Cards That Offer High-Yield Governance Token Rewards: Choose established cards like the Crypto.com Visa Card (CRO rewards), Monolith Visa Debit Card (MKR rewards), or ClubSwan Crypto Card (multi-token rewards). These cards provide direct governance token yields, letting you earn while spending and participate in protocol decisions.

-

Actively Participate in Governance Voting and Proposal Discussions to Unlock Bonus Incentives: Engage with platforms like Compound (COMP), Aave (AAVE), and MakerDAO (MKR) to vote on proposals. Some protocols reward active participation with bonus tokens or increased influence, enhancing both your rewards and your role in shaping DeFi.

-

Leverage Community Engagement Programs and Airdrops Offered to Cardholders: Many DeFi projects, including Uniswap and Curve Finance, periodically distribute airdrops or run community incentive programs for active users and cardholders. Stay engaged to maximize your eligibility for these valuable extras.

-

Utilize Layer-2 and Multi-Chain Card Options to Minimize Fees and Maximize Net Rewards: Opt for cards and protocols supporting Layer-2 networks (like Arbitrum or Optimism) and multi-chain compatibility. This reduces transaction fees and expands your access to governance token rewards across multiple DeFi ecosystems.

Remember to review factors like annual fees, supported regions, and current APYs before committing. For more detailed comparisons and strategies tailored for DeFi enthusiasts, see our dedicated guide.

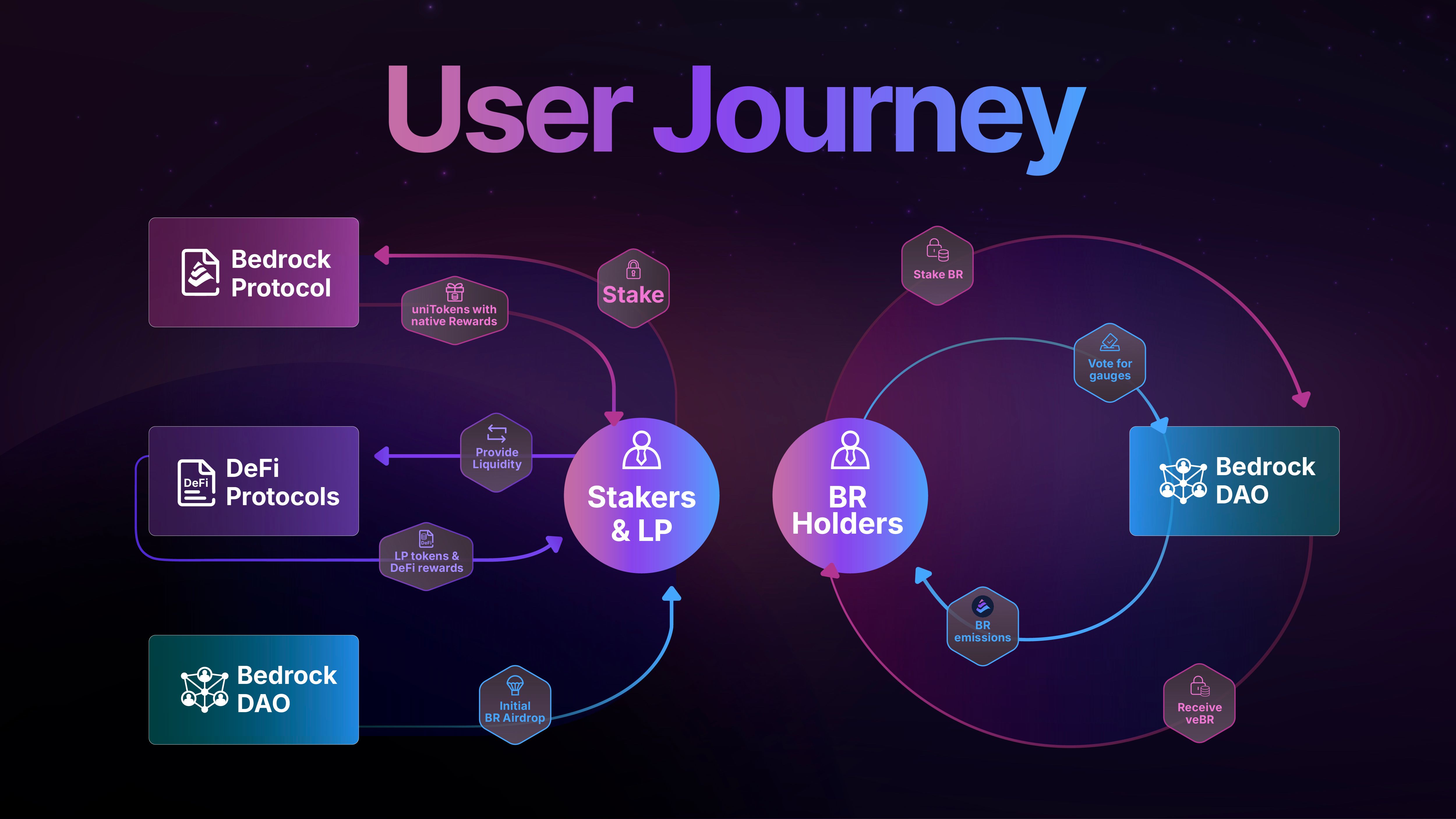

2. Stake Earned Governance Tokens Directly Within Supported DeFi Protocols

The real power of governance tokens is unlocked when you stake them directly within their respective protocols. Many DeFi platforms incentivize staking by distributing additional rewards or granting elevated voting privileges for active participants. For instance, staking COMP on Compound or AAVE on its native platform may provide both yield and a stronger voice in future proposals. This dual benefit, economic return and governance influence, makes staking a core strategy for maximizing DeFi card rewards.

Be strategic about timing: monitor protocol updates for higher-yield periods or bonus events tied to staking activity. And always consider smart contract risks before locking up assets.

3. Actively Participate in Governance Voting and Proposal Discussions to Unlock Bonus Incentives

Many projects now reward active community members who participate in on-chain voting or engage in proposal discussions with bonus incentives or emission multipliers. This means simply holding governance tokens isn’t enough; engaging with protocol decisions can unlock extra layers of value. Some cards even track participation metrics and provide tiered bonuses based on your level of involvement.

If you’re new to voting mechanics or want to learn more about maximizing these incentives as an active participant, our step-by-step guide covers essential strategies.

4. Leverage Community Engagement Programs and Airdrops Offered to Cardholders

Beyond staking and voting, many governance token cards now integrate exclusive community engagement programs and periodic airdrops to reward loyal users. These initiatives often include early access to new DeFi protocol launches, NFT drops, or bonus governance tokens for participating in educational campaigns and AMAs. Card issuers may also organize competitions or quests where active cardholders can earn additional rewards for completing on-chain tasks or contributing to community forums.

Staying engaged with these programs not only boosts your overall yield but also helps you stay ahead of evolving protocol changes. Make it a habit to check your card provider’s announcements, participate in community calls, and track upcoming airdrop snapshots, these can be significant sources of value, especially during periods of rapid platform growth or new feature rollouts.

5. Utilize Layer-2 and Multi-Chain Card Options to Minimize Fees and Maximize Net Rewards

As transaction fees on major blockchains remain volatile, optimizing your reward strategy increasingly depends on leveraging cards that support Layer-2 solutions or multi-chain interoperability. Cards with built-in support for networks like Arbitrum, Optimism, or Polygon allow you to claim rewards, stake governance tokens, and participate in protocol governance with drastically reduced gas costs. This efficiency means more of your earned tokens remain in your pocket rather than being eroded by network fees.

Additionally, multi-chain cards enable seamless participation across multiple DeFi ecosystems without the friction of bridging assets manually. This flexibility is crucial for advanced users who want exposure to diverse protocols and want to maximize reward opportunities wherever they arise.

Top Strategies for Maximizing DeFi Card Rewards

-

Select Crypto Rewards Cards That Offer High-Yield Governance Token Rewards: Choose established cards like the Crypto.com Visa Card (CRO rewards), Monolith Visa Debit Card (MKR rewards), or ClubSwan Crypto Card (multi-token rewards). These cards provide direct governance token incentives, enabling both financial returns and voting power within DeFi ecosystems.

-

Actively Participate in Governance Voting and Proposal Discussions to Unlock Bonus Incentives: Engage in on-chain voting and community forums on platforms such as Aave, Compound, and MakerDAO. Many protocols reward active voters with bonus tokens or multiplier rewards, enhancing your overall returns.

-

Leverage Community Engagement Programs and Airdrops Offered to Cardholders: Take advantage of exclusive airdrops, loyalty programs, and community campaigns from major card issuers and DeFi protocols. For example, Crypto.com and ClubSwan have periodically distributed bonus tokens and early access rewards to active card users.

-

Utilize Layer-2 and Multi-Chain Card Options to Minimize Fees and Maximize Net Rewards: Opt for cards and platforms supporting Layer-2 solutions (like Polygon) or multi-chain integrations (such as ClubSwan and Crypto.com). This approach reduces transaction fees and expands access to diverse governance token rewards across multiple DeFi ecosystems.

Strategic Checklist: Putting It All Together

For those seeking a deeper dive into optimizing every aspect of their DeFi card experience, from choosing the right card to unlocking advanced governance incentives, our comprehensive strategy guide is an essential next step.

Final Thoughts: Building Resilience Through Active Participation

The landscape of crypto rewards cards with governance token incentives is rapidly maturing. By selecting high-yield options, staking strategically within supported protocols, engaging deeply in voting processes, participating in exclusive community programs, and utilizing Layer-2/multi-chain features, active DeFi participants can not only maximize financial returns but also shape the future direction of decentralized finance itself.

The most resilient strategies are those that combine technical optimization with genuine community involvement. As always, stay informed about evolving tokenomics and shifting protocol incentives, your adaptability will be rewarded both financially and through increased influence within the projects you support.